Before the end of the year 2000, General Mills was offered a merger proposal and proxy statement. The prospectus detailed the terms and conditions for General Mills' acquisition of Pillsbury from Diageo PLC. Included in the proposal was the assumption of Pillsbury's debt and an unordinary contingency payment, resembling a contingent value right (CVR). This case study allows a student to look at the proposal and provide recommendations on its attractiveness.

Robert F. Bruner

Harvard Business Review (UV0089-PDF-ENG)

February 27, 2001

Case questions answered:

- What are General Mills’ motives for this deal? Estimate the present value of the expected cost savings.

- Why do you think the deal is structured this way? What other structure could have achieved the same end result?

- Why was the contingent value right (CVR) included in this transaction? How does it affect the attractiveness of the deal from the standpoints of General Mills and Diageo? How is an earnout different from a CVR, and in what situation should one or the other be used?

- How does the contingent payment work? Draw a payoff diagram (a hockey stick diagram) of the claw-back feature. What option positions should you take to create the same payoff?

- What is the contingent payment worth when the deal is negotiated in July 2000? What is it worth when shareholders vote on the deal in early December 2000? Use a Black-Scholes calculator to value the CVR (you can always download one from the internet).

- Is this deal economically attractive to General Mills’ shareholders? Would you recommend that shareholders approve or reject the deal?

- What can the bidder do to protect its shareholders from stock price fluctuations before the deal is closed? How can the target protect its shareholders?

Not the questions you were looking for? Submit your own questions & get answers.

General Mills' Acquisition of Pillsbury from Diageo PLC Case Answers

This case solution includes an Excel file with calculations.

Introduction – General Mills’ Acquisition of Pillsbury from Diageo PLC

Before the end of the year 2000, General Mills was offered a merger proposal and proxy statement. The prospectus detailed the terms and conditions for General Mills’ acquisition of Pillsbury from Diageo Plc.

Included in the proposal was the assumption of Pillsbury’s debt and an unordinary contingency payment resembling a contingent value right (CVR). This case study allows a student to look at the proposal and provide recommendations on its attractiveness.

Contingent value rights (CVR) in M&A

Payment conditional on milestones (events) or financial ratios (performance)

- Assets under management

- Alliance Bernstein’s acquisition of asset manager W.P. Stewart, 2013

- Drug Approvals

- Sanofi’s acquisition of Genzyme, 2011

- BioMarin Pharmaceutical’s acquisition of Prosensa in 2015

- Sale of real estate and foreign joint venture

- Cerberus acquisition of Kmart, 2014

- Resolve federal investigation into billing and referral practices

- Community Health Systems acquisition of hospital operator HMA, 2013

- NewCo stock price

- Canadian Pacific’s Bid for Norfolk Southern, 2015

- Deals with a CVR have a higher probability of success/completion

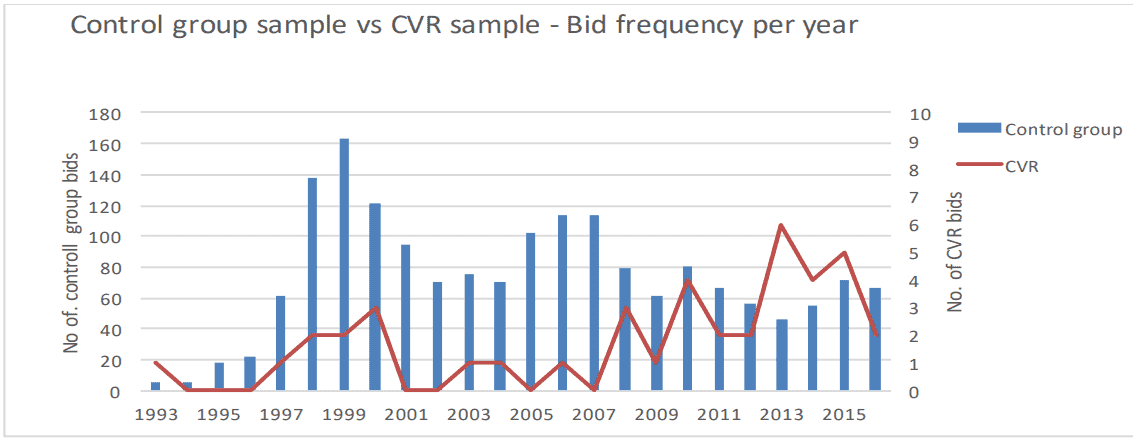

CVRs in 1800 deals for US targets 1993-2016

- Average premiums = 47% control group and 49% CVR sample

- Fewer intra-industry transactions in the CVR sample (53% vs. 68%) → information asymmetries

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!