Canyon Johnson Urban Fund (CJUF) is considering investing in real estate projects and raised $271.7 million as an investment. One of the projects being considered is in Hollywood and Highland where planning for the restoration of the area is on the process. The other project also under consideration is located in Sunset and Vine. Development investments in the past had proved unsuccessful in this second area. Also, the community had been wary of previous developments. Basketball star Earvin "Magic" Johnson and K. Robert Turner, managing partner of CJUF, are thus, torn on which area to delve into - Hollywood and Highland or Sunset and Vine?

Felix Oberholzer-Gee, Alexa Arena

Harvard Business School (706442-PDF-ENG)

Dec 10, 2005 (Revision: Sep 26, 2007)

Case questions answered:

We have uploaded two case solutions, which both answer the following questions:

- What are Canyon Johnson Urban Fund’s internal rates of return for the Sunset & Vine and the Hollywood & Highland projects? For Hollywood & Highland, include the hotel and theater in your analysis. (CJUF believes that it can obtain debt financing at a 5% interest rate for a term of 25 years. In your valuation of Hollywood & Highland, disregard the fund’s option for partial ownership of the hotel.)

- Which project should Turner choose? Thoroughly explain your rationale.

Not the questions you were looking for? Submit your own questions & get answers.

Canyon Johnson Urban Fund Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

1. What are Canyon Johnson Urban Fund’s internal rates of return for the Sunset & Vine and the Hollywood & Highland projects? For Hollywood & Highland, include the hotel and theater in your analysis. (CJUF believes that it can obtain debt financing at a 5% interest rate for a term of 25 years. In your valuation of Hollywood & Highland, disregard the fund’s option for partial ownership of the hotel.)

Hollywood and Highland: The project is located at a premier location at the epicenter of “old Hollywood,” which is the heart of Hollywood’s commerce and entertainment area. This Canyon Johnson Urban Fund proposed project aim was to restore Hollywood and Highland to its former glory.

The development hoped his design would be on par in scale and profitability with the famous revitalization of 42nd Street in New York City. The development consists of a 640,000-square-foot retail complex, a new state-of-the-art theater that will host the Academy Awards and a 550,000-square-foot hotel.

The main advantages associated with this project are its premier location and the potential benefit of adjacent Mandarin Chinese theatre.

Community Redevelopment Agency (CRA) recognized Hollywood and Highland as “one of the most strategically located sites.”

Another advantage is that Hollywood and Highland had already received positive media attention as well as commercial interest from Pepsi and Kodak. The government has also facilitated this development by providing $148M in financing.

The main disadvantage associated with this project for Canyon Johnson Urban Fund is the high cost of development, which results in a relatively huge required equity investment, which can make the project relatively high risk.

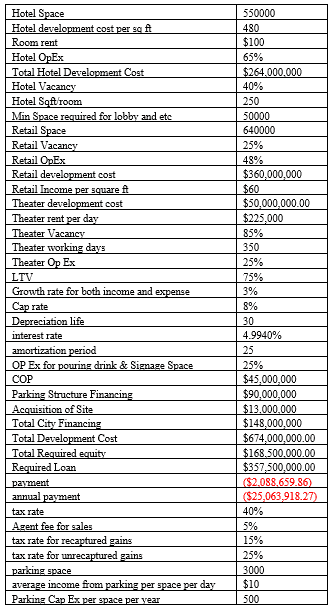

The main assumptions for the calculation are listed in Table 1. Based on the calculation in Table 1 and Table 2, the total development cost of this project summed up to $647MM, including hotel, retail, and theater.

Hotel costs are about $264MM, retail development costs are $360MM, and theater development costs are about $50MM, listed in Table 1.

Table 1 List of Assumptions for the Hollywood & Highland Project

To facilitate financing the theater, the city of Los Angeles issued $45 million in taxable certificates of participation (COPs) with a 5% interest rate and a 25-year amortization period.

CRA also provided $13 million toward the acquisition of the site in the form of a loan the developer was required to pay over the next 20 years.

The city of LA was also willing to finance the parking structure for $90 million, which would be self-paid using the parking revenue.

The total development cost for Canyon Johnson Urban Fund, which should be provided in a combination of loan and equity, was $674M, out of which $505.5M can be a bank loan (total loan will be $357.5M +$148M as 75% LTV) and would invest $168.5M in equity.

Table 2 demonstrates that the property promises a total income of…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!