The Camelback Communications, Inc. case study looks into the difference between COGS/inventory valuation vs. product costing. It shows the effect of changes in the cost system as practiced by the firm.

Robin Cooper

Harvard Business Review (185179-PDF-ENG)

June 03, 1985

Case questions answered:

- What will Camelback Communications, Inc. (CCI) now have to charge for each product to make a 40% mark-on? If CCI maintains its rule about dropping products with a mark-on below 25%, which additional products, if any, will it drop?

- If you decide to drop additional product(s), recalculate the allocation rate per hour for the new product mix. Repeat Question 1.

- What would happen if the firm kept its existing cost system but differentiated between variable and fixed costs and decided to maximize contribution?

- What would happen if the firm modified its cost system so that all variable costs were traced to the product accurately, but fixed costs were allocated using the existing system?

- What would happen if the firm modified its cost system so that it contained two cost pools, one containing the overhead costs associated with Products A and B and the other the overhead costs associated with Products C and D, and then allocated these overhead pools on the basis of direct labor hours?

Not the questions you were looking for? Submit your own questions & get answers.

Camelback Communications, Inc. Case Answers

This case solution includes an Excel file with calculations.

Learning Objectives – Camelback Communications, Inc. – Case Study

Recap Direct vs. Indirect Costs in the case of Camelback Communications, Inc.

Purpose of costing systems

Difference if the objective is reporting (COGS/inventory valuation) vs. product costing, especially with multi-products. It is important to accurately assign direct costs and allocate indirect costs between products when using product costing.

Need to account for all costs in the long run.

Product costing is used not only for product pricing but also for strategic decisions (like introducing/discontinuing products). All costs become variable in the long run. More costs become relevant in the long run (this is why our analysis is not mainly based on concepts of sessions 2-4, like contribution margin here).

The key differentiator of a costing system is the method of allocating indirect costs.

Direct costs are easy to measure. Indirect costs (overheads) are, by definition, uneconomic to measure (trace) by cost object (product in our case). The issue is important since overheads are a significant component of costs in a majority of companies today.

In Camelback Communications, Inc.’s case, the allocation of indirect costs is faulty.

- Should use two instead of one cost center.

- Should not use fixed OH (irrelevant) within cost centers.

- Is potentially vulnerable to wrong decisions due to errors in the current system of overhead allocation (using a single basis – direct labor in this case).

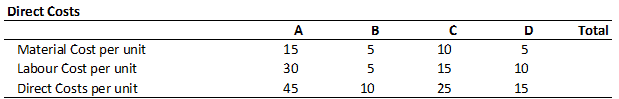

WORKINGS

* Overheads, by definition, are not measured by-products. They are only allocated. These are management estimates.

* Fixed overheads, in this case, are shared by two pairs of products. They cannot be split in this manner.

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!