Delphi Corp. is weighted down with huge pension and other retiree liabilities that is slowly creeping up to push it into bankruptcy. Jane Bauer-Martin, a hedge fund manager, is wondering what she should do with the fund's large investment in the publicly traded bonds of Delphi Corp. She is looking into delving into several and different credit derivatives (credit default swaps, credit-linked notes, credit default swap indices, total return swaps, etc.) to get away from its position in Delphi debt, or to study on future Delphi bond prices to maximize its investments.

Stuart C. Gilson; Victoria Ivashina; Sarah L. Abbott

Harvard Business Review (210002-PDF-ENG)

July 07, 2009

Case questions answered:

Not the questions you were looking for? Submit your own questions & get answers.

Delphi Corp. and the Credit Derivatives Market (A) Case Answers

This case solution includes an Excel file with calculations.

Company Overview – Delphi Corp.

Delphi Corp. is one of the global auto parts manufacturer companies in the world. The company was financially distressed due to the recent events that were taking place within the corporation.

For instance, the company was one of the leading players in its industry. However, one of the most important customers of the company, General Motors, was facing a significant decline in the company’s sales.

Apart from this, the prices of the commodity inputs and copper had risen dramatically. As a result, the company’s cost structure was putting a high burden on the profits of the company.

Delphi Corp. also had many obligations, like General Motors, which were outstanding on the company’s part for all of its unionized workers under the medical benefits plans and pension plans.

Problem Statement

The risk of bankruptcy was rising for Delphi Corp. The main issue contributing to the likely risk of the company’s bankruptcy was the problem with the performance of General Motors, which was one of the company’s biggest customers. The cost structure of Delphi Corp. was very high.

Apart from this, most of the competitors of the company, in the same industry in which Delphi Corp. was operating, had also filed for bankruptcy.

Now, the company’s hedge fund manager, Juan Martin, was considering a range of options. Martin must choose which option to avail himself of to overcome the risks of bankruptcy.

The key supplier of General Motors is Delphi Corp. Just like any auto parts manufacturer, the balance sheet for Delphi Corp. was flooded with extremely high debt related to retiree liabilities and large pensions.

These contributed to pushing the company to bankruptcy in the future. The final decision had to be made by the portfolio manager of Birchfield Capital Management LLC, Juan Martin.

Case Analysis

Many options are being considered by Juan Martin to hedge its position or maximize the returns over its investment.

The options include the use of various credit derivatives such as credit link notes, total return swaps, credit default swap indices, and credit default swaps to hedge the debt position of the company. In other words, Delphi Corp. could also speculate on the future bond prices of the company.

Default Probabilities

Estimating the default probabilities is the first and the most important step to assess the potential losses and the credit exposure faced by the financial institutions and investors of the company (Acharya, V.V., S.T. Bharath, and A. Srinivasan, 2007).

If we look from the policy perspective and the regulations concerned, then we can see that the default probabilities are the first and foremost step in testing and evaluating the systematic risk at a global, regional, and national level.

The CDS spreads are provided in the exhibits. These spreads indicate the current perception of the sovereign risk of the market. However, it should also be noted here that the credit spreads of CDS are dependent upon the global financial environment, counterparty risk, and market liquidity.

One of the most commonly used formulas in the fixed-income markets is the relationship of the fixed-income securities with the market.

Cash Flows and NPV Analysis

The following formulas, as shown below, show that relationship:

Credit Spread = (1 – Recovery Rate)*(Default Probability)

This concept of this formula has been used in the Excel spreadsheet to calculate the default probabilities of the cash flows and also perform the NPV analysis.

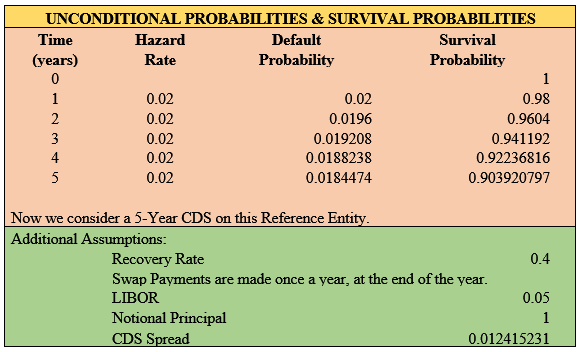

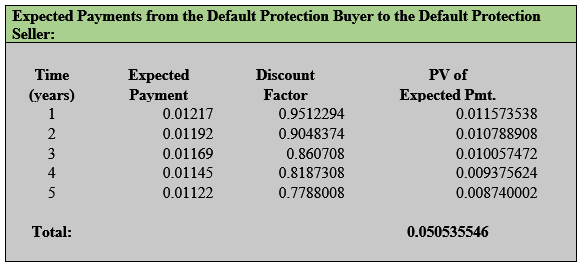

The first calculations of the cash flows and the net present value analysis have been performed based on the CDS staff, and the risk-free rate that has been used is around 5%.

The recovery rate stands at around 0.4, and the Libor rate has been assumed to be standing at 0.05 (G. and R. Lagnado 2002). The CDS spread is the breakeven CDS spread, which has been calculated in the CDS sheet.

Credit Default Swap

One of the financial swaps, which is the credit default swap, has been used to identify the credit event’s riskiness and the implications for the future survival or bankruptcy of the company.

The credit default swap is one of the financial swap agreements (Chernov, M. A.S, Gorbenko, and I. Makarov 2013). This agreement states that the creditor of the reference loan, who is the buyer, would be compensated by the CDS seller in the event of the default of the loan by the company or the debtor (Bloomberg 2009).

This means the issuer of the bonds, which is Delphi Corp., in this case, would provide the insurance or protection to the buyer of the bonds. The buyer of the loan receives the payoffs if the loan defaults. However, if there is no default likely to occur, then the buyer of the CDS will have to pay the spread or the CDS fee to the seller of the bond.

The face value of the loan is received by the buyer of the bonds if the company defaults on the loan and the defaulted loan is left out with the seller of that loan.

Therefore, it could be said that the credit default swap is very similar to credit insurance. The entire risk is transferred by the buyer of the protection seller for a fixed fee in return for all the credit losses if they come across in the future.

In the case of Delphi Corp., when the credit rating of the company was downgraded, it led to a significant increase in the price of the bond. The yield to maturity of the company occurred because the company had to settle the credit derivative contracts, and that too with the company bonds, which were par valued. This increased the demand for the bonds of the company.

Unusual spikes were created by the physical deliverance requirement in the market. As the bond is then no longer held by the buyer of the bonds, then the buyers have the option to speculate on the hedge defaults.

If the buyer of the bond under the terms of the protection in the credit default swap contract did not want to hold a particular bond, then within the next 30-day period, the buyer would have to buy the bond.

As a result of this, the prices of the Delphi bonds had risen, and along with this, there would also be seen a heavy trading activity of the defaulted bonds.

Further, the value of the credit default swaps is based on the default probabilities of the bonds. The default probabilities of the bonds are based on the spreads that are paid by the buyer of the protection to the company.

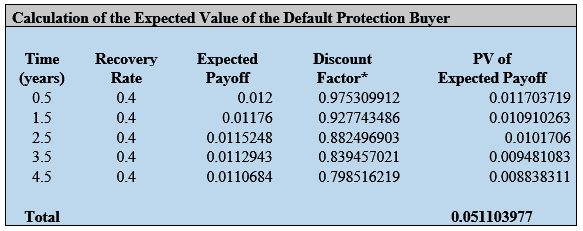

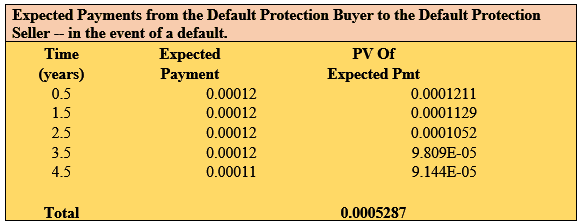

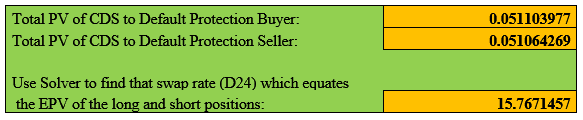

The calculations have been performed in the Excel spreadsheet, and the analysis of the default probabilities of the company based on the recovery rate of 0.05 shows that the total present value of the CDS to default, protection buyer, is 0.0511. In contrast, the total present value of the CDS to default protection seller is around 0.0510.

It could be clearly seen that the present value of the default protection buyer is much higher than that of the default protection seller. The swap rate has also been calculated at which the long and the short positions would equate, which is found to be around 15.76.

Shortening the Bonds

There is an untapped bank availability of around $ 3 billion held by the company. This amount is the main key to the whole thing. A term loan of about $ 1.5 billion will mature in 2009, and a 1.5 billion evolver is going to mature in the year June 2005.

If someone at this point thinks that only $ 1.5 billion is the total amount held by the company, then they would be wrong because there is a high probability on the part of the company that what is going to happen next and the revolver of Delphi Corp. would be extended for another year at a smaller size. The bank would ask for security and get secure.

The most attractive part of the capital structure of the company is the 6.660% unsecured bonds that are going to mature in the year 206 on the 15th of June. These bonds are trading at 94, and the yield to maturity on these bonds stands at around 12.3%.

The company also has cash available on its balance sheet, and the principal, which is outstanding on the bond, is 500 million. Therefore, the company has the option to pay out the outstanding principal of 500 million out of the cash available on the balance sheet of Delphi.

However, the future is uncertain, and if the company, due to any unforeseen reason, burns around 1 billion of the total cash available on the balance sheet of the company, then the borrowing from the term loan and the most likely renegotiated small size revolver of the company could be used by the management of the company to repay bonds.

If the company really wants its bonds to move in the right direction, then the company could end the portfolio hedging. The other thing that could be done by the company is to short the bonds of the company that yields around 12%.

This would help the company to increase its profitability as currently, the situation for the company is getting worse. This is because the 12% yield for the company’s bonds is not cheap. After all, coupons have to be paid by the company, and the company is losing money each day because of the reason of accretion from the current price to par.

Doing nothing and Influence in bankruptcy proceedings.

The third option available to the company is to do nothing. However, this is the least acceptable option for the company as the company’s debt position and its cost structure are eroding the profitability of the company and taking the company near bankruptcy each day.

The last but not the least option for the management of the company is to influence the bankruptcy proceedings.

The management of the company should, first of all, seek the guidance of the Auto Taskforce of the president and the treasury of the United States to transfer all the pension funds of the Delphi Corporation employees.

Further, the pensions that have been earned by the retirees of the company are all part of the earned pensions.

According to one of the reports, the company will also have to pay $ 23.1 million to clean up all the sites contaminated with asbestos and many other pollutants to settle all the environmental claims over the company in the sites of Ohio and Michigan.

Apart from this, the company would also have to pay $ 158000 to the agency of US environmental protection to clean up at another Ohio property of the company.

Conclusion

Looking at the detailed analysis that has been performed for Juan Martin and considering all the options along with the present value for the protected buyer and the protected seller under the CDS calculations performed in the spreadsheet, it could be seen that the company could avoid bankruptcy for the company in the short run.

However, there is a high likelihood that the company is going to default in the future. As the portfolio manager of Birchfield Capital Management LLC, he should advise the management of Delphi Corp to shorten the bonds of the company since this is the only option that could avoid bankruptcy for the company for some time.

However, he also needs to address the management of the company that the cost structure of the company is very high, the intensity of the problems in the sales side faced by General Motors is also severe, and most of the competitors of Delphi Corp. have also filed for bankruptcy. The company will ultimately have to file for bankruptcy under Chapter 11.

However, after this occurs, the company will have to emerge as soon as possible out of this bankruptcy. The company could also take steps to renegotiate with UAW and GM to lower the costs of labor. The bankruptcy of Delphi Corporation would be one of the largest bankruptcies that will be filed in the United States to date.

References

Acharya, V.V., S.T. Bharath, and A. Srinivasan (2007) “Does Industry-Wide Distress Affect Defaulted Firms? Evidence from Creditor Recoveries” Journal of Financial Economics, 85, pp:787-821.

Bloomberg (2009) “The Bloomberg CDS model.” Technical Report, Bloomberg.

Díaz, A., J. Groba, and P. Serrano (2013). “What drives corporate default risk premia? Evidence from the CDS market.” Journal of International Money and Finance, 37, pp. 529-563.

Chan-Lau, J.A. (2006) “Market-Based Estimation of Default Probabilities and Its Application to Financial Market Surveillance” IMF WP/06/104.

Chernov, M. A.S, Gorbenko, and I. Makarov (2013) “CDS Auctions” Review of Financial Studies, 26 (3), 768-805. Creditex and Markit (2010) “Credit Event Auction Primer.” Technical Report, Creditex, and Markit. Deliannedis,

G. and R. Lagnado (2002) “Recovery Assumptions in the Valuation of Credit Derivatives” The Journal of Fixed Income; March 2002, pp 20-30.

Duffie, D. (1999) “Credit Swap Valuation” Financial Analysts Journal, 52 (1), pp. 73-85.

Duffie, D. and K. Singleton (1999) “Modeling the Term Structure of Defaultable Bonds” Review of Financial Studies, Vol 12, N.4; pp-687-720.

Appendix

Additional File:

Excel Spreadsheet. Download here.[/emaillocker]