Precision Worldwide, Inc. is faced with the problem of whether to come up with a product that will match the competitor's product, when it should start matching and how to do it despite the fact that it still has a large inventory of its now inferior product. This issue arose when a competitor came up with a superior product that is less costly to manufacture.

William J. Bruns Jr.

Harvard Business School (XLS814-XLS-ENG)

May 22, 1997 (Revision: May 21, 2004)

Case questions answered:

What action should Hans Thorborg take? Why?

Not the questions you were looking for? Submit your own questions & get answers.

Precision Worldwide, Inc. Case Answers

Current Situation:

Precision Worldwide, Inc.’s (PWI) business model is manufacturing industrial machines and equipment worldwide. In addition to manufacturing industrial machines and equipment, PWI generates revenue by producing replacement parts and repair services.

One of the biggest parts of PWI’s business is the repair and replacement accounts, and the steel ring is the flagship product. In this mature industry, competition has increased with the emergence of Japanese manufacturers producing low-priced spare parts, and other companies have appeared with lower quality and lower-priced machinery.

Furthermore, a competitor has introduced a new type of ring: the plastic ring. This ring, which is considered a substitute to the already established product offering in the marketplace, has a longer usage life and significantly lower manufacturing costs than the traditional steel ring.

The plastic ring is being offered by a competitor in the French market, and PWI’s customers are beginning to inquire as to when they can expect the same product from PWI.

There is currently a large amount of finished goods inventory of the steel ring in addition to $110,900 worth of raw material. PWI now has to decide how to respond to the introduction of the new plastic ring and also determine what to do with the current inventory of steel.

Established Assumptions:

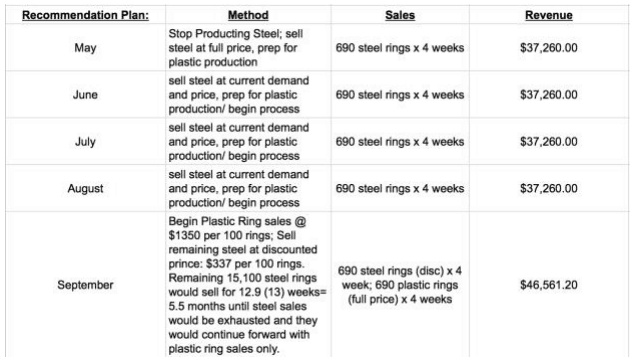

- Demand for steel rings will remain at 690 rings per week (6.9 batches per week) until all finished steel ring inventory has been sold, even when a discounted price is offered in September (explained in the Recommendations section).

- Plastic ring demand will be 690 per week when sales begin in September at the full price of $1350 per 100 rings.

- Raw material for steel rings is assumed to be sunk costs from now on, as further steel ring production will be stopped, and the material cannot be sold. Direct material costs for steel rings consist of only the materials needed to produce steel rings (steel).

- The current finished goods inventory for steel rings is 26,140 rings, where 690 can be sold per week until September. This would leave 15,100 in the finished goods inventory of steel rings in September.

- Four-month time horizon from now (late May) until mid-September.

- The discounted steel ring price in September will be less than ¼ of the original selling price. Plastic rings will be priced at $1350 per 100 rings, and since they have 4x the life span of steel rings, the price of steel rings will reduce to $337 per 100 rings.

- During the transition between steel and plastic rings, no more than 10% of PWI’s markets will be affected.

Analysis:

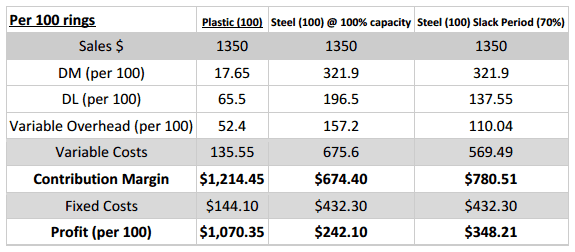

- Fully shifting production to plastic rings would give PWI an $828.25 ($1070.35 – $242.10) increase in profit per 100 rings.

- At the steady demand of 690 individual rings per week, PWI would recover the capital expenditure of $7,500 ($7500 / (($1214.45 – $674.40)*6.9))) within roughly two weeks when selling only plastic rings.

- PWI will recover the $110,900 value of the steel material approximately 30 weeks after the production of plastic rings begins. (($110,900 / (($1214.45 – $674.40)*6.9)))

- All plastic ring startup costs and the value of the excess steel raw material will be recovered within 32 weeks of plastic ring production beginning in mid-September.

- We used the difference in contribution margin between plastic and steel ($1214.45 – $674.40) to calculate these recovery times.

- These calculations do not factor in the additional sales we would expect from selling the finished steel rings at a discounted price, as mentioned in our recommendations below.

- Based on this analysis, the $110,900 in the raw material is irrelevant and can be thrown away or recycled. The cost should not hinder management’s decision to move forward with shifting production to only plastic rings.

Recommendations:

1. Stop producing additional steel rings immediately.

a. One of the first things Precision Worldwide should do is shut down NEW production of steel rings. There is an existing steel ring finished goods inventory (26,140 units) that PWI should draw down and sell from May to August.

b. Assuming demand for the steel rings will remain at 690 per week, we suggest they continue to sell the current finished goods inventory of steel rings at the price of $1350 per 100 rings until the plastic rings are produced.

c. At the present time, they should begin preparations for plastic rings with plans to begin sales in mid-September at the price of $1350 per 100 rings.

2. Introduce plastic rings to all customers in September and sell the remaining finished goods inventory of steel rings at a discounted price.

a. When the plastic rings go to market, we recommend that Precision Worldwide begin selling the remaining 15,100 steel rings at a discounted price of $337 per 100 rings.

i. This $337 price per 100 rings has been generated at slightly less than 25% of the original price because the lifespan of the steel is ¼ that of the plastic rings.

ii. We assume the demand for steel rings will remain at 690 per week after the launch of the plastic rings with the discounted price. To support this additional demand for rings, we recommend that PWI direct sales efforts of the discounted steel rings to customers of their competition and leverage the compatibility of the rings. This will ensure that demand for those rings remains strong when the substitute plastic ring is presented.

iii. With this discounted price and constant demand, the remaining 15,100 finished steel rings would sell for 22 weeks before running out, generating $50,887 in revenue.

b. From September onwards, Prestige Worldwide should focus all efforts on producing and selling plastic rings along with selling the remaining manufactured steel rings at a lower price.

Additional Things to Consider:

The manager at PWI will generate a larger profit for the company by switching to plastic rings. However, in the short run, the manager will incur an additional $7,500 cost, which will create a loss and would likely impact the compensation for that manager.

Even though, in the long run, the plastic ring would be more profitable for the company, PWI needs to consider how a manager would be less likely to invest in a new line of product given that it may impact his or her bonuses.

PWI should add a metric such as inventory management, if it doesn’t already employ such practices, to incentivize the manager to make the correct decision for the company.

There is also the need to consider the company’s reputation in this case. There is a new product that is superior in product life and is sold at the same price as the current market offering.

In order to protect its current customer base, PWI needs to be wary of the customer’s ability to shift to the competitor and must also not be too slow to introduce the plastic ring so as to not lose the advantage of being an early mover to the new technology.

(5 votes, average: 4.40 out of 5)

(5 votes, average: 4.40 out of 5)