With the ever-changing status of the market conditions and the doubt about where it will lead, H. J. Heinz's internal financial analyst found the need to come up with an estimate of the company's weighted average cost of capital (WACC). This case study analysis provides information not only for Heinz but also for other comparable firms. The study connects the practice of calculating the WACC and at the same time looks into the economic meaning of inputs to the calculation.

Marc Lipson

Harvard Business Review (UV5147-PDF-ENG)

November 08, 2010

Case questions answered:

We have uploaded two case solutions, which both answer the following questions:

- What were the yields on the two representative outstanding H.J. Heinz debt issues as of the end of April 2010? What were they one year earlier?

- What was the WACC for Heinz at the start of the fiscal year 2010? What was the WACC one year earlier?

- What is your best estimate of the WACC for Kraft Foods, Campbell Soup Company, and Del Monte Foods? How do these WACCs influence your thinking about the WACC for Heinz?

Not the questions you were looking for? Submit your own questions & get answers.

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Executive Summary

The central problem, in this case, was the calculation of the weighted average cost of capital for the Heinz Company. There are three main reasons why it was becoming problematic to compute the weighted average cost of capital for the H. J. Heinz Company.

The first reason was the rapid fluctuation of the stock price of the company over the past 2 years. The price had touched the same high level of $ 47 per share in 2010, and there was a huge debate about whether the WACC needs to be updated or not.

Secondly, the interest rates were highly low. The lower interest rates would also reduce the WACC for Heinz Company, and a large number of projects could be then accepted by H. J. Heinz.

Finally, the third issue was that the company was not certain how the consumers would react to this, as the chances of the consumers taking the risks changed because of the changing economic conditions.

Furthermore, the company is also facing stiff competition from three other competitors in the industry which are Kraft Foods, Campbell Soup, and Del Monte Foods. In this case analysis, we have attempted to compute the yields of the short-term and long-term bond issues of the company.

It could be seen that the yields have declined significantly in 2010 from 2009. After this, the weighted average cost of capital has been computed for 2010 and 2009 based on a number of input variables.

It could be seen that the WACC has declined significantly in 2010 as compared to 2009. Finally, the WACCs of all three comparable companies have also been calculated, all of which have higher WACCS than H. J. Heinz.

What were the yields on the two representative outstanding Heinz debt issues as of the end of April 2010? What were they one year earlier?

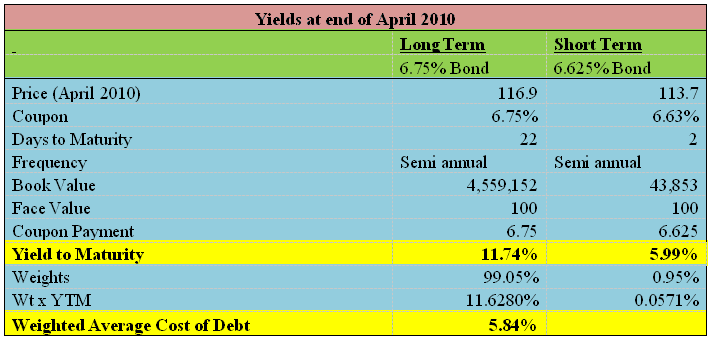

The yields of the two representative outstanding H. J. Heinz debt issues at the end of April 2010 are as follows:

The debt with 22 years to maturity is long-term debt, and the debt with just a maturity period of 2 years is short-term debt. The YTL approximation formulas have been used to compute the yields of the two debt issues at the end of April 2010. The formula used is shown in the Excel spreadsheet.

Similarly, the yields on both of these two representative bonds one year earlier based on the maturity and the book values of short-term and long-term debts in 2009 were as follows…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!