The CFO of Teletech Corporation is challenged by a claim that a major part of the company is not gathering a rate of return which is satisfactory, hence, such segment of the company should be sold. This case study analysis provides for an examination of the use of a single hurdle rate. By doing that examination, one could come up with an evaluation of all the segments of the company. Students would be able to estimate the weighted-average costs of capital (WACC) and come up with a solution to such a claim.

Robert F. Bruner; Sean Carr

Harvard Business Review (UV1375-PDF-ENG)

November 17, 2005

Case questions answered:

- Calculate WACC for the two divisions of Teletech using the approach described in Exhibit 2 and the data in Exhibits 1, 3 & 4. Assume that the data for Telecommunications Services represents Mr. Phillips’ segment and the data for Telecommunications Equipment and Computer and Network Equipment represents Ms. Buono’s segment.

- What are the implications of your calculations for Teletech?

Not the questions you were looking for? Submit your own questions & get answers.

Teletech Corporation, 2005 Case Answers

This case solution includes an Excel file with calculations.

Please scroll down to the bottom of this post to download the additional Excel spreadsheet.

Management Issue at Teletech Corporation

The case study “Teletech Corporation, 2005” presents one major management issue: the company is struggling to determine the most efficient approach to its hurdle rate.

Some employees claim it would be more beneficial to use a single corporate hurdle rate, whereas others defend separate divisional hurdle rates. Overall, they are struggling to find consensus.

It is important that the TeleTech team makes a strategic decision, as the hurdle rate(s) will be a key element in evaluating the company’s performance – including the planning of projects and investments and a response to Mr. Yossarian’s concerns.

Discussion

Mr. Phillips claims that hurdle rates should be calculated differently for each department. Given that the telecommunications (Telecom) division and the product & services (P&S) department have different risks and returns on capital (ROC), they take place in different categories of investments.

While Telecomm is considered an A rating, the P&S division is considered a BB rating, which characterizes them as different investments with their respective capital inputs and hurdle rates.

If Teletech Corporation insists on treating the two divisions with the same hurdle rate, it will give the company an A-/BBB+ rating, which is lower than the average telecommunications company, which may lead to reduced funding from the stock market.

Ms. Buono, on the other hand, says that Teletech should continue to have a single corporate hurdle rate. The company’s job is to create value for its shareholders by maximizing returns.

They do not necessarily care about where the money is invested within the company as long as it keeps providing them with the expected outputs. Therefore, the specificities of the hurdle rates do not concern them.

Investment should be placed in departments that provide the highest returns because that is the core mission of Teletech Corporation. Having divisional hurdle rates would compromise the company’s ability to compare divisional performances.

Written Analysis

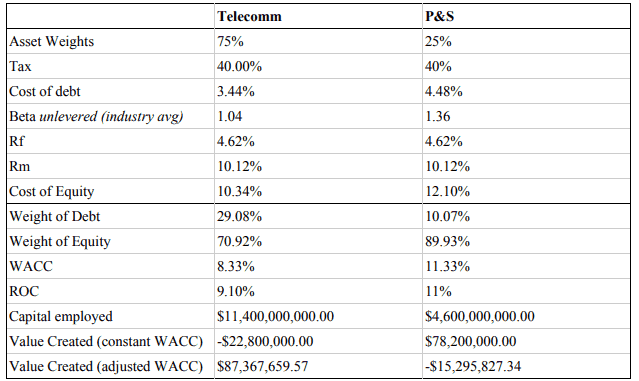

Table 1, which shows the WACC calculations for the Telecom and P&S divisions, presents the differences between the two. P&S, which has a larger beta, is riskier than Telecomm.

The cost of debt and the cost of equity are also different between the two.1 The P&S division has a 1.04% and 1.76% increase over the Telecom division for the cost of debt and cost of equity, respectively.

This leads to a very different weighted average cost of capital (WACC), with a 3% difference between the two departments, which is quite significant given the risk levels and financing situation of the departments.

The P&S division, therefore, is expected to make and generate 3% more capital than the Telecom division. Additionally, there is a 1.9% difference in ROC, which means that the same capital input into the two different divisions will provide different outputs.

Lastly, and most importantly, there are large differences in values created between the two divisions based on using a single corporate hurdle rate versus using separate divisional hurdle rates. With the corporate hurdle rate, the Telecom division destroyed $22.8 million in 2004, while P&S created $4.6 million in value.

In complete contrast, using divisional interest rates shows that the Telecom division created $87.4 million in value in 2004, while P&S destroyed $15.3 million. This is an enormous difference, and if the wrong hurdle rate is chosen, inaccurate performance assessment could cost the company millions of dollars a year.

Table 1, WACC Calculations for the Telecom and P&S departments.2

Arguments Critique

Ms. Buono makes a valid argument for using a single corporate hurdle rate for both departments. Reinforcing Teletech’s mission statement (i.e., “We will create value by pursuing business activities that earn premium rates of return”), she argues that risk and financial ratios are not relevant to the company’s performance.3

What matters is to provide premium rates of return for shareholders, and with a single corporate hurdle rate, Teletech Corporation can quickly determine which department is performing better and optimize its performance.

This argument may be, however, ignorant of the current and future operations of the company. The hurdle rate determines the value created from the projects and helps one decide which projects and departments get funding.

With a single corporate hurdle rate for all departments, it inaccurately assesses the potential for different projects and departments, leading to inefficient company investments. This logic flaw is evident through the analysis of the numbers above. P&S’ risk is higher than Telecomm’s, which leads to a higher WACC for P&S.

As lower risk is related to a lower return and lower initial rate of return (IRR), evaluating Telecom’s projects with a hurdle rate that is mixed with the higher risk of the P&S division, the assumed risk level for these projects will be higher than its true risk level. This skews the decision towards rejection even if the project would have provided a positive return.

For the project proposal from the P&S division, however, an inaccurately low level of risk would be assumed, making the decision biased towards acceptance even if the return is expected to be lower than the true discount rate.

Having a single corporate hurdle rate and treating both divisions can create a scenario where value-destroying projects are accepted while value-creating projects are rejected. This can be seen through the apparent underperformance of the Telecom division using the corporate hurdle rate and the positive performance of the P&S.

When the divisional hurdle rate is used, the Telecom division is evidently creating more value, and the P&S division is destroying value.

The former would have led to increased funding for a department that is destroying value while decreasing funding for a department that is a vital component of the company’s success. This behavior could lead the company to invest in P&S projects that encourage the taking of even riskier projects, creating a feedback loop.

A constant hurdle rate can also give investors the wrong perception of the type of investment they are making in Teletech Corporation. The company’s risk is higher than other telecommunications companies, which leads investors to expect a higher return.

However, the company still issues dividends as other companies in the industry. As TeleTech does not provide enough returns for the P&S industry, the company stocks may seem riskier and unattractive.

Recommendation on Next Steps to Mr. Harper

Mr. Harper is currently tackling two problems. One is the controversy of using one single corporate hurdle rate or having divisional hurdle rates, and the other is addressing Mr. Yossarian’s complaint regarding the P&S department.

They may seem distinct issues at first, but both can be solved with an analysis of why divisional hurdle rates should be used in the context of Teletech’s operations (as shown in previous sections of this paper).

With a detailed analysis, the board will hopefully be convinced to use divisional hurdle rates and see that the products and services department truly is underperforming.

This will validate Mr. Yossarian’s concerns, and from there, Mr. Harper can reassure him that the company is now heading in the right direction and there is no need for such drastic demands.

Instead, they can work together to ensure the P&S division works with the Telecom division to create future growth and profitability.

Reference

Bruner, R. F., Teletech Corporation, 2005. Darden Case No. UVA-F-1485. Retrieved on November 14, 2017, from https://ssrn.com/abstract=1279938.

1 #riskadjusting

2 Please refer to this spreadsheet for the calculations.

3 #businessstrategy

Additional File:

Excel Spreadsheet. Download here.