In 2012, GREE Inc. was among the world's most lucrative mobile social gaming companies. Its success in Japan was due both to the in-house games and also to the development platform it provided to third-party game designers. Its greatest challenge ended up being to replicate the prosperity of this two-pronged strategy in marketplaces around the globe, where it needed to contend not only with lots of other game developers (e.g. Zynga) but additionally using the mobile platform companies themselves (e.g. Apple's iOS and Google's Android).

Andrei Hagiu; Masahiro Kotosaka

Harvard Business Review (713447-HCC-ENG)

November 19, 2012

Case questions answered:

Please conduct a full SWOT analysis for Gree Inc.

Not the questions you were looking for? Submit your own questions & get answers.

GREE, Inc. Case Answers

What is the problem faced by GREE, Inc.?

GREE Inc. has been a successful Japanese company ever since it was first launched as a social networking company in 2004.

In early 2007, Naoki Aoyagi joined GREE Inc. after working as an investment banker for four years at Deutsche Bank. He established strategic alliances in Japan’s technology sector for the company to transform the firm into a more profitable business venture.

As competition increased from other Japanese operators, GREE Inc.’s revenues fell shorter than expected, and it quickly had to change its business model. Naoki Aoyagi and the management team found an opportunity to develop free mobile games as a means of generating traffic and advertising revenues.

The company has become one of the top platforms in the mobile gaming industry and is the producer of popular in-house games on large third-party platforms such as Apple’s App Store, Google Play, and Amazon.

As competition in the social gaming market increases, GREE Inc. faces challenges in more complex international markets and the major competitive mobile gaming platforms.

In addition to political regulation and economic constraints, GREE Inc. needs to differentiate itself from the competition, which begs whether it should focus on being a major gaming platform or a mobile gaming developer.

External Environment Analysis for GREE, Inc.

General Environment

| Segments | Trends |

| Technological |

|

| Political/Legal |

|

| Socio-Cultural |

|

| Global |

|

| Economical |

|

Industry Environment

The mobile gaming industry is huge, and it is expected to grow with an increasing trend at a 7.2% annual compounded rate, reaching $83 billion in 2016.

The industry contains many competitors thanks to the vast public interest in mobile gaming, creating an emergence of gaming platforms and in-house gaming development.

Social gaming was becoming the fastest-growing sub-segment in the gaming industry. Many gamers enjoy the concept of inviting their friends and differentiating themselves from other users by purchasing customized in-game content.

The social gaming industry is heavily concentrated. The top three players, Apple, Google, and Amazon, can heavily influence the mobile gaming industry’s scope and direction. Thus, smaller players need to assess their strategy to reduce intense rivalry.

Porter’s Five Forces analysis

Porter’s five forces analysis was conducted to evaluate the attractiveness of the mobile gaming industry to which GREE, Inc. belongs.

- The threat of new entrants: High

- Rivalry among competitors: High

- The threat of substitutes: High

- Bargaining power of suppliers: Medium

- Bargaining power of buyers: High

Based on this analysis, it is concluded that the industry is unattractive.

(See Appendix 1)

| Main Opportunities | Threats |

|

|

3. Internal Analysis for GREE, Inc.

Strengths:

- GREE Inc. developed a sustainable competitive advantage by being one of the first Japanese companies to exploit the opportunity for mobile gaming in the market

- The company invested heavily in advertising and promoting its gaming platform and products and developed a model for estimating the expected profitability of its advertising

- GREE Inc. can analyze the profiles and trends of its users, creating and adjusting its content that is most suitable to them

- Investing in human capital: Hiring media and advertising experts to improve the firm’s scale and scope amongst potential adopters

- Providing value-added content to users by generating in-game events, increasing user engagement, and leveraging celebrity endorsements amongst its products

- Acquiring OpenFeint, one of the largest U.S.-based platforms for iOS and Android devices

Weaknesses:

- Management’s inability to focus primarily on an international strategy: Developing mobile games or optimizing the platform

- Difficult for GREE to leverage game development in localized markets due to large culture shifts and vast consumer tastes and preferences

- Inability to deal with Japanese government legislation prohibiting Kompu gacha

- Failure to differentiate products can be imitable to a certain extent

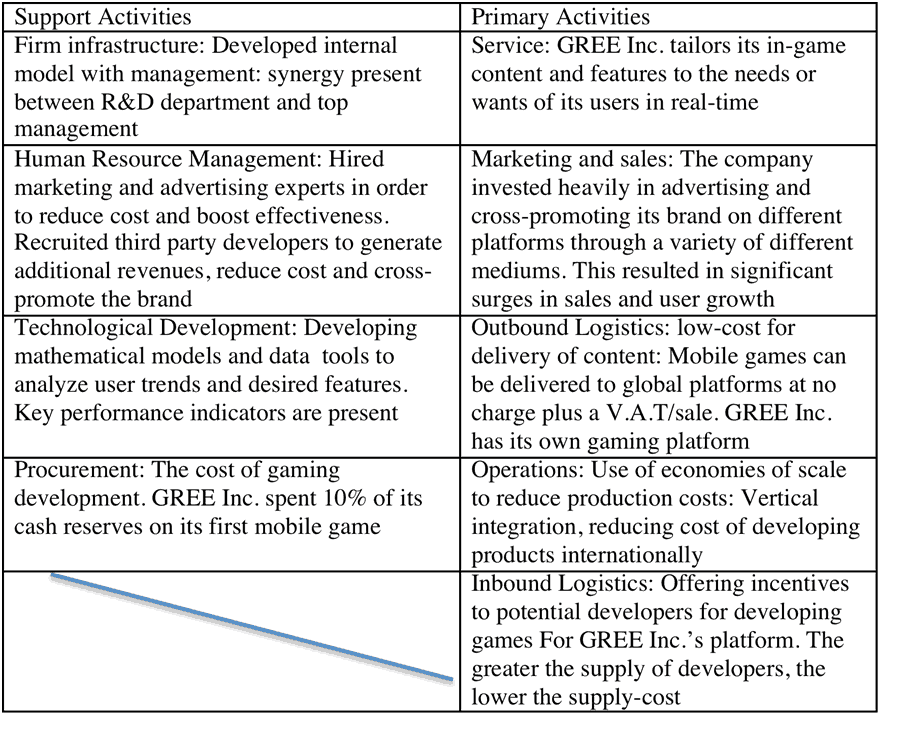

Value-chain analysis

The main part of GREE Inc.’s success depends heavily on the development of mobile games that strike the tastes and preferences of its users.

Third-party developers are a value-added element for the company as they create increased traffic on its platform, lower development costs, and generate additional revenues from the V.A.T. The ability of GREE Inc. to modify its content and create customized versions of its software enhances the reach and desire of its users.

The importance of establishing good relations in the mobile gaming industry is essential as global platforms have a far greater reach and brand recognition among their users, which greatly impacts the industry.

As a result, the company acquired OpenFeint, a global U.S. platform, to localize its products and market them to IOS and Android users.

The company also established strategic alliances with Project Goth, a social networking company in developing countries, and Tencent, which was China’s largest ISP, to broaden GREE’s scale and scope.

This results in GREE Inc.’s ability to produce various games with in-game content marketed to the individual user, enhancing its brand loyalty and popularity among its customers. (Please see Appendix 2)

Conclusion:

GREE Inc. had a sustainable competitive advantage by being one of the first Japanese companies to market social mobile games to its users. However, due to the market’s oversaturation, it is increasingly difficult for GREE Inc. to compete domestically and internationally.

The company’s acquisition of the OpenFeint platform in the U.S. was a major risk for GREE Inc. as the U.S. had already established major global players in the industry, making it increasingly hard to localize its business strategy to U.S. consumers.

The company’s inability to focus on a distinct corporate strategy regarding the continuous improvement of its platform or development of mobile games makes it difficult for GREE Inc. to compete in a global environment, as both elements naturally depend on one another to succeed.

Corporate-level Strategy:

GREE Inc. had capitalized on economies of scale. As more games were being produced, there were significant increases in advertising revenues from its in-game content, lower development costs, and improved firm efficiency.

The company focused on spending most of its budget on advertising and promoting its platform, something that competitors like DeNA found to be unnecessary.

Business-Level Strategy:

GREE Inc. has been differentiating its products from the competition by integrating customized in-game content within its applications and investing heavily in advertising to boost its brand awareness.

The company had undergone an integrated low-cost/differentiation strategy through vertical acquisitions and forming strategic alliances to further broaden its reach to different environments at a low cost.

Alternatives

GREE Inc. faces concerns regarding its business strategy on whether or not it should be localized in international markets, whether it could be a major player in the highly competitive mobile platform and development market, and how the prohibition of Kompu gacha can significantly impact the company’s ability to monetize its users.

GREE Inc. should focus on developing mobile games, as it is problematic to compete in the global platform environment with major players.

For instance, competing with global players such as Apple and Google would be troublesome for GREE Inc. since its games rely on their platforms to cross-promote the brand and generate revenues. Thus, it is recommended that GREE Inc. focus on a single strategy to build its core business.

The prohibition of Kampu gacha in Japan is problematic for GREE Inc., which lost 23% of its stock price as a result. GREE Inc. should adjust its domestic market policy, issuing warnings of in-game content within its applications, sending users payment notices, setting a maximum charge period, and encouraging users not to overspend.

To further localize GREE Inc. in international markets, it is recommended that the company accept licensing agreements from popular and well-known brands such as Disney, Marvel, and many more.

Many U.S. consumers could associate themselves with the brand as a result, which can spark a large increase in sales and the number of registered users.

It is recommended that GREE Inc. focuses on a core strategy regarding the development of mobile games. Large social and technological companies have already established themselves in the United States and have created their own platforms.

Global competition is high; barriers to entry in the industry are low. Thus, GREE Inc. must differentiate itself from the competition by developing games based on its users’ needs and wants and implementing value-added in-game content within the process.

Only then, once the company has become more established, it should adjust its policies and practices in its domestic market regarding Kampu gacha and negotiate licensing agreements among popular U.S. segments.

Appendix 1:

Appendix 2: