In order to make the most out of the shareholder value, Level 3 Communications compensates managers if the stock price movement of the firm surpassed that of the market. For the past year, Level 3 was worried about retaining its employees and, at the same time, providing them the proper compensation. Level 3's compensation plan is an important strategy in attaining its need for hiring good employees over the coming year. Its CEO needs to review the success of the plan and find rooms for its improvement if any.

Lisa Meulbroek

Harvard Business School (XLS829-XLS-ENG)

Dec 11, 2001 (Revision: Jun 11, 2002)

Case questions answered:

- Examine the delta of an at-the-money Level 3 Communications employee option if the strike price was fixed.

- Examine the delta of an at-the-money Level 3 employee option if the strike price is determined using the market adjustment K = Kt as described below.

- Examine the delta of an at-the-money Level 3 employee option if the strike price is determined using the market adjustment as described in question 2, and the payoff function follows the schedule below.

- Examine how the three different option specifications (in Q1‐Q3) are different in terms of how they affect the employees’ incentives.

Not the questions you were looking for? Submit your own questions & get answers.

Compensation at Level 3 Communications Case Answers

This case solution includes an Excel file with calculations.

1. Examine the delta of an at-the-money Level 3 Communications employee option if the strike price was fixed.

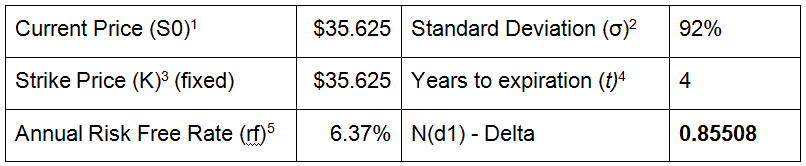

With a fixed strike price, we assessed the option as a “plain vanilla” American call using the Black-Scholes model with the inputs listed above. This gave us a delta of 0.85508 for the “at-the-money” option for a Level 3 Communications employee.

2. Examine the delta of an at-the-money Level 3 employee option if the strike price is determined using the market adjustment K = Kt as described below.

With a strike price adjusting to the index’s performance, we employed Fischer-Margrabe Option Pricing. As an extension to the Black-Scholes model, the FM model is employed for options whose exercise price is not certain.

In this case, it can be directly applied to the Level 3 Communications employee stock option to buy the employer’s common stock on a specified date at a price determined by that stock’s value relative to a stated market index.

A new volatility is calculated to take into account both stock and index volatility and their correlation so as to factor in the “out-performing alpha” in the scenario.

The new volatility is given by:

V2 = VS2 + VX2 – 2ρSX(VS VX) sx

Where VS = Volatility of Stock

VX = Volatility of Index

ρSX = Correlation of Stock and Index

With that, we arrive at a variance of 0.720484, and the square root of our variance gives us a volatility (SD) of 84.9%. Using the method in question 1…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!