The managing director of Fonderia del Piemonte S.p.A. must decide whether to approve an investment to automate parts of the plant's production process. The case study presents information sufficient to build cash-flow forecasts of production costs incremental to this investment. Discounted cash flow (DCF) analysis shows that the investment is promising, but this hinges on important assumptions about the plant's business volume, the ability to lay off workers, and the hurdle rate.

Robert F. Bruner; Michael J. Schill

Harvard Business Review (UV7207-PDF-ENG)

October 21, 2016

Case questions answered:

- Analyze possible options and conduct a risk analysis for each option.

- What is your recommendation for Fonderia del Piemonte?

Not the questions you were looking for? Submit your own questions & get answers.

Fonderia del Piemonte S.p.A. Case Answers

This case solution includes an Excel file with calculations.

Executive Summary – Fonderia del Piemonte S.p.A.

The managing director of Fonderia del Piemonte S.p.A. was considering whether she should replace the semi-automated machines with the new automated one, Thor MM-9. We analyzed this investment decision by following these steps:

- Recalculating the firm’s COC because the current hurdle rate is outdated. The new WACC – 2015 is 5.82%; We also assume that the firm can lay off unskilled workers and achieve labor cost savings in this case;

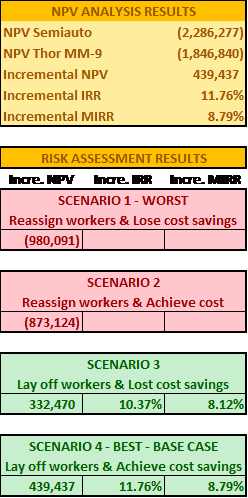

- Calculating the NPV of the cash flow for each option. From the result table, it is clear that NPV Thor is higher than NPV Semiauto. This means the cost of Thor MM-9 is lower than the cost of current machines. Therefore, replacing those machines with new ones can create value for the firm. However, since there are a lot of potential risks associated with this investment, we need to calculate incremental IRR and MIRR to compare with WACC and see if the investment is appealing;

- Calculating incremental NPV, IRR, and MIRR. These rates are considerably higher than WACC. Therefore, we conclude that the investment is appealing.

Our NPV analysis for Fonderia del Piemonte S.p.A. implies that the investment in Thor MM-9 is…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!