Sometime in March of 2009, the CEO of Danaher Corporation was challenged on how to maintain the growth of the company which experienced changing world-wide economic circumstances and other economic challenges including pressure from low-cost producers, new competition, lower demand for company products, and others. He was contemplating on whether he ought to change the company's strategy for growth or believe that he can attain the past successes of the company.

Nadathur Sriram; L.J. Bourgeois

Harvard Business Review (UV4256-PDF-ENG)

March 31, 2010

Case questions answered:

- What are the challenges Danaher is facing to sustain their growth, and what should it do to keep it and grow?

- What strategy should they follow to balance organic and acquisition-oriented growth?

- What should they do to evolve and maintain their unique company culture and business systems?

Not the questions you were looking for? Submit your own questions & get answers.

Danaher - The Making of a Conglomerate Case Answers

Memo

To: Larry Culp, Chief Executive Officer

From: Team C

Date: February 2, 2017

Re: Danaher Corporation

Executive Summary

The most important challenge faced by the company is sustaining growth and particularly balancing organic and acquisition-oriented growth when faced with increased challenges to successful acquisitions. Danaher must overcome this challenge while simultaneously evolving and sustaining its unique company culture and business systems.

The primary cause of this challenge is the growth of the private equity sector and the depletion of appropriate potential acquisition targets, particularly as mergers and acquisitions get more expensive.

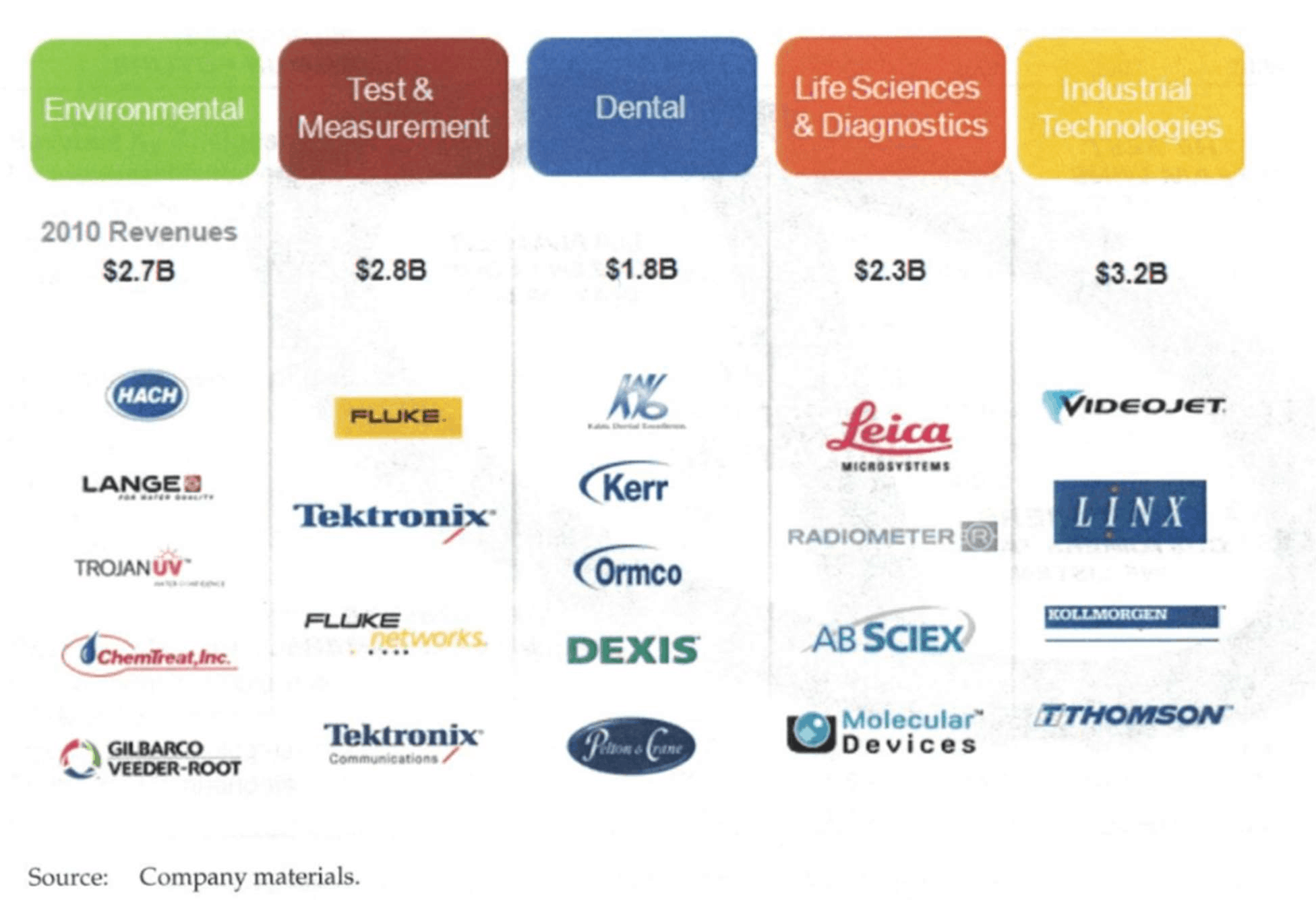

Since 2003, Danaher Corporation’s inorganic (acquisition) growth has dropped from 25% to under 10% in 2007 (Exhibit 1) as more private equity firms have entered the market. Additionally, the slowing US and global economies put limits on organic growth.

To address this challenge, Danaher should intentionally develop its brand while taking advantage of economies of scope, acquiring companies that provide cross-selling benefits across the industries where Danaher currently operates.

Danaher is unlike other conglomerates – rather than buying businesses simply to sell them, Danaher Corporation focuses on building companies with the Danaher Business System (DBS) and lean manufacturing practices.

Situation Overview

The most important challenges faced by Danaher are sustaining growth and balancing organic and acquisition-oriented growth when faced with increased challenges to successful acquisitions.

The corporation will have to use its cash flow for value-added acquisitions to maintain high growth rates. Danaher has to actively search for new business targets while competing with private equity conglomerates like Bain Capital and the Blackstone Group.

Additionally, in targeting new businesses, Danaher has generally focused on small to medium size companies. However, with the increasing costs of mergers and acquisitions, the company now faces the challenge of either acquiring more companies at a faster rate or targeting larger, more established firms.

Danaher must overcome all of these challenges while simultaneously sustaining the company culture and ensuring that Kaizen continues to push strong performance across the corporation.

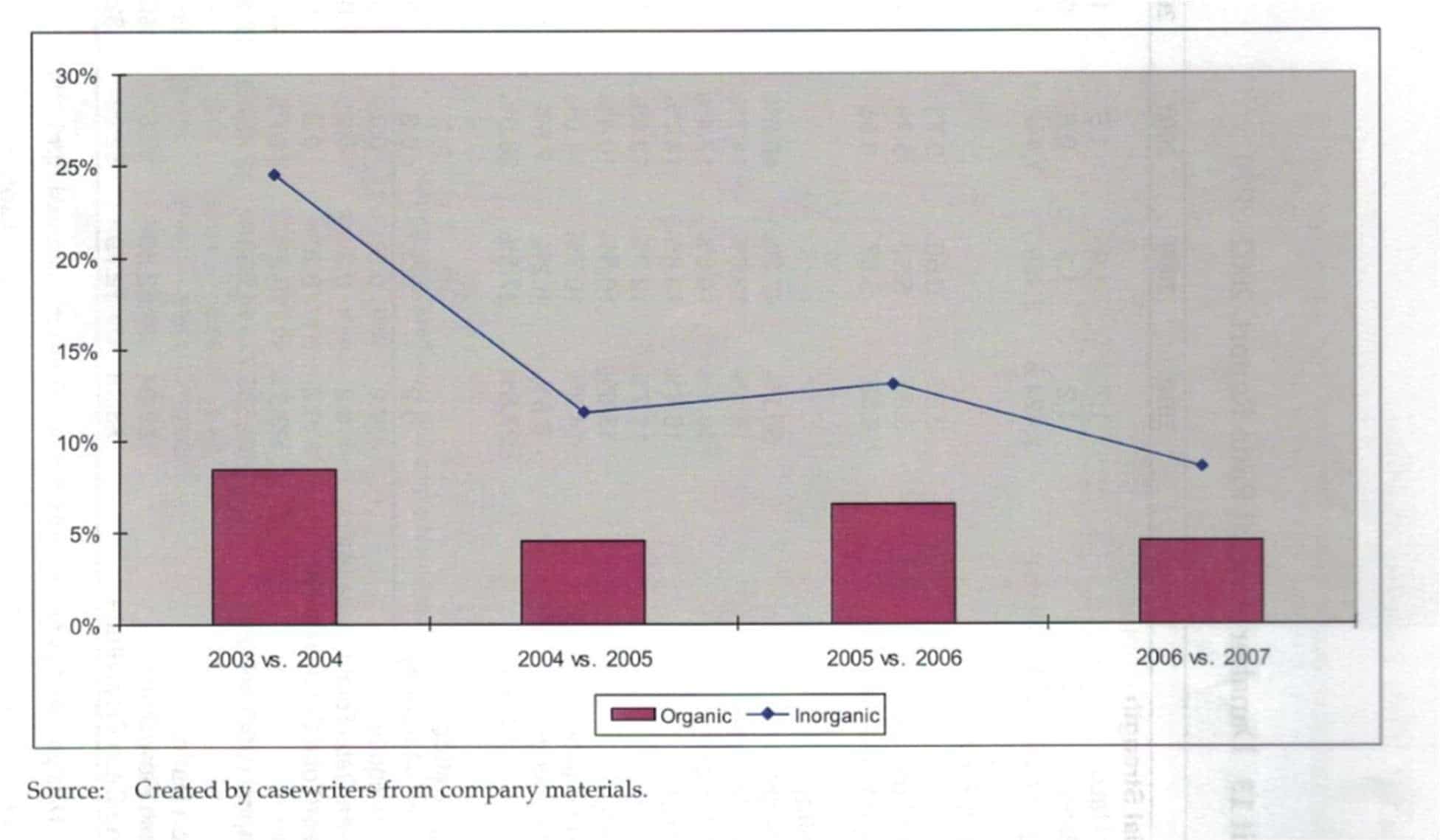

The company’s operating model and business system are both keys to its success as it continues to grow. However, if the company culture breaks down, Danaher risks losing its competitive advantage (Exhibit 2).

The primary causes of the challenge of sustaining and balancing organic and acquisition-based growth are the expansion of the private equity firms, the depletion of potential acquisitions, and slowing cash flow.

Danaher is able to act upon both the depletion of potential acquisitions and the slowing of cash flow, but the firm does have less control over the expansion and growth of private equity firms.

Private equity firms have vast amounts of capital to spend on acquisitions. They also have the ability to more easily acquire bigger targets, making it more difficult for Danaher to convert larger, older, and more well-established companies.

This is coupled with slowing US and global economies, which in turn limit natural organic growth. Additionally, portions of Danaher’s existing portfolio are subject to swings in end markets, making cash flow less predictable and larger business acquisitions riskier.

As Danaher’s success relies heavily on its operating model and business system, the company risks disturbing its organizational culture with major company-wide shifts in response to unavoidable challenges.

Action Overview

To solve its growth challenges, Danaher should make the following changes to its strategy and tactics.

Proposed changes in the strategy:

- Invest more in horizontal diversification to utilize its synergies. Danaher should review its current businesses in order to assess tangible and intangible assets, particularly to identify industries where the corporation can manage at least two connected units that utilize the assets.

- Take advantage of economies of scope, acquiring and developing only companies that provide cross-selling benefits or other sources of corporate advantage. Whereas Danaher has recently focused on the acquisition of any companies in its portfolio segments where the corporation expects a strong return on invested capital, moving forward, the corporation should only acquire companies that will improve its overall standing.

- Streamline the Danaher portfolio, retaining only companies that contribute to an overall strategy of developing corporate advantage through economies of scope, supporting the corporation’s newly established strategy of horizontal integration.

- Develop and sustain Danaher’s distinct culture, particularly its DBS practices and Kaizen philosophy, to improve the way the corporation manages its portfolio companies.

Proposed changes in the tactics:

- Build a branded house to help customers recognize Danaher’s reputation and reliability in order to maximize cross-selling benefits. In doing so, dedicate significant resources to public relations and marketing to raise public awareness of the Danaher branded house, ensuring that potential customers understand the scale and scope of its work.

- Identify future acquisitions that horizontally integrate, align, and create synergies with existing portfolio companies in order to generate cost advantages. By targeting “bolt-ons” and limiting acquisitions of adjacencies and new platforms, Danaher will maximize its current and future positions.

- Ensure strategic platforms will either demonstrate ongoing organic growth or have growth-by-acquisition potential. In addition, Danaher should examine any businesses in its portfolio that solely function as adjacencies. For segments and businesses that offer neither type of growth potential, create a strategy to exit the market and/or divest businesses as appropriate.

- By implementing the previously noted strategies and tactics, the composition of Danaher’s portfolio may change drastically. As such, it will be even more important to maintain the corporation’s culture, human resources structure, and implementation of DBS, ensuring that all develop alongside the portfolio. In particular, the company’s historical focus on innovation and growth, as well as tools and processes around new product development, marketing, and sales, will continue to play an important role in its overall approach to lean manufacturing and continuous improvement.

- When Danaher’s acquisitions include technology or science-based companies, DBS must evolve to serve them such that continuous improvement still adds notable value. In technology and science environments, all major components of DBS – people, plan, process, and performance – will manifest differently than they did in Danaher’s previously more industrial portfolio in order to make a similar impact.

Action Rationale:

The proposed course of action is the best approach to solve the identified problem for the following reasons:

With almost thirty years of experience in the field, Danaher has a strong competitive advantage over its similar competitors. Its business model, and particularly the DBS, set the corporation apart, as demonstrated by its stock’s performance, significantly outperforming its competitors and the S&P 500.

With leaders and an entire corporation that is committed to and trained in the system, Danaher has created a resource that is valuable, rare, and extremely difficult to imitate.

By building a branded house, Danaher will best be able to take advantage of cross-selling benefits within an industry, which are most likely to develop in one-stop shops where customers can take advantage of a single point of contact for all their needs.

Until recently, Danaher has stayed under the radar, with limited interviews granted and no public relations staff. We recommend reversing this strategy and using the branded house approach to link successful businesses to each other in the company’s customers’ eyes.

Assuming Danaher has chosen to horizontally diversify into markets that create economies of scope, ensure that these acquisitions will pass the ownership test, resulting in cross-selling benefits greater than would exist through joint sales or a collaboration contract.

Danaher historically categorizes acquisitions into three different categories based on the target’s relation to existing businesses. If we are truly committed to horizontally diversifying, we must look to acquire more businesses that fall into the “bolt-on” category.

Historically, these are smaller acquisitions, but this could become threatened as private equity firms are acquiring more and more businesses and as mergers and acquisitions become more expensive overall.

While your prediction that Danaher and private equity firms are not targeting the same companies may be true, we must recognize that the “bolt-on” category of businesses may become more expensive and less accessible. By creating actionable economies of scope, we will have more free cash available for acquisitions.

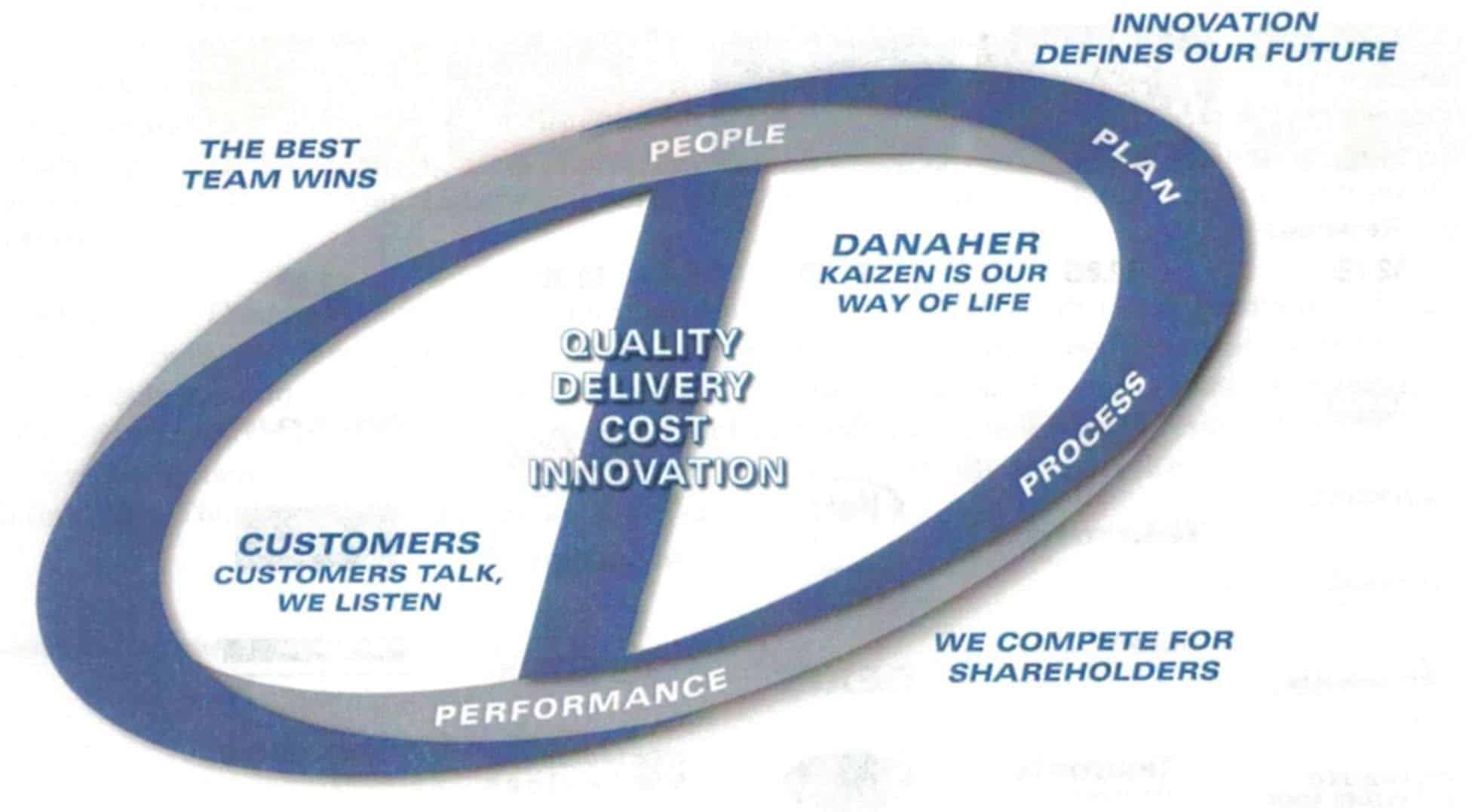

The five major business segments for Danaher are Life Sciences and Diagnostic, Dental, Test and Measurement, Environmental, and Industrial Technologies (Exhibit 3). We believe that Danaher can identify core functions that utilize the company’s tangible and intangible assets that already exist within its portfolio.

Danaher’s culture and strategy are already in place, and is capable of handling this task. DBS already emphasizes “Growth, Lean, and Leadership” within its four P’s – people, plan, process, and performance – and the company must now utilize this process to identify overlapping and conjoining resources.

For Danaher to maintain its successful year-over-year returns and growth, its portfolio companies need to demonstrate returns and growth. By purging companies that are no longer growing and do not offer economies of scope, the corporation will be able to free up capital to invest in companies that will provide greater corporate advantages and align better with DBS.

While these companies may currently show returns, Danaher dedicates significant time and energy to its operations that could be focused on improved cross-selling benefits and horizontal integration that would have a larger overall impact on the corporation.

Conclusion

The above analysis reflects our strong belief that the following proposed action is the best strategy to solve the key problems faced by Danaher and ensure long-term success.

The firm should invest in horizontal diversification, take advantage of economies of scope by focusing on the acquisition of “bolt-on” businesses, streamline Danaher Corporation’s portfolio, and continue to develop the company’s distinct culture. Horizontal diversification will allow the company to further take advantage of its innovative DBS.

Continuing to focus on acquisitions of “bolt-on” businesses will ensure strong cash flows, which will allow it to make larger acquisitions when market conditions are favorable.

Danaher should continually reexamine its portfolio and divest when companies no longer offer economies of scope to ensure its business remains streamlined. If Danaher integrates these recommendations into its existing business model, the corporation will succeed in sustaining both organic and inorganic growth despite the expansion of private equity firms and the weakening of US and global economies.

Though Danaher established itself as a successful business over nearly three decades, the company just now faces the new and growing challenges of emulation and imitation. In order to sustain its competitive advantage, Danaher must continue to build on the Danaher Business System that fosters sustained performance improvement by its employees and the organization as a whole.

The company now occupies a unique position where slight adjustments to the business and operating model will allow for steady and continuous growth.

Exhibits

The above analysis is supported by the attached exhibits as follows:

Exhibit 1. Organic (core) versus Inorganic (acquisition) Growth, 2003-2007

Exhibit 2. The Danaher Business System Image

Exhibit 3. Portfolio Segmentation