Seagram is thinking of office relocation. Its vice president of finance is faced with several choices and has to analyze discounted cash flow analysis and the capital asset pooling and tax benefits, among other considerations. This case study focuses on both concepts of discounted cash flow and net present value with Seagram's version of economic value added (EVA). It also dwells on the rent-versus-buy option, one of the extreme challenges most company managers are facing in the course of management of a business. It also takes into consideration the fact that in Hong Kong, buying property is seen as more efficient since the valuation of properties continuously appreciates. This study also discusses briefly capital asset pooling and Hong Kong depreciation tax law.

Claude P. Lanfranconi; Geoff Crum

Harvard Business Review (99B018-PDF-ENG)

June 29, 1999

Case questions answered:

- Seagram is considering the decision to relocate to Tsim Sha Tsui and has to choose between buying the property or renting. Prepare an analysis of the present value of cash flows associated with each option (with some basic sensitivity analysis) and make a recommendation on the buy versus rent decision.

- You are working for a consulting firm, and you have been asked to estimate the cost of equity capital for Seagram in 2015. You have identified two proxy firms that are in the same business as Seagram and are listed on the Hong Kong Stock Exchange (HKSE). The two firms are Tsingtao Brewery Co, Ltd (stock code: 168) and China Tontine Wines Group Limited (stock code: 389). The latest annual reports for the two firms are available on IVLE. Information about the firm’s beta is available on Bloomberg. What is your estimated cost of equity for Seagram? State the assumptions you make.

- Discuss the advantages and disadvantages of using the Seagram Value Added concept at the divisional level.

Not the questions you were looking for? Submit your own questions & get answers.

Seagram Greater China: Office Relocation in Hong Kong Case Answers

QUESTION 1

Currently located in Kowloon Centre, Tsim Sha Tsui, Seagram is considering relocating to the Miramar Tower on Nathan Road, Tsim Sha Tsui.

In our report, we have considered the following options relevant to the decision-making process: to remain at the current location, to rent the property located at Miramar Tower, or to buy the property located at Miramar Tower.

Throughout this report, we will use the net present value (NPV) of the cash flows method and the Seagram Value Added (SVA) method in our analysis.

Assumptions

During our analysis, the following main assumptions have been made:

- All costs and gains are in cash.

- The year used is Seagram’s fiscal year.

- Costs and gains are always incurred at the beginning of the fiscal year, while the tax is paid at the end of the fiscal year.

- Per Seagram’s procedure, a 10-year horizon is used for NPV calculations.

- For tax savings calculations, positive profits are assumed for the entire horizon.

- Per Hong Kong law, depreciation expenses of fixed capital assets and expenditures incurred on the purchase of fixed assets are not deductible for tax purposes. Instead, tax relief in the form of capital allowances under Capital Asset Pooling is available.

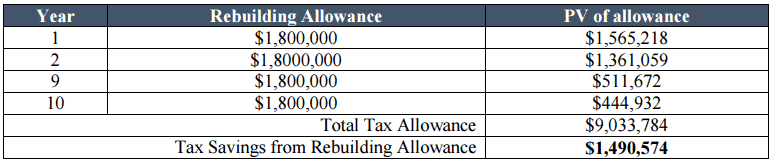

- Rebuilding Allowance of 2% is assumed to continue for the next 10 years, independent of changes in tax laws that were effective from 1998

- Unless otherwise stated, all cash figures are in Hong Kong Dollars.

Options

Option I: To Remain at the Current Location

Taking into account taxes, the relevant cash flows in this option are:

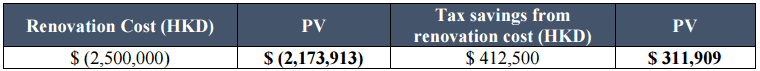

Renovation cost

Given the initial estimates that renovation costs would be in the range of 2 to 3 million, our group chose to take a conservative stance and estimated this cost to be $2,500,000.

Since the renovations are scheduled in the “following year,” we assume that this cost is paid upfront at the start of the year, at T=1. Tax savings associated with this cost, however, only occur at the end of the year, at T=2. The PV of cash flows related to this cost discounted at 15% is as shown:

Also, we assume that the entire $2,500,000 spent on the renovation is to be taken as leasehold improvements and, hence, is permitted for rebuilding allowances.

As with the tax savings mentioned above, this only occurs at the end of the year at T=2. Following Hong Kong tax laws, a 2% annual allowance is taken from the original cost of $2,500,000. The PV of cash flows (discounted at 15%) related to this rebuilding allowance is:

Monthly Rental Fees (8th Floor)

The 8th floor houses the sales division, and the monthly rental cost of this space is $78,520. We have assumed that this fee will be constant and not change for the next 10 years.

Since rental fees are paid monthly, this cash outflow is discounted monthly at a discount rate of 1.25% to better represent the PV of cash flows. The PV of cash flows is as shown:

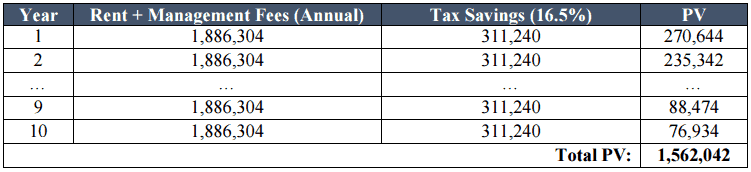

The tax savings associated with the rental fees will later be discussed together, along with the tax savings due to the management fees for the space owned on the 3rd floor.

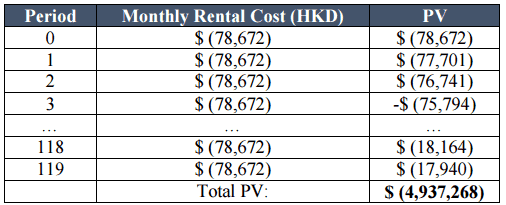

Monthly Management Fees (3rd Floor)

The 3rd floor houses the finance and accounting HQ, and while the space is owned by Seagram, a monthly management fee of $78,672 is required to be paid. Again, we assume that this fee will be constant and not change for the next 10 years.

Since management fees are paid out monthly, this cash outflow is discounted monthly at a discount rate of 1.25% to better represent the PV of cash flows. The PV of cash flows related to this fee is as shown:

As mentioned earlier, we shall now discuss the tax savings that arise from the rental and management fees combined. Tax savings arise at the end of each year, and we discount this yearly at 15%. PV of the tax savings are as shown:

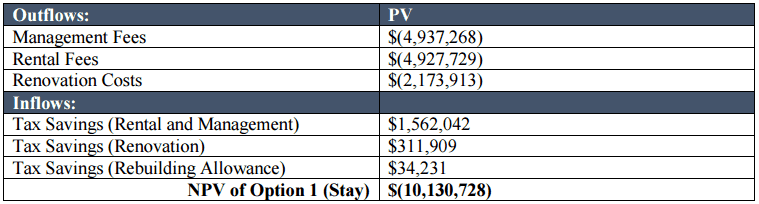

NPV of Option I: Based on our chosen estimation of 2.5 million as renovation costs, we have calculated the NPV of the stay option to be $(10,130,728).

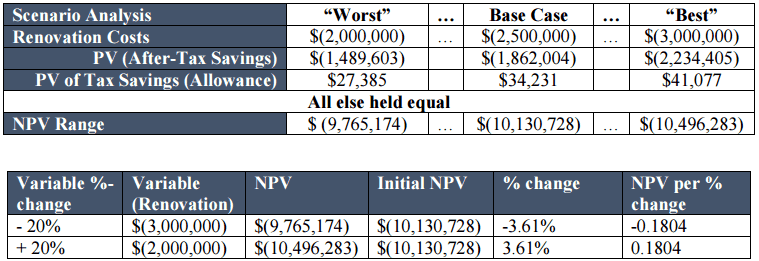

Sensitivity & Scenario Analysis

Recognizing that the estimated value of renovation costs will affect the eventual value of NPV, we performed a sensitivity and scenario analysis to determine its impact. The fluctuation of renovation cost from 2-3 mil will result in an NPV range between $ (9,765,174) and $(10,496,283).

According to the sensitivity analysis, we observe that a 1% change in renovation cost will affect NPV by a factor of 0.1804.

Option II: To Rent the Property

Taking into account taxes, the relevant cash flows in this option are:

Disposal of property

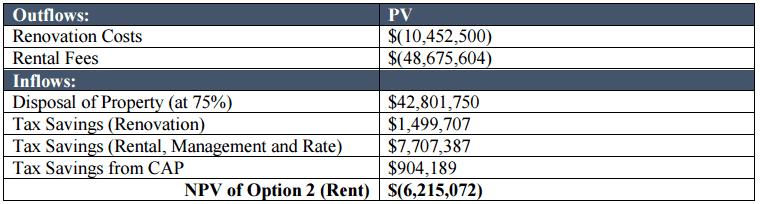

According to Hong Kong taxation laws, capital gains are not taxed. Given the 70-80% estimate of the original estimated selling price, we took a conservation middle value of 75% in our calculation and found the NPV of proceeds earned to be $42,801,750.

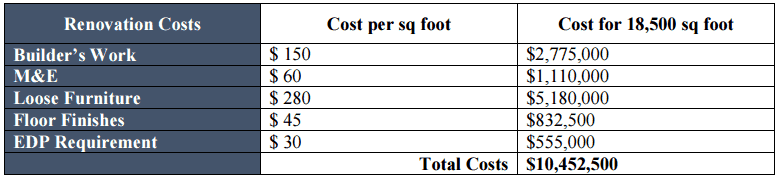

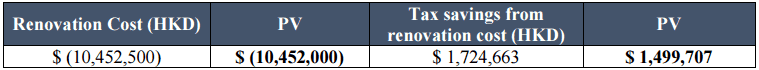

Renovation cost

Total renovation costs for the rental space amount to $10,452,500, as reflected in the table below. We assume that the renovation cost is paid fully in cash at T=0 while tax expense is paid at T=1. Hence, the PV of renovation costs and its tax savings are $ (10,452,000) and $ 1,499,707 respectively.

Monthly fees

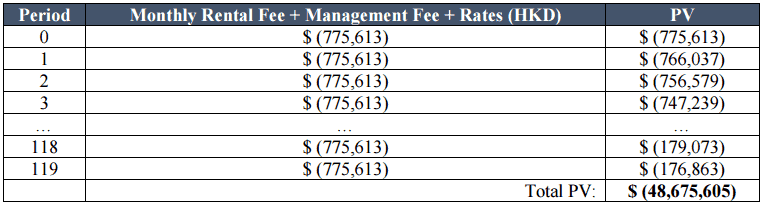

Monthly fees consist of rental fees, management fees, and rates, which add up to $775,613. This is assumed to be constant over the next 10 years.

When discounting the monthly fee of $775,613, we use a monthly rate of 1.25% as derived from Seagram’s annual WACC of 15%. The NPV of monthly fees across the 10 years was calculated to be $(48,675,605), before accounting for taxes.

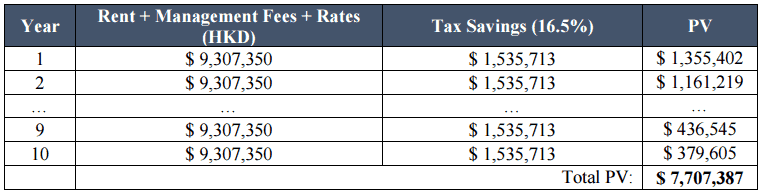

Tax savings arise at the end of each year, and hence, we discount this yearly at 15%. PV of the tax savings are as shown:

Tax allowance from Capital Asset Pooling (CAP)

Under Hong Kong’s GAAP, tax allowance in the form of CAP is available for plant and machinery. The assets are classified into three capital pools: 10%, 20%, and 30%, with a 60% write-down in the purchase year.

At fiscal year-end, the respective percentage would then be deducted from the remaining pool and expensed for tax purposes. Rebuilding allowance is also allowed for leasehold improvements and the initial purchase cost of a building. There is no initial allowance provided, and there is a 2% annual write-down taken from the original cost of the pooled assets.

We note that from YA 1998/99, the annual allowance for Rebuilding allowance was increased to 4%. However, using the revised 4% rate results in applying hindsight to the decision, and hence, we applied the original rate of 2% throughout the analysis. Another assumption was that there were no new assets added to the pools over the next 10 years.

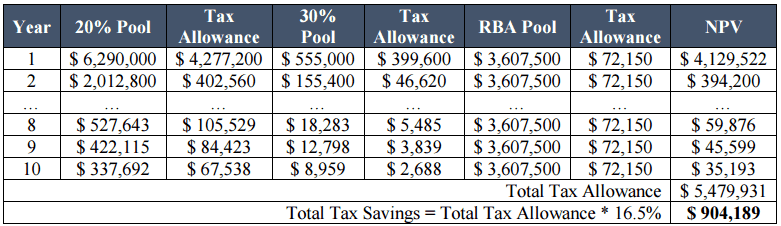

We have calculated the NPV of tax allowances from CAP to be $904,189 over 10 years, as reflected in the table below:

NPV of Option II: Based on our chosen estimation of 75% of proceeds to be realized from PDA, we have calculated the NPV of the rent option to be $(6,215,072).

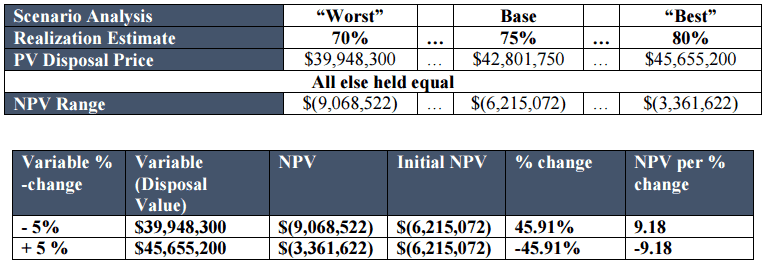

Sensitivity & Scenario Analysis

Recognizing that the estimated value of disposal will affect the eventual value of NPV, we performed a sensitivity and scenario analysis to determine its impact. The fluctuation of disposal value from 70-80% of the initial estimated cost resulted in an NPV range of $ (9,068,522) and $(3,361,622).

According to the sensitivity analysis, we observe that a 1% change in realization estimate will affect NPV by a factor of 9.81, as shown in the tables below:

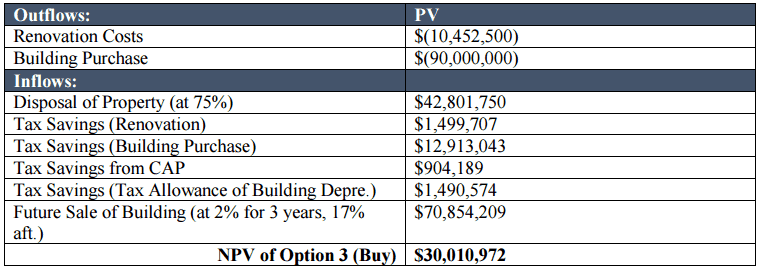

Option III: To Buy the Property

Taking into account taxes, the relevant cash flows in this option are:

Disposal of property

The NPV of proceeds earned was found to be $42,801,750, as explained under Option II.

Renovation Cost

The NPV of renovation cost is $(8,952,793) net of tax savings, as explained under Option II.

Building Purchase and Depreciation Savings

The cash purchase of the Miramar Tower office location is an outflow of $90,000,000, occurring at T=0. We assume the amount is fully paid in cash upfront at T=0, with tax savings at T=1.

According to Hong Kong taxation laws, an annual allowance of 2% of the original cost of commercial office property will be granted from the year of purchase, calculated to be $1,800,000 per year. The discounted sum of 10 years’ worth of savings, multiplied by the tax rate, gives us savings from depreciation, calculated to have an NPV of $1,490,574

Tax Allowance from Capital Asset Pooling

The allowance for CAP as part of renovations is calculated in Option II, which is found to be $904,189 over 10 years.

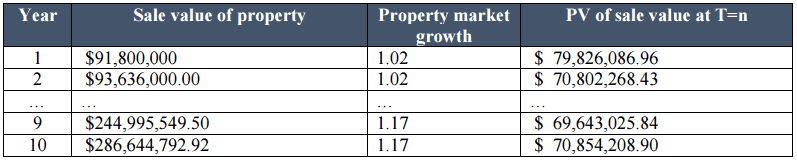

Future Sale of New Building

The future sale value of Seagram’s new building is calculated by multiplying the cost price of $90,000,000 with property market growth each year for 10 years – 2% per year in the first 3 years, followed by 17% per year up until year 10.

We assume the building’s sale is at the end of year 10 and that property market growth improves in the above-mentioned percentages. After discounting back the resale value using a WACC of 15%, we obtained an NPV of $ 70,854,208.90.

NPV of Option III: Based on our chosen estimation of 2% growth in the first three years and 17% growth in subsequent years, we have calculated the NPV of the buy option to be $30,010,972.

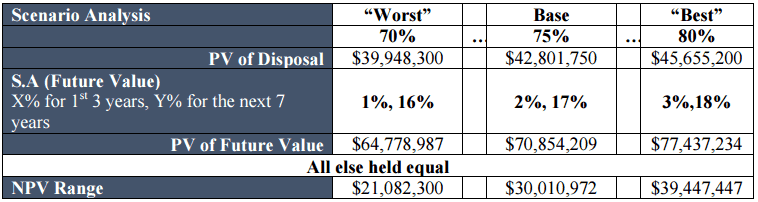

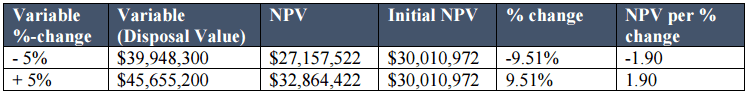

Sensitivity & Scenario Analysis

Recognizing that the estimated property growth rate and disposal value of the building will affect the eventual value of NPV, we performed a sensitivity and scenario analysis to determine its impact.

In the “worst” case scenario, we assume a 70% realization of the initial disposal estimate alongside a 1% growth rate for the first 3 years, followed by a 16% growth rate for the next 7 years for the new building.

In the “best” case scenario, an 80% realization of the initial disposal estimate, with a 3% growth rate for the first 3 years, followed by an 18% growth rate for the next 7 years. We observe an NPV range of $21,082,300 and $39,447,447.

According to the sensitivity analysis, we observe that a 1% change in realization estimate will affect NPV by a factor of 1.90, as shown below:

Assumption: Holding growth rate and all else constant

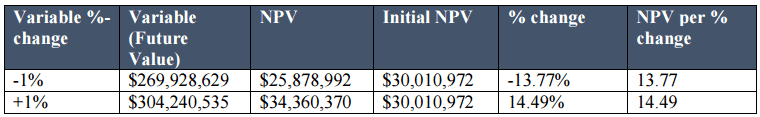

Due to the compounding effect of growth rate, we observe that the changes in NPV per percentage change in growth rate vary, depending on the direction of change. The results are as shown below:

Assumption: Holding disposal value constant at 75%, and initial growth of 2% constant

Change of subsequent growth rate from 16% to 18%

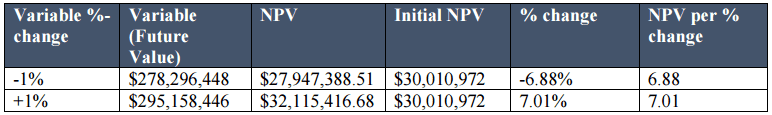

Assumption: Holding disposal value constant at 75%, and subsequent growth of 17% constant

Change of initial growth rate from 1% to 3%

Caveat

While taking into consideration the options of “stay,” “buy,” and “rent,” it should be noted that one key difference of the “stay” option is the missed opportunity to consolidate and establish a shared service center, which the “buy” and “rent” option would be able to achieve.

This consolidation could possibly lead to cost savings, which are not reflected in NPV calculations.

![]()

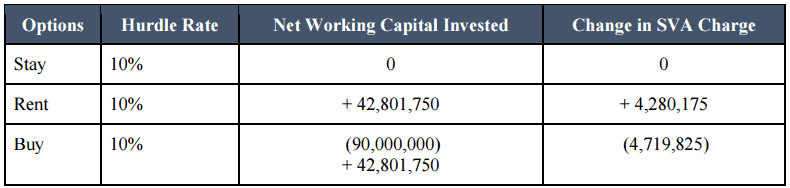

Incorporating SVA

As given in the case, the formula for SVA calculation is:

Net Income after SVA = Net Income – (Hurdle Rate x Working Capital invested)

Net Income after SVA = Net Income – [Hurdle Rate x (Current Assets – Current Liabilities)]

We will be calculating the relevant Net Income after SVA for the time T = 0 only. As the purpose is to compare between options, only relevant changes in net working capital investment relative to the ‘Stay’ option (taken as status quo) will be considered, and all else is taken to be constant.

Thus, while in accounting, the buying of property (Fixed Asset) for the new office does not directly affect Working Capital, we assume that cash (Current Asset) is used to purchase Fixed Assets (Main Assumption 1), and SVA reflects this implicit cost of investing in Fixed Assets.

Similarly, the freeing up of cash (Current Asset) from the sale of current property (Fixed Asset) will affect Net Working Capital in the same way.

Stay Option: Status Quo

Rent Option: Disposal proceeds (cash inflow)

Buy Option: Disposal proceeds (cash inflow) and Purchase of fixed asset (cash outflow)

Using the hurdle rate of 10%, the effects of each option on SVA are shown below:

To help Mr. Swanson decide which option to proceed with, both NPV and SVA have to be considered in conjunction.

Under NPV and DCF analyses, the best option would be to Buy as the NPV is the highest. However, using SVA analysis, Rent would be the preferred option by Mr. Swanson as it creates a positive effect on Net Income after SVA, hence, better performance evaluation.

NPV provides a more holistic view of the value and profitability of the project as it discounts future cash flows. At the same time, SVA measures the efficiency of the use of working capital. As such, NPV would be a more useful measure in making investment choices, which points to the Buy option as the optimal choice.

While the buy option has the lowest SVA, Mr. Swanson should still consider taking it on as it has a positive NPV. Although doing so may result in a poorer performance evaluation from the SVA point of view, there are benefits to be reaped in the future. When this property is sold in the future, assuming appreciation in property prices, he would potentially receive better bonuses.

Conclusion

Since the Buy option would create the most value for all stakeholders involved, we recommend Mr. Swanson to Buy the new property at $90,000,000.

QUESTION 2

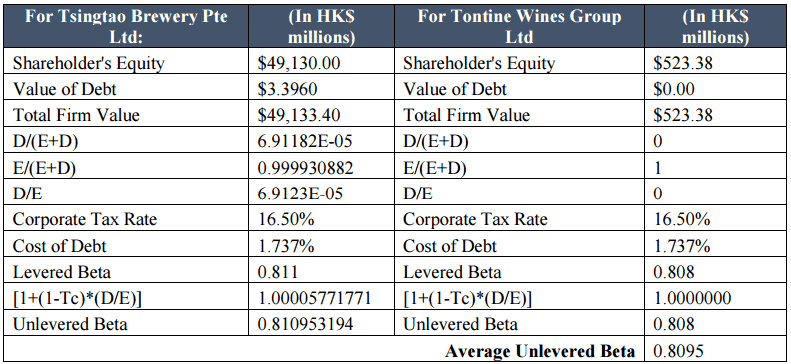

To estimate Seagram’s cost of equity in 2015, two comparable companies, Tsingtao Brewery Co, Ltd and China Tontine Wines Group Limited, are studied. We will use the two betas of the companies extracted from Bloomberg Terminal on 17 Sep 15, as well as the information provided from their 2014 annual reports.

Un-levering betaFirstly, we will un-lever the two companies’ betas using their respective D/E ratios. In our calculation of the firms’ betas, we assume their value of debt in 2015 is the same as in 2014.

For instance, we assume that Tontine Wines Group Limited would not take up any financial leverage in 2015, hence maintaining its unlevered stance since 2014.

As Seagram ceased operations in 2000, it is difficult to estimate Seagram’s performance relative to the two firms in 2015. Therefore, we assign equal weights to the betas of both Tsingtao Brewery Pte Ltd and Tontine Wines Group Limited and derive Seagram’s unlevered beta. This is calculated to be 0.8095.

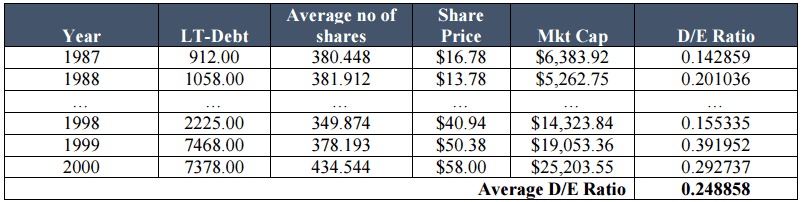

Extrapolation of D/E Ratio

Since Seagram ceased operations in FY2000, we have to extrapolate the 2015 D/E ratio from its past annual reports. In this case, we will take the average of all the D/E ratios from 1987 to 2000 to extrapolate for its 2015 D/E ratio.

We derive Seagram’s D/E ratio by taking the ratio of Long-Term Debt to its Market Cap, which is the product of its share price for the year and the average number of shares outstanding.

Similarly, we assign equal weights to the D/E ratios from the Year 1987 to 2000. We observe that there are no major fluctuations in the D/E ratios. Hence, it would be reasonable to simply take the equally weighted average of the respective D/E ratio as the forecasted D/E ratio for Seagram in 2015. Hence, we estimate Seagram’s 2015 D/E ratio to be 0.249.

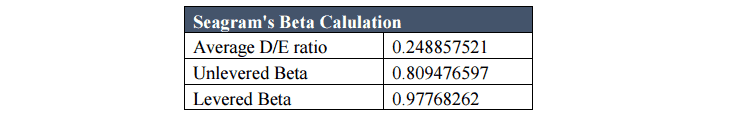

Levering Beta

We will apply the D/E ratio computed in the second step to derive the levered beta for Seagram.

Hence, Seagram’s levered beta is 0.978.

Estimated Cost of Equity

Lastly, we will find Seagram’s cost of equity capital using the Capital Asset Pricing Model (CAPM). We will use the Hong Kong risk-free rate of return of 1.737% and the market risk premium of 10.141%, extracted from Bloomberg Terminal on 17 September 2015, in our model to derive the cost of equity for Seagram.

Hence, Seagram’s cost of equity = 1.737% + (0.978 x 10.141%) = 11.65%

QUESTION 3

According to the case, SVA can be applied to both geographical areas (e.g., Canada, Hong Kong) and functional departments (e.g., Sales, Finance). This will be our definition of the ‘divisional’ level.

As given in the case, the formula for SVA calculation is Net Income after SVA = Net Income – (Hurdle Rate x Working Capital invested) = Net Income – [Hurdle Rate x (Current Assets – Current Liabilities)].

Thus, while in accounting, the buying of property (Fixed Asset) for the new office does not directly affect Working Capital, we assumed that cash (Current Asset) is used to purchase Fixed Asset (Main Assumption 1). Hence, SVA reflects this implicit cost of investing in Fixed Assets.

Advantages of SVA

As SVA is devised by Seagram headquarters (HQ), the company is able to use it as an internal measure of control and for cross-divisional performance appraisal metrics.

Firstly, SVA aligns the divisional managers’ interests with HQ’s policy. For example, it penalizes managers for investing working capital by incurring a charge on the division’s Net Income.

As managers’ compensation is tied to their respective department’s Net Income after SVA, this method forces them to internalize the implicit costs of investing excess working capital, which is in line with Seagram’s policy to not hold fixed assets unnecessarily.

Moreover, it encourages divisions to employ working capital more efficiently. This is because Net Income alone only accounts for the operating costs (and cost of debt) of the division, while SVA accounts for both operating costs (and cost of debt) and working capital cost employed.

Thus, Net Income is unable to account for the opportunity cost of using working capital, for example, the opportunity cost of tying up cash (current asset) to invest in property instead of renting. Therefore, Net Income after SVA is a better performance appraisal metric than Net Income.

Secondly, as SVA is an internal measure of performance, Seagram is not required to follow GAAP in using this measure, hence allowing for more flexibility.

For example, Seagram uses the hurdle rate in SVA calculation instead of WACC. Since the hurdle rate is set by the Seagram HQ, Seagram is able to vary the hurdle rates between different geographical divisions with different business risk environments and evaluate managers’ performance more fairly. In contrast, WACC assumes that the risk in all divisions is consistent.

Thirdly, SVA is simpler to calculate than NPV and DCF analyses. There are no cash flow projections involved, and only data that are easily obtainable from Seagram’s annual reports are needed.

Disadvantages of SVA

Firstly, SVA could incentivize managers to take detrimental short-term actions that maximize their own interests. For instance, managers may reject positive NPV projects, as seen in the option of buying the property, to minimize the working capital invested. This means that shareholders’ wealth is not maximized as SVA does not consider future cash flows to the firm.

Secondly, it is unfair to compare divisions with intrinsically different working capital needs, as this causes certain divisions to be unfairly rewarded while others are unfairly punished.

For example, the HR department inherently requires less working capital than the Production department, and hence, Net Income after SVA would be higher for the HR department.

As a result, the HR manager may receive higher compensation than the Production manager. However, this might not reflect the true performance of the Production department but instead unfairly penalize them.

Thirdly, SVA relies on accounting methods of revenue realization and expense recognition in Net Income calculation instead of cash as in DCF analysis. Hence, managers can alter decision-making processes, such as delaying the recognition of expenses to manipulate SVA to their advantage.

Conclusion

While SVA is a good internal control and appraisal measure used to align managers’ interests with corporate policy, over-reliance on SVA could demotivate well-intentioned managers, such as Mr. Swanson, who may feel unjustly penalized by the lack of recognition of their true level of effort and performance.