This case study entitled "PepsiCo, Profits, and Food: The Belt Tightens" describes the problems facing Indra Nooyi after 5 years of PepsiCo's new and questionable nutrition strategy.

Joseph L. Badaracco Jr.; Matthew Preble

Harvard Business Review (314055-PDF-ENG)

September 23, 2013

Case questions answered:

Case study questions answered in the first solution:

- In response to mounting criticism, Nooyi launched a strategic review of PepsiCo to answer some fundamental questions in late 2011. Please answer with the time focused on 2011:

What was the right balance in terms of investments and management focus between PepsiCo’s major brands, such as Pepsi-Cola and Doritos, and its healthier offerings?

Was it possible to succeed with a focus on nutritious foods, considering its broad product portfolio and competitors eager to eat away at its market share?

How long could Nooyi accept subpar performance while developing the Good-for-You category?

Where should Nooyi place her bets for PepsiCo?

What should Nooyi do to protect PepsiCo’s position in developed markets such as the US?

What products should it develop and sell for emerging markets, and should it try to get ahead of the potential obesity crisis in these countries? - Now, take the 2015 perspective and answer:

Where was Nooyi correct? Where was she wrong or too optimistic?

Case study questions answered in the second solution:

- Please solve the case study by developing your analysis, alternatives, and recommendations.

Not the questions you were looking for? Submit your own questions & get answers.

PepsiCo, Profits, and Food: The Belt Tightens Case Answers

Case summary – PepsiCo, Profits, and Food: The Belt Tightens

PepsiCo is a global food and beverage company with 274,000 employees in more than 200 countries around the world. The company’s market capitalization and its annual revenue in 2014 were around $141 billion and $66.68 billion, respectively.

In 2006, Indra Nooyi became the company’s 5th CEO. Nooyi wasn’t new to PepsiCo. In fact, she joined the company in 1994 and served as senior vice president of strategic planning and senior vice president for corporate strategy and development.

In recent years, Nooyi launched Performance with Purpose – the strategy that will deliver “sustained financial performance”[1]. The strategy focused on increasing the usage of natural ingredients in PepsiCo’s products and decreasing ingredients such as sodium, saturated fat, and sugar. Thus, the company’s focus shifted from its core soda business, such as Pepsi-Cola and Mountain Dew, to its more healthy products, such as Quaker Oatmeal, Tropicana, and Naked Juice.

This strategy reflected Nooyi’s belief that consumer demand was shifting from the company’s major brands towards more healthy ones since people started becoming more concerned about their health and obesity.

The company divided its brands into three main categories: the Fun for You, the Better for You, and the Good for You.

According to PepsiCo, the Fun for You category represents “the food and beverages making life more fun for people around the world”[1].

The Better for You category represents “snacks baked with lower fat content, snacks with whole grains, and beverages with fewer or zero calories and less added sugar”[1].

Finally, the Good for You category represents “nutritious products that include fruits, vegetables, whole grains, low-fat dairy, nuts, seeds, and key nutrients, with limits on sodium, sugar, and saturated fat that meet global dietary requirements.”

Nooyi planned to increase revenue generated by the company’s Good for You category up to $30 billion by 2020.

However, a slow increase in share price, relative to PepsiCo’s main competitors, together with poor soda sales in the US, drew criticism of Nooyi’s strategy.

In 2010, some thought that Nooyi might lose her position at PepsiCo. However, the absence of a potential successor and the fact that the board of directors publicly supported Nooyi made her remain as the company’s CEO.

Nevertheless, many healthcare activists supported PepsiCo’s action to develop healthier food products. Most of PepsiCo’s products contain high levels of sugar, sodium, or saturated fat – substances that contribute to cardiovascular disease, diabetes, and obesity.

According to the information presented in the case study assignment: “nearly 36% of adults and 17% of children in the US were obese”. “In 1990, no state had more than 15% of its adult population classified as obese. By 2010, no state had a population where less than 20% of adults were obese, and many states had rates of 30%”[3].

It was estimated that at least 20% of the weight gain in the US during the 1977 – 2007 time period was due to the consumption of sweetened beverages. Yet, 50% of Americans consumed at least one carbonated drink a day, which averaged the annual soda consumption to 50 gallons per capita.

In many US states, actions like banning junk foods from public schools and selling sugary drinks in small containers were taken by state governments to address obesity. Thus, PepsiCo and many other companies started to redesign their product portfolio in order to adapt to the reduction of soda and junk food consumption.

Answers

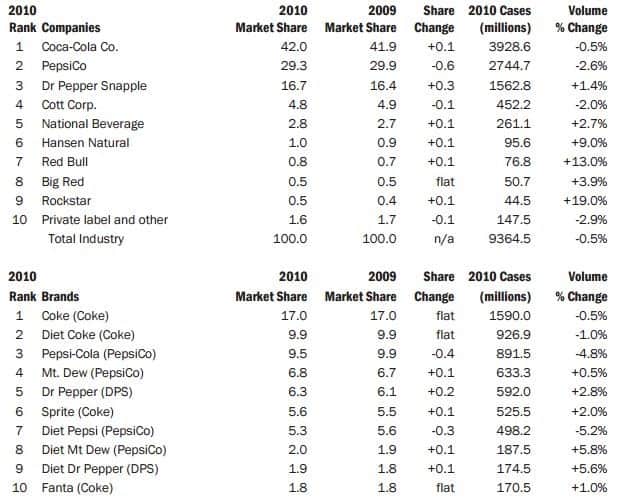

1. According to the information released by Beverage Digest, in 2010, the sales of Pepsi-Cola were down by 4.8%, moving it to third place after Coke and Diet Coke, respectively. PepsiCo’s US market share declined by 0.6% in the same year (Figure 1).

Overall, during Nooyi’s tenure, PepsiCo’s US market share declined by 2.7%, whereas Coca-Cola’s share declined only by 1% during the same period. However, in terms of total revenue, PepsiCo Americas Beverages has been showing a solid increase from $ 10,937 billion in 2008 to $22,418 billion in 2011.

Similarly, the net revenue of Frito-Lay North America was about $ 13.3 billion, which is a 6% increase relative to 2010 and a 7% increase relative to 2009.

Figure 1 – Top 10 Carbonated Soft Drinks Companies and Brands for 2010[5]

The fact that PepsiCo moved its focus from its major brands to the Good for You category explains why PepsiCo lost more of the US soda market share compared to Coca-Cola. However, for the same reason, the company saw an

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!