Theo Chocolate, Inc. is a small start-up chocolate manufacturer that seeks to establish its name and brand amidst competitions. Its driving edge is being the "only organic, Fair-Trade, bean-to-bar chocolate factory in the United States". For a few years, Theo has garnered a growing number of followers. However, despite steady improvements in all financial indicators, Theo finds it hard to gain much profit. It is then faced with the question of whether it can afford to stay true to its strategy and value proposition while seeking to be more profitable.

Michael Cummings; Gary Ottley

Harvard Business Review (BAB692-PDF-ENG)

April 01, 2012

Case questions answered:

Not the questions you were looking for? Submit your own questions & get answers.

Theo Chocolate Case Answers

This case solution includes an Excel file with calculations.

Executive summary – Theo Chocolate

Theo Chocolate, despite a commitment to sustainability and Fair-Trade, won’t be profitable by 2012 due to:

- The company didn’t take into account its customers’ concerns/interests;

- Demand for Fair Trade products wasn’t high enough, while the organic chocolate market was highly competitive;

- Cost structure with high intensity in SG&A;

- Ineffective and costly Marketing strategy.

However, it is possible for Theo to become profitable by 2015 with a new marketing strategy that could effectively communicate to customers the sustainability and Fair-Trade effects of the company. Also, their investments in CSR will prove to be beneficial in the long term.

Analysis

1. Why Theo Chocolate will not be profitable by 2012

a. Quantitative analysis (Exhibit)

2007 – 2009: One of the main reasons for the unprofitability of Theo Chocolate was the huge spending in SG&A. Although Theo managed to decrease operating costs, the total expense still exceeded gross margins by 43% of sales and thus resulted in a huge net loss over this period.

Noticeably, even though Theo tried to decrease overall costs from 2008 – 2009, Marketing spending still slightly increased from 35.24% to 35.44%. However, it seems Theo’s Marketing strategy was not effective since there was a significant drop in sales growth rate (137% to 16%) in 2009.

2010 – 2012: it was clear from historical performance analysis that Theo Chocolate was bearing extremely high costs. Even though the company could eventually decrease these costs to the point of profitability (2015), there was no concrete evidence that the company could do that within three years and not hurt the growth potential.

To illustrate this, the forecast shows that in order to be profitable, Theo would need to decrease their COGS by 10% and SG&A by 40%. For COGS, since Theo Chocolate paid the higher-than-market price due to a commitment to Fair Trade practice, it would be really difficult for the company to significantly decrease this cost from the supplier end. Theo would have to reduce the cost by improving its operational effectiveness instead, but it would still take time and require high demand from customers to achieve an economy of scale.

The same case applies to SG&A. In order to cut off 40% of operating costs, Theo Chocolate would need to reduce marketing costs by 25% and admin costs by 15%. This would require Theo to completely revise its Marketing strategy and overhead cost allocation. Achieving all of these cost reduction targets within three years would be unrealistic, considering the size (small) and the life cycle (growth stage) of the company.

b. Qualitative analysis

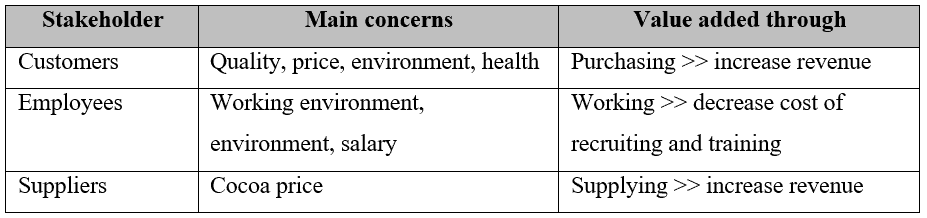

Theo Chocolate’s major stakeholders and The triple bottom line

In the Theo Foundation Principles and six tenets, Theo is concerned a lot about its suppliers, employees, community, and the planet. It is true that these are all major stakeholders and that Theo should pay attention to these stakeholder groups. However, there is still one part of the People that Theo Chocolate didn’t mention, which is…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!