The Investment Detective case study allows a student to learn and compare various capital investments. It tackles the evaluation of cash flows of various projects and determines which is the most attractive based on its net present value (NPV), internal rate of return (IRR), return on investment (ROI), etc.

Robert F. Bruner and Sean Carr

Harvard Business Review (UV0072-PDF-ENG)

March 27, 1991

Case questions answered:

- In the case of The Investment Detective, for each set of project cash flows, calculate the payback period and rank the projects.

- For each set of project cash flows, calculate the Internal Rate of Return (IRR) and rank the projects.

- For each set of project cash flows, calculate the Net Present Value (NPV) using discount rates of 8%, 10%, and 12%, respectively. For each discount rate, rank the projects. Explain why the ranking changes as the discount rate increases. Now, assume that Project #7 and Project #8 are mutually exclusive, and the cost of capital is 10%. Answer the following two questions only for projects #7 and #8.

- How would you rank these two projects based on NPV? Based on IRR? Are your rankings the same? If not, explain why.

- In addition to NPV and IRR, are there any other considerations that might affect your choice of the project?

Not the questions you were looking for? Submit your own questions & get answers.

The Investment Detective Case Answers

This case solution includes an Excel file with calculations.

The Investment Detective Case Study

The Investment Detective case study allows a student to learn and compare various capital investments. It tackles the evaluation of the cash flows of various projects.

It determines which is the most attractive based on its net present value (NPV), internal rate of return (IRR), return on investment (ROI), etc.

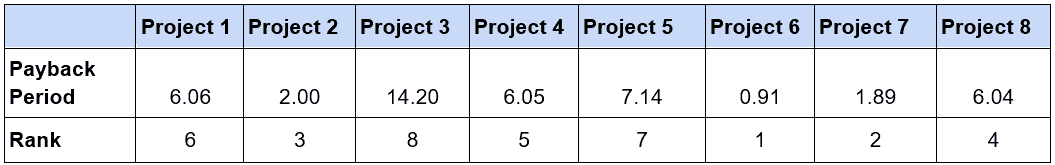

1. In the case of The Investment Detective, for each set of project cash flows, calculate the payback period and rank the projects.

(Please refer to the attached Excel spreadsheet for additional computation.)

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!