This case study analysis seeks to answer the question of how a multinational firm should manage foreign exchange exposures? It looks into the transactional and transitional exposures and the possible responses to these exposures. It discusses the two specific hedging decisions by General Motors and shows the company's corporate hedging policies and how internal rules affect hedging decisions. The firm has to put into consideration getting away from the required policies. It depicts exposure to the Canadian dollar with adverse accounting effects and to the Argentinean currency when devaluation is foreseen. It analyzes the foreign exchange hedging strategies that General Motors undertook in each situation.

Mihir A. Desai; Mark F. Veblen

Harvard Business Review (205095-PDF-ENG)

March 08, 2005

Case questions answered:

Case study questions answered in the first solution:

- Should multinational firms hedge foreign exchange risk? If not, what are the consequences? If so, how should they decide which exposures to hedge?

- What do you think of GM’s foreign exchange hedging policies? Would you advise of any changes?

- Should GM deviate from its policy in hedging its CAD exposure? Why or why not?

- If GM does deviate, how should GM think about whether to use forwards or options for the deviation from the policy?

- Why is GM worried about the ARS exposure? What operational decisions could it have made or now make to manage this exposure?

Case study questions answered in the second solution:

- Why a passive hedge? Why is the hedge rate 50%? Should it be different?

- Should management attempt to hedge translational risk?

- In regards to the Loonie, what course of action should GM take? Is this different than the current strategy employed?

a. This should be data-driven

b. Consider the impact of hedging with both futures and options

c. What is the earnings impact? Should this matter?

Not the questions you were looking for? Submit your own questions & get answers.

Foreign Exchange Hedging Strategies at General Motors: Transactional and Translational Exposures Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Should multinational firms hedge foreign exchange risk? If not, what are the consequences? If so, how should they decide which exposures to hedge?

Foreign exchange risk is a financial risk posed by an exposure to unanticipated changes in the exchange rate between two currencies. Multi-national firms involved in exports or imports of goods and services or foreign investments are faced with exchange rate risks, which can have severe financial consequences if not managed properly. Thus, a multinational firm should hedge foreign exchange risk.

Foreign exchange risk impacts a multinational firm in different ways.

- Affects the firm’s cash flows, reported earnings, and thus, its stock price (Translation Exposure)

- Influences the outstanding foreign-currency-denominated contracts and obligations, thus the firm’s earnings and cash flow (Transaction Exposure)

- Affects the firm’s market share and position with regard to its competitors, the firm’s future cash flows, and, ultimately, the firm’s value. (Operating Exposure)

Thus, these exposures should be hedged to reduce cash flow and earnings volatility and also the adverse impact of foreign currency gain & loss on a firm’s value and equity. It also helps in reducing transaction costs when obligated to make payments in different currencies. In the case of General Motors (GM), it’s important to hedge as GM sells its products in many countries, and it has properties on multiple continents. (From Exhibits 2 and 3)

Consequences of not hedging foreign exchange risk

- In the case of adverse exchange rate movements, translational exposure negatively affects consolidated earnings and equity.

- Uncertainty in future cash flows and earnings if transactional exposures are not hedged.

- Risk of losing competitive advantage if operating exposures are not hedged, which in turn affects the profit margin, sales, and firm value.

Multi-national firms should hedge these exposures based on different factors.

Implications of Impact: MNCs should first analyze the impact of these exposures on their firms’ earnings, cash flows, and value by currency volatility, value at risk, sensitivity, and scenario analysis. Firms should hedge only those exposures which have significant negative impacts.

The cost associated with hedging: MNCs should hedge only those exposures for which hedging benefits exceed their costs. Costs could be either implicit, like an investment of resources in FX management or explicit, like Option premiums.

FX risk management policy: Firms should prioritize their policies in case of any conflicts arising from hedging different exposures.

What do you think of GM’s foreign exchange hedging policies? Would you advise of any changes?

GM’s existing foreign exchange policies were designed to meet three major objectives:

- To reduce cash flow and earnings volatility.

- To minimize management time and costs associated with FX management.

- To align FX management in a manner consistent with how GM operates its core business.

Their first objective was to only hedge cash flows (transaction exposures) and ignore balance sheet or translation exposures. The second objective was a passive approach. The third objective was to map FX management to the geographic operational footprint of the underlying business.

Their foreign risk exposure spins mainly around their domestic currency (US $) against fluctuations of the Canadian Dollar, Japanese Yen, and Argentina Peso. With their passive policy, they hedge only 50% of commercial (operating) exposures on a regional level.

Their hedging policies should consider hedging from a global perspective instead of a regional level, as they operate in multiple territories around the world. The company relies mainly on passive hedging approaches since its abandonment of actively managed risk management decisions. Therefore, we would suggest the integration of active strategies considering the expected results and actual outcomes between actively and passively managed strategies.

Should GM deviate from its policy in hedging its CAD exposure? Why or why not?

GM’s exposure to foreign exchange risk arises from its Canadian subsidiary as its functional currency is in US dollars, even though it has large Canadian dollar assets. The company faces both transactional and translational risk in this case due to CAD-dominated cash flows.

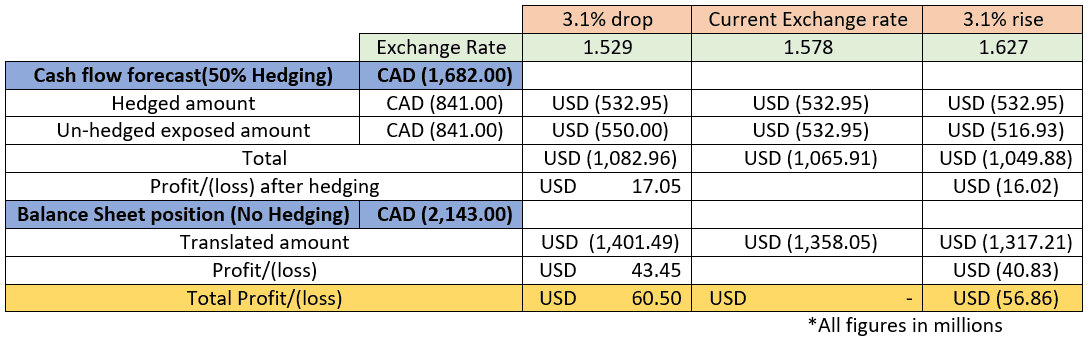

From Exhibits 9 and 10, we can see that the transactional exposure is to the tune of 1.682 billion Canadian dollars, and the translational exposure is to the tune of 2.143 billion Canadian dollars.

The company’s current policy advocates a 50% hedging strategy; however, the impact of going for a 75% hedging strategy needs to be assessed. The assessment needs to be done on a plus-or-minus 3.1% movement around the 1.5780 exchange rate.

Existing hedging policy:

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!