The case study discusses how Indus Towers was formed. Indus Towers is the largest telecom tower company in the world engaged in creating and managing the infrastructure of wireless telecom operators. It seeks to achieve the said objective through three competitors - Bharti Airtel, Vodafone Essar, and Idea Cellular - which will be brought in India's telecom market and by consolidating their holdings. This case dwells on the process of collaborating with competitors despite the strong competition among them.

Ranjay Gulat; F. Asis Martinez-Jerez; V.G. Narayanan; Rachna Tahilyani

Harvard Business Review (110057-PDF-ENG)

February 10, 2010

Case questions answered:

- Why did the market environment in India permit tower sharing to develop vs. other markets?

- How do both the tower economics and marketing priorities of mobile operators drive the construction, priorities, and pricing of Indus towers?

- Should Indus Towers expand into urban areas or not? How is the idea of tower sharing potentially relevant to other markets internationally?

- What type of CEO should be hired to succeed Stefan Langkamp? What are the key skill requirements?

- How should Indus Towers organize itself going forward? How should it evaluate itself, and what should be the measures of success?

Not the questions you were looking for? Submit your own questions & get answers.

Indus Towers: Collaborating with Competitors on Infrastructure Case Answers

Situation Analysis – Indus Towers

In December 2007, Indus Towers was formed as a joint venture between the Bharti Airtel, Vodafone Group, and the Aditya Birla Group. Ownership is split with Vodafone and the Bharti Group, each owning 42 percent and the Birla Group 16 percent.

The company has a portfolio of approximately 93,000 towers, making it the largest independent tower company in the world. The challenge now is to expand and achieve Indus’s goal of 125,000 towers by 2010.

Key Issue that Indus Towers is Facing

The fundamental question is, would Indus Towers be the tower provider of the future? Some of the key aspects to determine that would be to see how the company would define success in the absence of peer benchmarks, where the company decided to focus – rural vs. urban cities if the company would increase its revenue through tenancy or increased rentals and lastly who would be the right CEO to lead the company in the next phase.

Background

In the USA, the average tenancy for telecom tower companies was 2.7 to 3 operators per tower as compared to India, where the concept of tower sharing was still evolving. In 2007, operators shared only 25% of towers, and the average tenancy was 1.2 to 1.5 per tower.

The government’s target of providing 500 million telephones by 2010 and the launch of 3G services, which required denser network coverage, were expected to create a demand for additional towers.

The saturation of urban markets was driving operators to the rural market, and incremental subscriber growth was expected to come from low teledensity in rural areas. Setting up telecom towers in rural India was especially difficult due to issues like electricity, erratic power supply, and security problems.

Indian regulations permitted passive infrastructure sharing, which involved non-transmitting equipment, such as the actual tower, the air-conditioner, or the backup power equipment.

Due to intense competition for offering extensive geographic coverage, everybody put up their own towers, and the result was ill-organized clusters of towers without any strategic planning. Now that coverage is no longer a big differentiator in urban areas, it’s time for collaboration and sharing of infrastructure.

Additionally, in rural areas with low-density populations, it makes much more sense for operators to share the towers to divide their costs. Regulations also allowed the sharing of Infrastructure.

Consumers

In 2008, the Indian telecommunications industry was the fastest growing in the world, with about 10 million wireless subscribers added every month and a compound annual growth rate of 65% from 2004 to 2008.

The intense competition had driven the average monthly revenue per user (ARPU) down to $6.83, well below the $52 for the U.S. and $40 for developed Europe.

A rapidly growing industry meant that the success would be driven by scale for which extensive coverage was necessary. However, establishing towers across the nation was a very costly solution, and with low ARPU, it didn’t make economic sense. Therefore, competing firms come together for collaboration.

Partnership

Partner firms settled on valuing towers according to a point scale that weighted different tower attributes and contributed towers valued at an equal number of points. This meant Indus’s operation was confined to the 16 circles where Vodafone had a presence. In the circles where Airtel had an increased presence, the company would not increase its tower footprint, while Indus would not compete in the remaining circle.

The management committee had equal representation of all the partners. The CEO, Stefan Langkamp, and CFO were nominated by Vodafone. The CEO and supply chain head were from Infratel, while Idea nominated the HR head and the CTO.

Infratel contributed about 300 people who were experts in the areas of operations and maintenance, acquisition, and site deployment. The idea provided people in the area of operations and maintenance.

The partnership had a commitment from all the partners, yet it was going to be tough as every company has its own motives and ideas for business.

Moreover, Senior management comes from different businesses with varied cultures. It would be hard to get people out of their mindset that they are representative of individual companies.

Competition

Indus’s chief competitors were Reliance, which had set up its separate tower company, and Tata, which was planning to merge its tower arm with Quippo Telecom.

American Tower had also started to operate in India, but it did not have a sufficient tower portfolio, and there were not many towers left for it to acquire.

Finally, some other smaller tower companies were willing to fold their tower portfolios into Indus or other tower companies because they had lost the bulk of their customer base and had tenancy ratios of less than one.

Considering Indus Tower has all three operators obliged to use Indus exclusively for their tower requirements and were prohibited from building their own towers in 16 circles, it gives a clear edge to the company over its competitors.

Furthermore, even partnerships between companies involved in the formation of Indus Towers cease to exist in the future. They would still be bound by an exclusive obligation to Indus for a certain period. This secures the future of the firm as well.

Economics

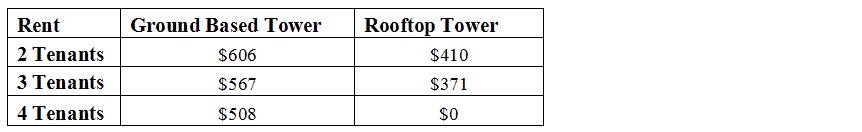

The fixed cost of establishing a Ground-based tower was $59K, and the monthly operating cost was $1500, including $1100 for depreciation and Interest. Assuming it gets 4 tenants, monthly revenue would be $1900, making it a profitable venture.

On the other hand, the roof-top-based tower’s fixed cost was $39K, and the monthly operating cost was $1100, including depreciation and interest. It can only support three tenancies, generating $1050 per month.

It makes complete sense for telecom operators to enter into a partnership as the fixed cost is really high, making it an unviable option in a market with a low ARPU. At the same time, Indus Towers required a minimum of three tenants to cover their operations for the Ground-based tower. The rooftop tower is going to be a drag on the company as with its maximum capacity of 3 tenants, they would just be break-even.

Recommendation

Rural vs. Urban: The most important aspect is the maximum utilization of assets. Therefore, I believe Indus needs to expand its operations in urban areas in the existing 16 circles wherever possible. The next phase of expansion should be in urban areas of new circles. Nationwide coverage would give Indus Towers an extensive advantage over its competitors. Moving to rural areas should be the last option as it requires at least 3 tenants to break even, which would be tough.

Rentals vs. Tenancy: Indus’s focus should be to increase tenancy on Ground-based towers as they have the capacity for up to 6 tenants. The company can even offer rentals as low as $300 for 6 tenants, and even then, the venture would be profitable. On the other hand, for rooftop towers, the company should increase rentals as currently, with their maximum occupancy of 3 tenants, they are just breaking even.

CEO: The next CEO should be an outsider who is not an affiliate of the partner firms, preferably someone who has worked in a joint venture and is aware of the challenges associated with it. I would also argue that having someone from the telecom business may not be necessary as Indus Towers is not in the telecom business but in the infrastructure business. It’s a different mindset where you think about the long term.

Criteria of Success: Considering Indus Towers is an Infrastructure firm, success would be guided by asset utilization, capturing revenue-generating sites, getting other firms on board, and using a scale to reduce operating costs.

Challenges

Competition: There are other bigger players like Reliance, Tata, and American Towers who have the resources to expand quickly or go into partnership to compete with Indus Towers.

Intra-company issue: Since employees and management were an assembled group, coherency in the processes and ideas would be harder to achieve, which would keep impacting the efficiency of operations. Adding to that, the company’s partners have different objectives, and getting everyone on board with the future expansion plan could face resistance from the firm with different goals.

Regulations: India’s regulatory market is very unpredictable. As regime changes, regulations around passive infrastructure sharing could impact the company’s operation, but that’s very unlikely considering the government’s focus on increasing rural telecom penetration.

Exhibit 1

Exhibit 2