The Linton's must come up with a decision on whether to buy a house or just continue renting a townhouse. This "Stedman Place: Buy or Rent?" case study discusses the factors that must be considered in coming up with the decision and the net present value, internal rate of return, and the costs and benefits of homeownership.

David S. Scharfstein; Andre F. Perold

Harvard Business Review (207063-PDF-ENG)

September 27, 2006

Case questions answered:

- Describe the Linton’s current dilemma, as well as the tradeoffs of owning versus renting in Stedman Place.

- Discuss the adequacy of the Linton’s down payment in light of their overall financial situation. How much do the Linton’s need to earn per year to comfortably afford the ownership of the property? Hint: Examine this on the basis of the recommended maximum 28% ratio of monthly PITI (principal, interest, taxes, insurance) to monthly gross income.

- What should the Linton’s do? Should they buy or continue to rent?

Not the questions you were looking for? Submit your own questions & get answers.

Stedman Place: Buy or Rent? Case Answers

This case solution includes an Excel file with calculations.

1. Describe the Linton’s current dilemma, as well as the tradeoffs of owning versus renting in Stedman Place.

The Linton’s are facing a steep hike of 20% in rent making them consider the option of buying a house in Stedman Place. They are planning to live in Newton for another five years and need to also consider whether owning the house for this short period of time would make buying the house a worthy investment.

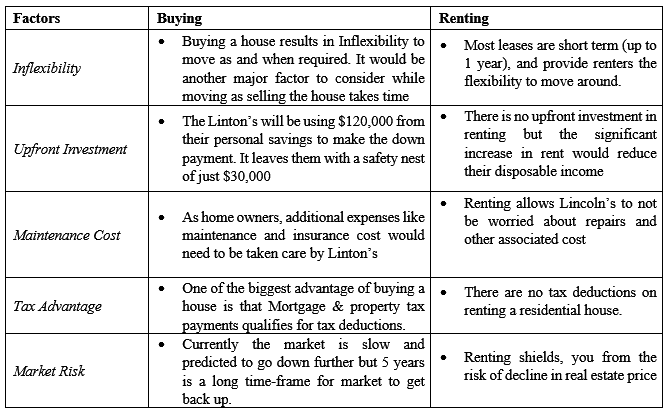

The factors that they should consider before buying or renting the house are:

2. Discuss the adequacy of the Linton’s down payment in light of their overall financial situation. How much do the Linton’s need to earn per year to comfortably afford the ownership of the property? Hint: Examine this on the basis of the recommended maximum 28% ratio of monthly PITI (principal, interest, taxes, insurance) to monthly gross income.

The real estate agent recommends…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!