Danshui Plant No. 2, located in China, entered into a 1-year contract with Apple Inc. for the assembly of iPhone units. In the first quarter of its operations under the said contract, it was not able to come up with the expected number of units it can assemble. It then faced several issues that included unfavorable production volume variance, unprofitability, and recruitment. The plant manager must identify the root of these problems so that they may be addressed properly and resolved.

William J. Bruns Jr.; Julie H. Hertenstein; Kelvin Liu

Harvard Business Review (913525-PDF-ENG)

September 28, 2012

Case questions answered:

- What role does Danshui Plant No. 2 play in the overall value chain surrounding this product line and contract? What’s the impact of that value chain on the strategic issues facing this plant? What seems to be the critical business issue the plant (and Wentao) is facing?

- Calculate their budgeted cost per unit, then look at the following:

a.) What is the selling price?

b.) What is the gross margin? And the gross margin percentage?

c.) What do you think of this budgeting? Why would they budget so close to breakeven?

d.) What is their actual cost per unit?

e.) What is breakeven (in units)? Should 180,000 units show a profit or a loss? - Calculate a flexible budget:

a.) What are the flexible-actual variances?

b.) What do you learn from the flex-actual variances? How does this story compare to Jianye Ma’s explanation? - Calculate these variances:

a.) Calculate the direct material variances for flash memories. Should they worry about flash memory costs?

b.) Calculate the direct labor variances. Is there a labor rate problem? Or a labor efficiency problem? Is this something that Danshui Plant No. 2 can resolve internally? - Assess and comment on the actual volume of work they’ve been doing relative to expectations. Is this an issue? If so, how might they address it?

- Conclude your analysis and assessment with some specific recommendations – WHAT SHOULD WENTAO CHEN DO?

Not the questions you were looking for? Submit your own questions & get answers.

Danshui Plant No. 2 Case Answers

This case solution includes an Excel file with calculations.

Executive summary – Danshui Plant No. 2

Danshui Plant No. 2 is a contract manufacturer and is in a contract to assemble 2.4 million iPhone 4s for Apple. The plant is facing major issues, including unfavorable production volume variance, unprofitability, and recruitment.

The August report prepared by Jianye Ma suggests that the shortfall in production volume is the main reason for the unprofitable situation of the plant. However, flexible-actual variance analysis reveals that possible causes for these issues might lie in the direct material flash memory variance and labor cost variance.

Further variance analyses on usage/price (flash memory) and efficiency/rate (labor) show that the labor rate is the root of all problems the plant is experiencing.

Recommendations for the current situation include: (1) Raise labor wages to hire enough qualified labor to volume up production and (2) Contact and renegotiate the selling price with Apple to cover the unfavorable labor cost variance. In the long run, Danshui should consider building new plants in areas with a high unemployment rate to maintain low labor costs and prevent labor shortages and invest in new technologies to reduce labor costs and improve efficiency.

Analysis

1. Value chain and strategic issues

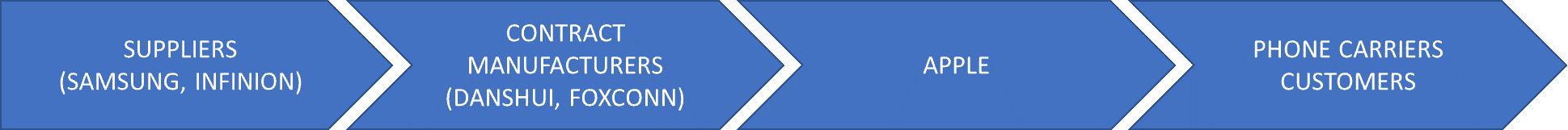

The value chain of the iPhone 4 consists of suppliers, contract manufacturers, Apple, and phone carriers/customers. In this value chain, Danshui is the contract manufacturer and is in charge of assembling 2.4 million iPhone 4.

Since Danshui mainly competes on prices, being able to offer low prices is critical to its business. However, as being in the middle of the value chain, Danshui does not have much control over material prices (since the plant does not manufacture any components) and quality. Therefore, in order to offer low prices, the plant will have to focus on reducing labor costs and improving operational effectiveness.

Considering the current situation, the plant is having three major issues:

(1) Production volume: They were not able to assemble 200,000 units as planned;

(2) Profitability: They had a loss of $672,000 instead of a profit of $100,000; and

(3) Hiring: They were not able to find qualified workers, and labor costs are increasing by 30-35%.

If these issues persist, Danshui Plant No. 2 will not be able to fulfill the contract and will suffer a huge loss at the end of this contract. In addition, their reputation and creditability will be damaged if they fail this contract.

2. Budgeted cost per unit – Actual cost per unit – Breakeven

a. Cost per unit

Exhibit 1 reveals the cost per unit and gross margin (budgeted and actual) of Danshui Plant No. 2’s production in August 2010. With a selling price of $206.20 and total costs of…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!