This case study analysis deals with the reasons behind the acquisition of TDC by the NTC consortium. It discusses how the restructuring and other operational and strategic changes following the NTC acquisition added value. It also delves into the effects of remaining a publicly traded company versus being acquired by the PE consortium.

Josh Lerner

Harvard Business Review (815084-PDF-ENG)

December 03, 2014

Case questions answered:

- What were the main reasons the NTC consortium acquired TDC? Was this a good investment opportunity, ex-ante, from the PE investors’ point of view? Does it look like it will be a successful investment ex-post?

- What are the specific challenges facing a PE investor with large public-to-private deals, such as TDC?

- In what ways did the restructuring and other operational and strategic changes following the NTC acquisition add value? Do you think this restructuring would have been undertaken if TDC had remained a publicly traded company rather than being acquired by the PE consortium? Why/why not?

- What are the pros and cons of the three different options for Sunrise: (a) keep the subsidiary and continue with the IPO; (b) wait for competition authorities and hope for a sale to Orange; or (c) sell Sunrise to CVC? Which option would you recommend?

Not the questions you were looking for? Submit your own questions & get answers.

Private Equity Transforming TDC Case Answers

This case solution includes an Excel file with calculations.

1. What were the main reasons the NTC consortium acquired TDC? Was this a good investment opportunity, ex-ante, from the PE investors’ point of view? Does it look like it will be a successful investment ex-post?

NTC saw in TDC a unique investment opportunity that would likely not be available to many PE funds. TDC was the leading player in Denmark, with superior market shares across all different segments: landline voice, mobile, and broadband.

While the landline market was registering structural declines, the development of the other segments where TDC was operating was expected to more than offset the decline in landlines.

As of 2005, a modest CAGR of 1.6% was expected for TDC up to 2010. Despite not creating an impressive growth case, NTC would exploit its operational improvement plan without having the top line significantly decrease for market development reasons. NTC’s investment thesis was designed around improving operations by divesting most non-core assets and refocusing TDC as a true Nordic player.

TDC had been operating with particularly low margins (EBITDA margin of 28% as of 2005) compared with best-in-class players across the European market with EBITDA margins at c.39-40%.

While NTC had access to limited information due to the company’s public status, it was believed that formerly state-owned companies were characterized by complex and highly bureaucratic structures and often over-staffed.

Moreover, incumbent players such as TDC were defined as low-risk utility-like investments with the potential to enjoy strong cash conversions.

The divestment plans of the acquisition strategy relied on the ability to sell non-core assets in other markets to other strategic players and try to capture a strategic premium in those deals, as while these were mostly zero-synergies assets for TDC, they were believed to be appealing for local players in those markets.

Furthermore, NTC saw some opportunities to expand in key strategic segments within the Nordic market, such as

mobile, fiber, and cable TV.

The size of the acquisition itself was also a distinguishing factor that made this investment opportunity unique for NTC. There was virtually no competition for a deal of this dimension. The ability to bring together some of the best PE funds in the world was an extraordinary accomplishment not only in terms of expertise brought to the table but also in terms of the unique firepower capacity.

The fact that it was a noncyclical asset was also beneficial for leverage reasons, as NTC would be able to use a higher portion of the debt to finance the deal (as it turned out, NTC used 82% of debt in the acquisition).

Notwithstanding the great potential identified, there were some risks attached to the deal. TDC had a strong brand within the Danish market, and the deal would be under constant public scrutiny. Hence, a bad execution could severely hurt customer perception.

From a financial perspective, ex-ante returns did not look particularly high according to Danske estimates that assume an immediate sale of non-Nordic assets – the different cases yield an IRR ranging from 9 to 13% and a money multiple from 1.6 to 1.9x.

These estimates seem to be significantly below NTC targets. Hence, NTC’s expected financials must have been significantly above analysts’ estimates. Moreover, NTC affirmed that its maximum bid amounted to DKK 390 per share, and the deal closed at DKK 382 per share.

Throughout the investment period, most measures were successfully implemented on the operational side, with TDC achieving significant cost savings and successfully divesting non-core activities, in part due to the good performance of the new management team.

Some of the most notable measures include divestment proceeds exceeding Danske’s bull scenario by more than DKK 400m, identified headcount redundancies of ~3.500 employees, and the overall ability to reduce costs at a 10% annual rate, bringing EBITDA margins to close to 40%.

On the other hand, some factors reduced the investment’s return potential, namely the new tax laws undermining interest tax shields, the growth assumptions in the mobile segment that were not verified, leaving total top-line growth below expectations, and the blocked merger between Sunrise and Orange that halted the opportunity for a relatively early exit and generated high costs.

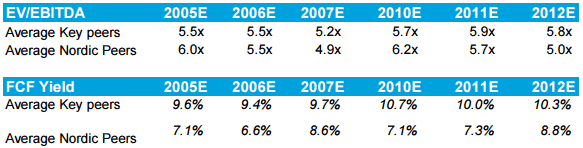

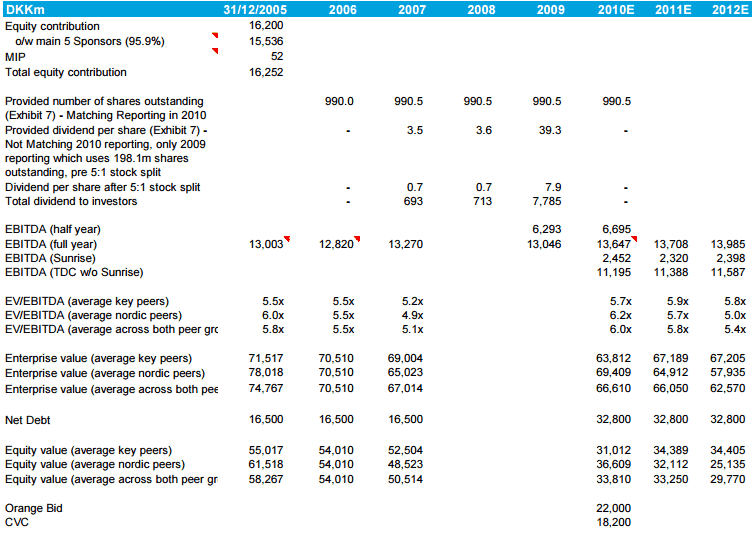

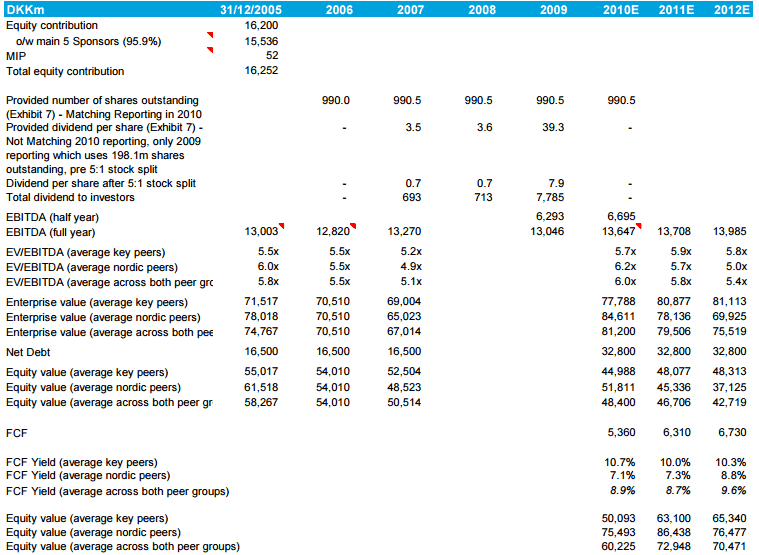

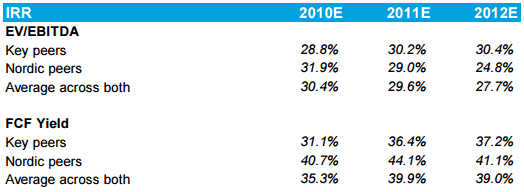

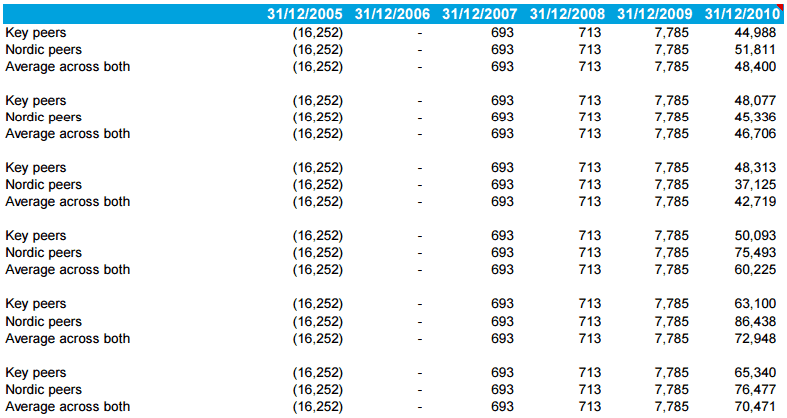

Despite these headwinds, return expectations as of 2010 seem to substantially exceed initial analysts’ expectations, with IRRs ranging from 25% to 35% depending on the exit scenario (see Exhibits– different scenarios discussed under Section 4).

2. What are the specific challenges facing a PE investor with large public-to-private deals, such as TDC?

Compared to regular private-to-private deals, public-to-private deals impose additional layers of complexity on PE investors. As confidentiality and the dissemination of insider information is a critical issue with listed targets, potential investors can be granted access only to public information during the due diligence process.

Compared to a private due diligence process, this could mean that less information, especially regarding the most recent business performance, is available.

Furthermore, the assessment of cost structures will be incomplete, making an assessment of possible improvements and synergies more difficult. A potential deal will most likely be subject to public scrutiny, especially if the interested PE investors are foreign. The target holds a strong market position in a regional market, as is the case with TDC.

In end-consumer-driven businesses, negative public opinion could severely impact business performance after closing the deal. And resistance by the government could hinder closing the deal altogether.

Depending on the public target’s shareholder structure, a potential acquisition by a PE fund could need the approval of millions of shareholders, meaning that there is no direct counterparty for negotiations that also has decision authority.

Even though the board can proxy as a negotiation partner, reaching an agreement with the board might be difficult as management could be unwilling to cooperate, given the likely prospect of them losing their job in case the PE takeover goes ahead.

Reaching an agreement with the board before launching a tender offer, i.e., not launching a hostile takeover offer, could prove pivotal in maintaining a favorable public perception.

Even after having reached an agreement with the board, there is no guarantee that a tender offer will give the PE investor a large enough share to squeeze out the remaining companies, especially since public-to-private deals might be targeted by vulture investors or hedge funds, hoping to profit from not tendering their shares and attaining a higher price.

The number of specific challenges a PE investor faces in a public-to-private deal can be expected to increase with deal size. Large PE deals often require the collaboration of multiple PE funds, as PE funds tend to be restricted regarding the size of a single investment.

This raises the necessity to coordinate with other PE funds on plans for operational changes, the relationship of the target with other portfolio companies of the involved funds, and, subsequently, the split of any arising synergies.

Furthermore, differing timelines of the involved funds can be an issue, especially since public-to-private transactions could take longer to close, given the increased complexity and the protocol that has to be followed.

Furthermore, if deals become very sizable, debt availability could become an issue. Considering the need for coordination between funds and possibly more difficult debt funding, large public-to-private deals can be expected to be more human resource intensive.

Finally, large public-to-private deals often involve the sale of a national strategic asset, as is the case for TDC, which can be expected to attract special interest and possible intervention from the government. In TDC, this manifested itself in the targeting of tax benefits of debt by the Danish government.

3. In what ways did the restructuring and other operational and strategic changes following the NTC acquisition add value? Do you think this restructuring would have been undertaken if TDC had remained a publicly traded company rather than being acquired by the PE consortium? Why/why not?

The success of NTC’s investment depended on the ability to carry out certain operational and strategic changes, as outlined in Section 1. Most of the operational and strategic changes included on NTC’s agenda were successfully implemented.

As previously discussed, the headcount was streamlined. It successfully reduced the workforce by more than 4,000 employees only from identified redundancies and outsourcing. Properties were consolidated, generating additional cash from real estate sales and reducing operating expenses; duplicate business divisions were eliminated, and call centers were consolidated.

The value added by these operational changes is mostly expressed by the impressive margin improvement between the acquisition date and 2010, with EBITDA margins reaching some of the industry’s best levels at c. 40%.

On the strategic side, divestment of non-core assets outside the Nordic region was significantly valued if we assume Danske’s “bull case” as a benchmark, except for the Hungarian subsidiary. This unlocked a greater sum-of-the-parts value than initially expected, as TDC could sell most assets with significant strategic premiums.

On the other hand, strategic add-on acquisitions completed in the Nordic market increased exposure to high-growth segments such as fiber and cable TV, helping TDC to position itself in a higher multiple segment in the future.

Customer satisfaction and corporate culture were also improved through the implementation of the TAK program. Although it is difficult to estimate the value generated by these measures, efficiency likely increased, and some internal synergies were created.

These measures also helped with the financial strategy implemented by NTC, as the cash generated was used to pay down debt, increasing potential equity value at exit.

Several factors support the thesis that the restructuring would not have happened had TDC remained a publicly traded company. A very simple reason, to begin with, is just the fact that there was no restructuring announced when TDC was publicly owned.

The issues or improvement opportunities were apparent before the acquisition by the PE consortium as they only had publicly available information on which they based their restructuring program. The restructuring is quite substantial and changes the entire organizational structure of the company.

This would potentially require shareholder approval, which can prove difficult if the shareholders don’t share the view of management. Additionally, those restructurings may have a negative short-term impact on earnings, which CEOs of public companies might not want to risk given their pay structure and the public market’s focus on short-term profitability.

Moreover, those restructurings are very much tied to the specific people in the management, as shown by the hiring and firing of Alder, who did not deliver on the restructuring.

In contrast, Ovesen proved to be key for “difficult change.” Those people were specifically hired because of their background in restructuring. In contrast, in a public company, the CEO would have stayed on and would not have been an expert for turnarounds but probably a generalist.

To add to that, management was likely less incentivized than under the ownership of the PE consortium. Also, there were no signs of TDC being in severe distress that required a significant restructuring (margins were at the low end, but cash conversion was still relatively high).

Hence, if TDC had remained publicly owned, it is likely that the status quo would have been kept. On the other hand, ATP mentioned that there was a list of initiatives to be carried out.

However, it is highly unlikely that those initiatives were that far-reaching as otherwise, the PE consortium’s investment thesis would not have been applicable.

4. What are the pros and cons of the three different options for Sunrise: (a) keep the subsidiary and continue with the IPO, (b) wait for competition authorities and hope for a sale to Orange, or (c) sell Sunrise to CVC? Which option would you recommend?

As for the option to keep Sunrise and continue with the IPO, several problems arise. TDC would not reduce its net debt level below 2.0x EBITDA, which seemed to be a hurdle for the market.

This meant that there was no option for a share buyback, and hence, most of the proceeds from the IPO would have to be used for retiring debt, limiting distributions to the investors. Thus, the IPO would have to be a primary issue that dilutes NTC’s stake.

Moreover, sizing was an issue as a stake too small would result in limited investor interest due to lack of liquidity, while a stake too big would result in severe dilution of NTC.

Sunrise also added woes to TDC’s equity story as margins and cash conversion were significantly below TDC’s. Moreover, TDC would not be considered a pure Nordic asset as Sunrise makes up a sizeable part of the company and exposes shareholders to the FX risk against the CHF.

On the other hand, Sunrise could also add an interesting perspective to the equity story. Sunrise would add the lack of growth and diversification to the Nordic segments that experienced declines over the past.

Moreover, as there are still plenty of improvement opportunities reflected in the comparably low EBITDA margin and cash conversion, IPO investors get potential catalysts for realizing future upside that the PEs cannot realize due to lack of significant control. The potential sale of Sunrise to Orange might also attract investors to the IPO who might want to reap the strategic premium on the potential transaction in the future.

Most importantly, continuing with the IPO saves the PEs time as their job regarding restructuring TDC is basically done with no further plans to be carried out.

Waiting only dilutes the IRR of investors, although one must also consider this from an NPV perspective as the IRR exceeds the LP’s required returns. Additionally, the continuation of the IPO is the least risky alternative.

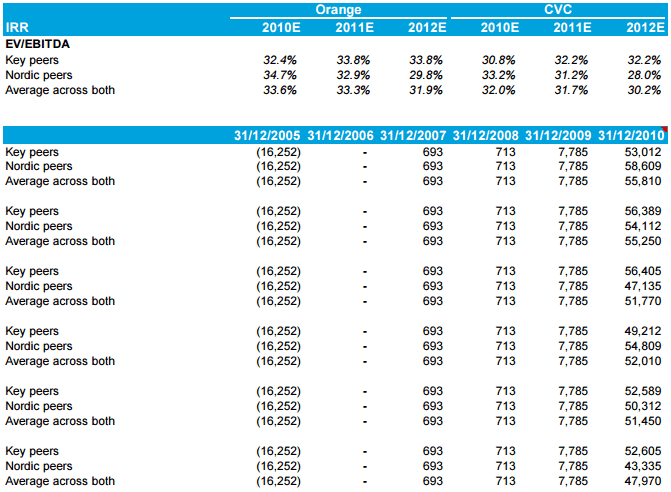

From a pure financial return point of view, this alternative yields the lowest IRR due to the dilution of margins by Sunrise while simultaneously applying the same market multiple for the whole company. In contrast, Sunrise’s multiple could potentially be higher due to the growth profile and improvement potential ahead despite the negatives around the equity story.

The second alternative, to wait for the outcome of an appeal of the competition commission’s decision, presents a very risky alternative. The investors are not able to properly judge the likelihood of a positive outcome.

Moreover, this delays the process significantly, and as there is no further agenda for TDC, this delay would probably be IRR dilutive. The outcome is also highly dependent on France Telecom’s willingness to make concessions and be still interested in pursuing the deal, something beyond the control of the PEs.

While TDC could wait for a better market environment, an earlier IPO could partly benefit from a rebound in the market, as well as not the whole stake will be sold initially. Moreover, it was unclear whether the value of Sunrise could be sustained as an independent unit during the periods of delay.

A failed outcome of the appeal would also hurt a later IPO and sell the equity story as investors will be wary of an asset that was intended to be sold, which was not accomplished.

On the plus side, the acquisition would result in the highest financial outcome as the purchase price offered by Orange beats the offer of CVC. The listing proceeds thanks to the strategic premium, resulting in the highest IRR scenario for investors without adjusting for the solution’s riskiness.

The third option, to sell to CVC, offers a lower price than selling to Orange, but it is superior to listing the whole company in terms of returns. The PEs could keep their initially envisioned IPO structure of a secondary issuance with share repurchases that allow them to lower their debt levels and make distributions to investors. Moreover, TDC could be sold as a pure Nordic asset.

However, when looking at the valuations for peers, the Nordic companies trade lower when looking at 2011E and 2012E EBITDA. Hence, the valuation in the IPO might come in lower than compared to the case of keeping Sunrise and getting a valuation that leans towards international peers.

Moreover, the bid is a non-binding, conditional offer and hence brings uncertainty with it. It also delays the IPO by a bit, which is likely to be IRR dilutive thanks to the lacking agenda for TDC and the slow pace of growth.

Given the above arguments, especially regarding the lacking agenda of TDC’s owners and a possible IRR dilution when delaying the IPO for longer, we would recommend keeping the subsidiary and continuing with the IPO, possibly divesting Sunrise after the IPO.

Exhibit 1. TDC Standalone and divestment of Sunrise

TDC Standalone + Accepting one of the bids for Sunrise

Exhibit 2. TDC Standalone and Sunrise combined entity

TDC & Sunrise

Additional File:

Excel spreadsheet. Download here.