This "OptiGuard. Inc.: Series A-Round Term Sheet" case study deals with the dilemma of an entrepreneur in the cybersecurity industry who is seeking venture financing. For a time, he has been unsuccessful in raising funding from venture capitalists (VCs) but has gained some local investors. When the fund was starting to run out, he again attempted to raise more funds. In November 2015, the company received an offer for a $5 million Series A round. This case study allows students to analyze the adequacy of the offer.

Susan Chaplinsky

Harvard Business Review (UV7297-PDF-ENG)

July 21, 2017

Case questions answered:

Case study questions answered in the first solution:

- What contract terms are important, and whether they are favorable to the entrepreneur or to the investor as written in OptiGuard Inc.’s Term Sheet?

- How attractive is the company to prospective investors?

- Before the Series A round, what is OptiGuard’s post-money value? After the Series A round, what is the pre- and post-money value if the offer is accepted as proposed?

- What are the implications for WVP if another investor offers to provide OptiGuard an additional $7.8 million in equity after the Series A round at a price of $8.00 a share? At $3.00 a share?

- What are the implications to WVP if it has a participating versus conventional liquidation preference and OptiGuard is sold for $15 million in three years?

- If you were Mannix, would you accept WVP’s offer as proposed or attempt to negotiate certain terms of the offer? If you choose to negotiate, what adjustments would you seek to make?

Case study questions answered in the second solution:

- How attractive is the company to prospective investors?

- Does the term sheet for the Series A round generally favor the entrepreneur (Mannix) or the VC investor (WVP)? Be sure to cite specific terms and features of the contract to support your opinion.

- Before the Series A round, what is OptiGuard’s post-money value? After the Series A round, what is the pre- and post-money value if the offer is accepted as proposed?

- What are the implications for WVP if another investor offers to provide OptiGuard an additional $7.8 million in equity after the Series A round at a price of $8.00 a share? At $3.00 a share? Compare WVP’s anti-dilution rights to full ratchet anti-dilution. What happens to the entrepreneur’s stake in each case?

- What are the implications to WVP if it has a participating versus conventional liquidation preference and OptiGuard sold for $15 million in three years?

- If you were Mannix, would you accept WVP’s offer as proposed or attempt to negotiate certain terms?

Not the questions you were looking for? Submit your own questions & get answers.

OptiGuard, Inc.: Series A-Round Term Sheet Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Understanding OptiGuard, Inc.’s Situation

Before diving into the term sheet features, it is useful to take a step back and understand where OptiGuard, Inc. stands as of November 2015 as a business.

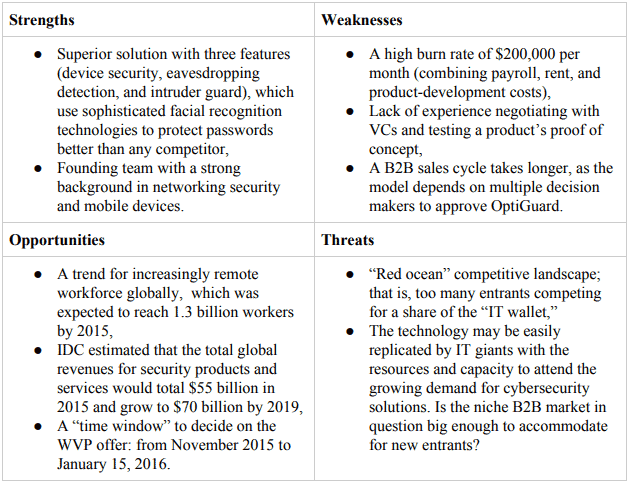

Table 1 features a SWOT Analysis of OptiGuard Inc., which captures the pros and cons of the company’s stance both internally and externally when it received a Series A offer from WVP.

Table 1. SWOT Analysis of OptiGuard’s Circumstances

Contract Terms

Given Mannix’s background as someone who left a secure job at a large IT company to start his own business, he probably behaves more like a “King” founder rather than a “Rich” one.

I used Wasserman et al.’s analysis of King founders’ interests (2012), then assessed the following terms’ favorability to Mannix.

Dividend Provisions: Even though this term is more relevant to Rich founders, not having an obligation to pay dividends is still very favorable to Mannix.

Protective Provisions: Ideally, King entrepreneurs would push for no protective provisions to control big decisions. This way, the voting terms for preferred shareholders are not favorable to Mannix, especially the vi term (i.e., “agree to a merger, sale, or consolidation of the company”), which can restrict exit plans OptiGuard Inc. soon.

Board Representation: Common shareholders would still elect most of the board (4 out of 7), which is favorable to a control-motivated founder.

Use of Proceeds: The investment would have to be used as “working capital,” which restricts its application to maintenance expenses (e.g., payroll and rent). R&D costs and debt payments would be off the table, impacting OptiGuard’s growth plans and, therefore, not being beneficial to a King founder.

Closing: The closing date is very relevant in this case, as briefly mentioned in the SWOT Analysis. Mannix received the WVP offer in November 2015 and only has to decide by January 15, 2016.

In the meantime, he can conclude the ongoing negotiations with two large healthcare providers and signal market approval. In this case, he could potentially get better offers from other VCs (and pay back the bridge loan to WVP) or have evidence to negotiate better terms.

Valuation

OptiGuard Inc.’s pre-money valuation is…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!