New Heritage Doll Company is a manufacturer and retailer of specialty doll products. It must come up with the decision of choosing which of its two projects they are to fund. This case study distinguishes the two projects by computing the cash flows and by differentiating various project performance measures.

Timothy A. Luehrman; Heide Abelli

Harvard Business Review (4212-PDF-ENG)

September 15, 2010

Case questions answered:

Case study questions answered in the first solution:

- Assume that you are Emily Harris and use the data in Exhibits 1 and 2 to derive cash flows for DCF analysis of the New Heritage Doll Company.

- Calculate the NPVs and IRRs.

- What numbers in the projections in Exhibits 1 & 2 seem most questionable to you?

- What recommendation would you make to the capital budgeting committee?

Case study questions answered in the second solution:

- Set forth and compare the business cases for each of the two projections under consideration by Emily Harris. Which do you regard as more compelling?

- Use the operating projections for each project to compute a net present value NPV for each. which project creates more value?

- What additional information does Harris need to complete her analysis and compare the two projects?

- What specific questions should she ask each of the project sponsors?

Case study question answered in the third solution:

- The production division of the New Heritage Doll Company has two projects that can be presented in the next budget meeting. However, due to constraints on financial and managerial resources, both projects can’t be presented to the committee. Based on your evaluation, which project should be presented in the capital budgeting meeting?

Not the questions you were looking for? Submit your own questions & get answers.

New Heritage Doll Company Case Answers

This case solution includes an Excel file with calculations.

You will receive access to three case study solutions! The second and third solutions are not yet visible in the preview.

Part 1: Emily Harris’s Suggestion to the Budgeting Committee of New Heritage Doll Company

Dear Budgeting Committee,

New Heritage Doll Company’s mission is to constantly engage customers with our dolls in a way that is both meaningful to them and value-aggregative to the company. Our everyday operations aim at making products that incorporate the fun kids look for in dolls and the family values their relatives will buy the products for.

Our ultimate goal, therefore, is to continue providing the traditional doll experience yet combine it with innovative features that make us stand out within the industry, allowing for the maximizing of return on investments through higher margins.

In this context, I am forwarding the details of two proposals the production division has been working on.

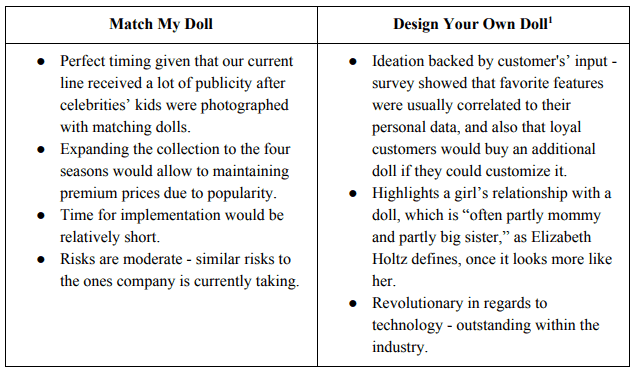

The first one is called Match My Doll (MMD), and it consists of the expansion of a line we currently have that matches dolls and child clothes and accessories for warm weather. The goal is to create options for all seasons.

The second one is named Design Your Own Doll (DYOD), and it proposes the customization of dolls through a website. Customers would be able to buy dolls they designed themselves.

Here is a summary of the advantages associated with both proposals in regard to nurturing customer loyalty:

As both would add value to New Heritage Doll Company’s relationship with our customer base from a design perspective, we must develop a budgeting analysis of both proposals to assess their fitness for the company’s overarching goals. Given financial constraints, we will then select a winner.

The numbers for the sections below were based on forecasts for the next decade (2010-2020).2

Revenue

Due to the differences in the implementation process, the Match My Doll line would be able to start production earlier and generate revenue from 2011 on, whereas the Design Your Own Doll line, with all the technological changes to the production process, would only start generating revenue in 2012.

After the first couple of years, however, DYOD would be expected to…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!