Case solution for the Groupe Ariel case study in which the company reviews a proposal to buy and use cost-saving equipment at a manufacturing facility in Monterrey. The equipment will allow the company to automatically recycle and remanufacture cartridges of toner and printer. Recycling and remanufacturing these cartridges is an important venture of Ariel's business. The corporate policy of Ariel necessitates an analysis of the discounted cash flow (DCF) and a net present value (NPV) estimate for capital expenditures in international markets. It is facing the challenge of coming up with the decision on which currency to use: the Euro or the peso.

Timothy A. Luehrman; James Quinn

Harvard Business Review (4194-PDF-ENG)

April 19, 2010

Case questions answered:

- Compute the NPV of Groupe Ariel Mexico’s recycling equipment in pesos by discounting incremental peso cash flows at a peso discount rate. How should this NPV be translated into Euros?

- Compute the NPV in Euros by translating the project’s future peso cash flows into Euros at expected future spot exchange rates.

- Compute the two sets of calculations and corresponding NPVs. How and why do they differ?

- Suppose Mexican inflation is projected at 3% instead of 7% per year. What would the cost savings be?

- Suppose Ariel expects a significant real depreciation of the peso against the Euro. How should we incorporate such an expectation into his NPV analysis?

- Should Groupe Ariel approve the equipment purchase?

Not the questions you were looking for? Submit your own questions & get answers.

Groupe Ariel S.A.: Parity Conditions and Cross-Border Valuation Case Answers

This case solution includes an Excel file with calculations.

1. Compute the NPV of Groupe Ariel Mexico’s recycling equipment in pesos by discounting incremental peso cash flows at a peso discount rate. How should this NPV be translated into Euros?

To calculate the NPV of Groupe Ariel Mexico’s recycling equipment, we must know the difference in cost savings that the company would be getting if it switched from its old recycling equipment to the new machinery.

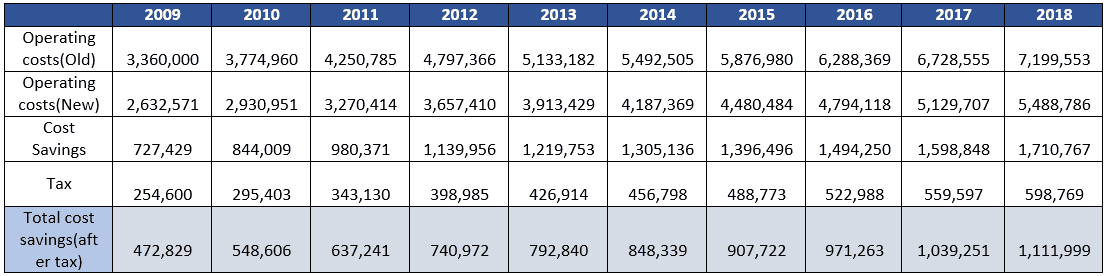

Using the operating costs from Exhibit 2, we arrive at:

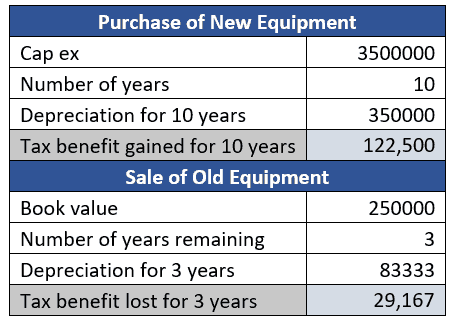

In addition to the cost savings, the tax benefits of depreciation that are obtained through capital expenditure should also be taken into account.

Since the old equipment is being sold at 175000 instead of the book value of 250000, we are getting a loss of 75000. We can get a tax benefit by showing this loss on our books.

Tax benefit due to the sale of the asset at a reduced price = 75000 * 35% = 26250

Thus, the net Cash flows from the equipment switching exercise can be calculated as follows:

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!