Husky is a producer of injection molding systems based in Canada. Ever since its inception, the company enjoyed strong growth and profit as it produces excellent performance systems. However, competitors start emerging and the company experienced a decline in profits. Its CEO and founder Robert Schad must come up with a plan to defend the company. Should the company retain its traditional market or should it expand beyond it?

Jan W. Rivkin

Harvard Business Review (799157-PDF-ENG)

May 14, 1999

Case questions answered:

- Is there a willingness to pay for the Husky Injection Molding Systems? In other words, are they worth the price the company charges? Please calculate a dollar value of how much more you are willing to pay for a Husky Injection Molding PET machine compared to the machine of a major competitor.

- Given the recent crisis, what should Husky’s next steps be? Be specific and discuss possible drawbacks.

Not the questions you were looking for? Submit your own questions & get answers.

Husky Injection Molding Systems Case Answers

This case solution includes an Excel file with calculations.

1. Is there a willingness to pay for the Husky Injection Molding Systems? In other words, are they worth the price the company charges? Please calculate a dollar value of how much more you are willing to pay for a Husky Injection Molding PET machine compared to the machine of a major competitor.

Husky Injection Molding Systems PET machine customers are more sophisticated than B2C customers and make extensive calculations when comparing vendors/systems.

Four main elements can affect customers’ willingness to pay for PET machines. These elements are:

- Incremental productivity costs

- Incremental raw material costs (resin cost)

- Incremental electricity consumption costs

- Incremental rent costs due to increased floor space

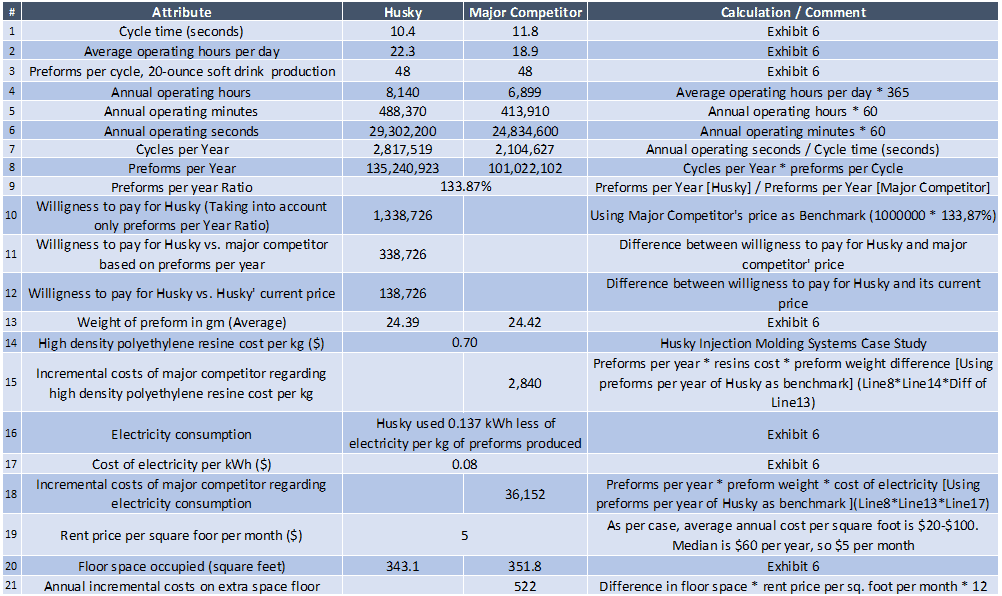

Husky’s PET machines are characterized as more productive. They conduct 33,87% more preforms per year than the main competitor (Line 9 of Figure 1) due to their shorter cycle (1.4 seconds less – Line 1 of Figure 1).

This means that to produce the same number of preforms, B2B customers need one Husky system or an equivalent of 1,34 systems of a major competitor.

Also, Husky’s final product is lighter (0,03 gm – Line 13 of Figure 1) and consumes less electricity (Line 16 of Figure 1). Moreover, the required floor space is 8.7 square feet less than the major competitor (Line 20 of Figure 1).

As a result, to make the same preforms with Husky Injection Molding Systems, customers of a major competitor had incremental costs regarding resins, electricity, and rent.

These incremental costs have been calculated in lines 15, 18, and 21 of Figure 1. Customers’ willingness to pay is $1,378,240 (Figure 2). This amount is 37.8% higher than the major competitor and 14.9% higher than Husky’s current price (Figure 3).

Figure 1: Calculations, Comments, and Sources

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!