The case study describes Accor, a lodging and restaurant enterprise from 1967 to the acquisition of Motel 6 in 1990. A special focus is on Paul Dubrule and Gerard Pelisson as well as their management policies. The case study focusses on organizational, strategic and integration issues.

Philip M. Rosenzweig, Benoit Raillard

Harvard Business School (393012-HCB-ENG)

Sep 8, 1992

Case questions answered:

- What is the variable geometry organization structure? What are its advantages and disadvantages? What were the key features that made it work for ACCOR?

- At the end of the case, the company’s approach to decentralization and cohesion is being examined. What are your recommendations for change in light of ACCOR’s recent growth?

Not the questions you were looking for? Submit your own questions & get answers.

Accor (A) Case Answers

Problem Definition

Since Dubrule and Pélisson founded Novotel, the ancestor of ACCOR, in 1967, the story of the company has been about growth, diversification, and expansion. The highly value-oriented and decentralized approach of the founders prevailed over the years, even when the firm had been presented with the difficulties of merging with the tightly controlled and centralized culture of JBI in 1983.

However, recent acquisitions and changes within the organization might indicate the need for an overall organizational change for ACCOR. The following section analyses the current situation and characteristics of the company and identifies the three most relevant challenges at which we direct our recommendations, detailed in the coming sections.

ACCOR’s operations show both global and local orientation (Mendenhall, 2003). Their strong emphasis on common values that connect all branches, the integration of new structures over time (e.g., the appearance and decline of country managers), and their significant focus on sustainable global talent and leadership development of their employees (e.g., training, rotation between countries and sectors is very common) all emphasize ACCOR’s global orientation.

On the other hand, the importance of decentralized, lean operations with a high degree of responsibility in the hand of country, region, or brand managers, their specialized services, and personalized focus on employee satisfaction (e.g., the case of the employee relocated to France upon will after being an expat for 15 years) point in the direction of taking into account local and employee-specific needs.

The founders claim to be proud of ACCOR’s “variable geometry organizational structure” that cannot be described using traditional terminology (e.g., functional, matrix, etc. organization) and can be seen as a more dynamic structure, resembling the network structure described by Nohria (1992).

This is supported by the fact that ACCOR is decentralized, with high decision-making power in the hands of front-line managers. It is fully vertically integrated, many times blurring the boundaries between the company and its environment (Nohria, 1992).

Using this structure has provided many advantages for ACCOR; among others, it provided high flexibility and adaptability that helped the company stay on top of the game even in times when the industry was not booming (e.g., the Gulf War), develop a high leveled trust culture based on qualified professionals, and enabled it to expand and grow and be present at all three sectors, being global (luxury) and local (economy) at the same time.

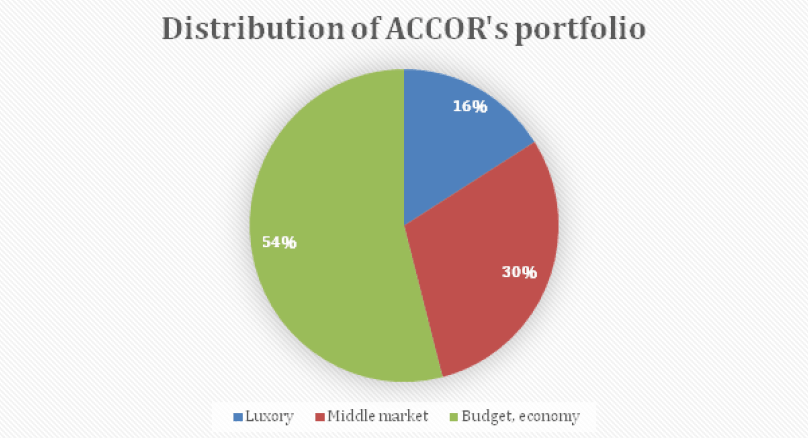

For the distribution of the sectors, see Appendix 1. However, the disadvantage of such a structure has been the low level of coordination and cohesion and the inability to recognize all possible synergies, resulting in possible duplications.

The three major challenges faced by ACCOR in the integration of Motel 6 into its business are as follows:

- Firstly, having realized how important McCarthy is to Motel 6 and the continued success after the acquisition, a challenge for ACCOR would be finding ways to persuade McCarthy to remain as CEO, and in case ACCOR doesn’t succeed, should they still go ahead with the acquisition.

- Secondly, the company needs to decide how to integrate both firms to ensure the acquisition is successful. For this, the company needs to have a clear idea of how to fit Motel 6 into ACCOR’s organizational structure. If they should continue with the country structure or treat Motel 6 as a separate entity reporting directly to headquarters?

- Lastly, the extent to which the operations at Motel 6 should be changed, restructured, or left untouched should be determined carefully so that employees at Motel 6 do not feel threatened by the new changes and ultimately end up leaving the company.

RECOMMENDATIONS

Change in Management: Should the CEO continue to stay or not?

We are positive about the fact that Joseph McCarthy’s CEO position must be retained. This can be done by persuading him to stay for a further period of two to five years to continue to lead his team to greater success post-acquisition with ACCOR.

Since we are planning to treat Motel 6 separately as an independent brand, and he would still be the one in charge of making all the shots with regard to Motel 6, this could be a way to induce him to stay in the company as it would be highly beneficial for us to have McCarthy to gain from his long career experience in the lodging industry.

Also, it made him realize that continuing his position is very critical to the company presently to keep up the success of Motel 6, which he built with his hard work and dedication, and he definitely wouldn’t want to see it in ruins.

However, we realize that there is a possibility that McCarthy might not be willing to continue as president since he was 60 years of age and also had earned a significant amount of money through this acquisition deal.

In such a scenario, we would appreciate his assistance to ensure a smooth transition after the acquisition to help integrate both firms by sharing his knowledge and experience with the person who is about to resume his role as CEO. An ideal candidate for the position of CEO would be to hire someone internally from the management team at Motel 6 who has closely worked with McCarthy. That way, it ensures the person is well-trained for taking up this position and knows exactly how things work at Motel 6 as opposed to hiring someone externally.

In the event of McCarthy not willing to continue as president of Motel 6 post-acquisition, we still think it’s a good idea to go ahead with the acquisition since this move is in line with the objectives of ACCOR, which is to obtain a leading position in the North American lodging industry. Especially after facing problems in the luxury and medium-priced hotels in the US, it is in the company’s best interest to focus on the economy segment to enhance its financial performance.

Motel 6, being a pioneer and market leader in its industry, proves to be a good fit for Accor, and since it already has a strong management team which was led by McCarthy and is well established, we believe that the top management and employees together would be capable of successfully running Motel 6.

Motel 6 as a separate and independent brand

Motel 6 should be kept as a separate division. Firstly, it is important to note that ACCOR is an organization that is more tailored to the needs of premium customers (luxury and middle markets) in comparison to Motel 6, which offers budget services. Since ACCOR and Motel 6, both attract a different customer type, it would be unsuitable if Motel 6 joined Novotel and Sofitel in the same division and both reported to a country manager (ACCOR North America), as the manager will struggle to align the two, and make the correct strategic decisions.

For instance, strategies that are tailored towards Novotel’s customers will be very different from those of Motel 6. Thus, a standardized approach will not work for the country manager, who may be under pressure to try to coordinate the two businesses as much as possible to ensure the ACCOR values, mission, and strategy are consistent.

In addition to this, they will become over-pressured by the different demands of the two and the complexity of decisions that need to be made. This could have the consequence of the country manager making poor, irrational decisions that cost ACCOR money and jeopardize their business growth strategy.

Alternatively, Motel 6 should be kept as an independent brand reporting directly to Dubrule and Pelisson. The advantages of this include that Motel 6 will be managed separately. Thus, there will be less resistance from employees as they will not have to adapt to frequent changes, which could be the case if there is a country manager involved with their own agenda, which cascades down to management.

Furthermore, this type of structure is better since Motel 6 can be held accountable for their own performance.

For instance, the management will be able to better and more efficiently respond to problems as and when they arise, whereas if the country manager makes the decisions, they may be distracted with other issues at Novotel or Sofitel, which would be more time-consuming. It also spreads the responsibility if more people are involved.

The managers at Motel 6 will be better equipped with the knowledge and skills to solve problems more swiftly. This is in comparison to the country manager, who may lack the capabilities and relevant skills to deal with customer/ operational issues at Motel 6.

Operations and Change Management

Motel 6 has a strong management team and is prospering under the command of McCarthy. Thus, we recommend that the structure and systems of Motel 6 should remain as it is in order for ACCOR to expand deeper in the segment of budget motels under the guidance and support of the ACCOR headquarters.

However, Paul Dubrule and Gérard Pélisson must focus on gradually instilling the strong value system and the know-how of ACCOR in Motel 6 in order to integrate them in the long run.

Cultural and Operational Integration

To begin with, Motel 6 is a pure American company and has a strong management team with its own systems and values. In our opinion, with Motel 6, ACCOR does not only penetrate into the budget motel segment of the U.S. but also adds to its ranks a huge amount of knowledge of the American market.

This knowledge is vital for ACCOR in order to expand in the markets of the U.S. and Canada. Hence, ACCOR should not force its values from the top down but rather cultivate conditions that will enhance collaboration and simulation among its divisions.

First, ACCOR must establish formal procedures that support the communication between Motel 6, ACCOR North America, and the headquarters. For instance, monthly meetings are a good way for top managers to interact and develop professional ties. Additionally, job rotation would be very beneficial for both employees and the firm.

On the one hand, managers expand their competencies, and on the other, job rotation enables knowledge transfer. Moreover, a decisive step for ACCOR to integrate Motel 6 is to invest in establishing a second Academy in the U.S. in order to transfer the best practices more quickly in the geographical region of North America.

Second, Dubrule and Pélisson must enhance strategic collaboration by strengthening the informal ties of managers of Motel 6, ACCOR North America, and the headquarters. By creating and supporting informal networks, ACCOR can boost knowledge sharing and collaborating behavior between divisions (Cross, Borgatti, Parker), which in turn will support the integration process.

For example, the HR function can sponsor social activities, such as cooking and sports events, for employees from different functions and divisions.

In addition, a useful tool the HRM function could use in order to develop the informal network of the Motel 6 employees is social network analysis (SNA). Social network analysis is the process of investigating social structures through the use of network and graph theories.

The SNA provides vital information about the current informal network of employees between functions and divisions. (Cross, Borgatti, Parker) Hence, SNA is an important tool that can guide the management for future investments in creating and supporting unofficial contacts.

RISKS & LIMITATIONS

Although the acquisition of Motel 6 would strengthen ACCOR’s position in North America, it comes with a number of risks. A major risk could be failing to find a suitable candidate with relevant experience to replace McCarthy as CEO in case McCarthy decides to retire.

This would negatively impact the acquisition since Motel 6 was doing exceptionally well under the leadership of McCarthy as he was the key person to bring about significant changes in the company and assist Motel 6 in gaining back its position in the industry if the right person does not take over all of McCarthy’s efforts to build Motel 6 would be in vain.

Further, employees may be hesitant about the change in leadership and may not react well to the acquisition. Additionally, coordination for ACCOR becomes difficult to achieve if Motel 6 operates as an independent brand. and the two divisions may come into conflict with each other since they are treated separately.

If coordination is difficult, top management will struggle to ensure that the corporate agenda follows through. In addition to this, the change and struggle to provide support individually to Motel 6 may overburden HQ; as a result, they may neglect other divisions.

REFERENCES

Mendenhall, M.E., Jensen, R.J., Black, J.S., &Gregersen, H.B. (2003). Seeing the Elephant: Human Resource Challenges in the Age of Globalization. Organizational Dynamics, 32, 261-274.

Nohria, N. (1992). Note on organizational structure, from Harvard Online.

Cross, R., Borgatti, S. P., & Parker, A. (202). Making Invisible Work Visible: Using Social Network Analysis to Support Strategic Collaboration. California Management Review VOL. 44, NO. 2, 25-46.

APPENDIX 1