An initial public offering (IPO) was scheduled for Slater & Gordon (S&G), an Australian law firm, in May 2007. The IPO is seen to pave the way for S&G to become the first publicly-traded law firm in the world. The firm and its underwriters had prepared and released a prospectus. They were now processing investors' line-up. A portfolio manager at Freemantle Securities, Gloria Rosen, is looking into buying the stock for her small-cap growth fund. A few days before the end of the placement of an order for the offering, she must come up with the decision on whether to invest and how much to invest. In order to come up with a decision, she must consider the value implications of the business model of the law firm, its growth plan, and the relevant risks involved in such investment.

Benjamin C. Esty; E. Scott Mayfield

Harvard Business Review (213019-PDF-ENG)

October 17, 2012

Case questions answered:

- Analyze Slater & Gordon Limited’s “No Win-No Fee” business model. How much is a successful personal injury lawsuit worth? (Hint: use the financial model included as part of the courseware).

- Does S&G’s consolidation strategy create value? Will it continue to create value as it grows?

- How much is S&G worth as a company? (Hint: Use the financial model included as part of the courseware and assume the appropriate discount rate – the weighted average cost of capital is 11%).

- Should Rosen invest in the S&G IPO? If so, how much should she invest?

Not the questions you were looking for? Submit your own questions & get answers.

Creating the First Public Law Firm: The IPO of Slater & Gordon Limited Case Answers

This case solution includes an Excel file with calculations.

Executive Summary – Creating the First Public Law Firm: The IPO of Slater & Gordon Limited

Slater & Gordon (S&G) Limited, an Australian public law firm, is seeking to raise funds to finance its rapid growth. The company’s growth strategy is based mainly on acquisitions and organic growth. The firm’s business model, “No Win No Fee,” enables it to generate substantial revenues, thanks to the high success rate of its lawsuits (95%).

However, the company wants to raise additional capital for acquisitions and growth in the future. Hence, the company wants to go public as going public seems to be the best method to raise additional capital compared to other options. The company needs to evaluate the decision to go public, considering growth prospects, legalities, and shareholder incentives.

The company has a consolidation growth strategy, which might prove profitable in the short run (8-10 yrs.) but might not create value in the long run due to market consolidation. The fundamental value of the firm is determined based on a series of assumptions (EBIT margin, EBIT improvement, NWC, etc.), which we have detailed in the core of this report.

Based on our analysis, we found that S&G’s IPO is underpriced and has the potential to generate an IPO initial return of 289%. Therefore, we recommend Rosen invest in the firm’s IPO. However, for calculating the investment amount, Rosen will have to calculate the correlation of S&G’s stock with the assets of the existing portfolio and see how the firm will contribute to the volatility and return of the assets under management by Rosen. She will also have to consider the money available to spend on IPO and the weight she wants to give S&G in her portfolio.

Introduction

S&G’s business is organized into three segments: personal injury litigation, non-personal injury litigation, and project litigation services. The first two segments of the business represent the core business, and the personal injury litigation segment account for 75% of the core business revenues for Slater & Gordon. All the segments work on a contingency basis, i.e., a “No Win-No Fee” policy, meaning that S&G received payment as a fee for the case only upon successful completion of the case.

With such a strategy, S&G bears the internal expenses of the staff as well as the incremental expenses of research, expert witnesses, and other legal costs associated with each case, but the firm receives payment only upon completion of the case. This meant that S&G essentially provided free funding to its clients while cases were pending.

1. Analyze S&G’s “No Win-No Fee” business model. How much is a successful personal injury lawsuit worth?

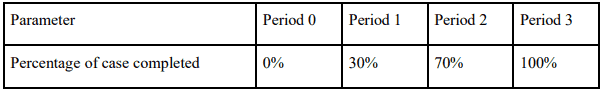

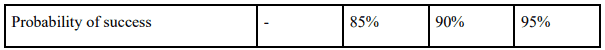

“No Win-No Fee” business model: A typical personal injury case could take between 6 and 24 months for completion and had an estimated fee of about A$15,000. During that time, Slater & Gordon would book revenue based on the percentage of the case that has been completed, its assessment of the probability of success, and the fee expected to be received upon successful completion of the case. Hence, at each stage of completion,

Revenues (Work in progress) = Fee (if successful) *(Completion %)*(Success Rate)

In recent years, 95% of S&G’s personal injury cases have resulted in success. Most of the personal injury cases were resolved within two years, which is equivalent to four periods of six months each. The case is usually decided at the end of the third period, and the payment is made in the fourth period. The completion percentage and the success rate in different periods are as follows:

For the case proceedings, Slater & Gordon bears the litigation expenses, including costs associated with staff, buildings, and other large fixed costs. These costs are recognized as incurred over the…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!