TRX, Inc. was founded in 1999. It serves the technology-based travel arrangement industry. This case study deals with the company's undertaking an initial public offering or an IPO and going public.

Susan Chaplinsky; Kensei Morita; Xing Zeng

Harvard Business Review (UV1207-PDF-ENG)

September 20, 2008

Case questions answered:

- How can TRX, Inc. raise capital to fund future growth and achieve strategic recapitalization?

- Should the company go for an Initial Public Offering? or Private placement of equity? or Private placement of debt?

- Which option provides the highest equity value to the company?

Not the questions you were looking for? Submit your own questions & get answers.

TRX, Inc.: Initial Public Offering Case Answers

This case solution includes an Excel file with calculations.

Company Overview – TRX, Inc.

TRX, Inc. was founded in 1999. The major investors for the company include BCD Technology, Hogg Robinson Holdings, and Sabre Investments, Inc.

The company serves in the technology-based travel arrangement industry. There are three major service offerings: Transaction processing, Data integration, and Customer care.

Industry analysis

- The negative impact of Terrorist attacks in the USA.

- The decreasing number of Air passengers.

- Rising fuel cost (Increment of oil price).

- Acquisition of small travel agencies by large corporations.

TRX, Inc. PESTLE analysis

Political

- Recent terrorist attacks in the major US and European cities exert negative pressure.

- The rules and regulations regarding serving as a travel agency and transaction management have become severe.

Economic

- The cost of operating a business by small travel agencies and technology-based firms is increased.

- Because of the strong presence of low-cost services, which further reduces the price per service.

Social

- There is a tendency among people to act as their own travel agents and perform required activities on their own. Such social factors are causing lower demand for services for companies like TRX, Inc.

Technological

- The presence of new technology and efficient usage might cause a further reduction in the product and service price.

- The trend of focusing on Web-based sales and other digital services is fueling a reduction in concentration from usual travel-agency services.

Legal

- The industry is regulated according to travel and tourism laws, financial service-related regulations, and rules of the online platform. Such kind of legal bond makes it hard for new entities to enter. And the cost of operation is also increased.

Environmental

- Concern about the proper usage of fuel and wastage in operating the business and providing services in environment-preserving ways have been enhanced in recent times.

Company analysis (SWOT analysis)

Strengths

- TRX, Inc. has a diversified service portfolio

- Efficiency in serving large customers.

- Economies of scale.

Weaknesses

- The high amount of borrowed funds.

- Dependence on the growth of the travel industry to generate revenue.

Opportunities

- Growing Demand.

- Building a long-term relationship with large corporations.

- Opportunity to become a market leader in Transaction processing and data integration.

Threats

- Intense Competition in the service areas of TRX, Inc.

- Lower demand for tech-integrated services.

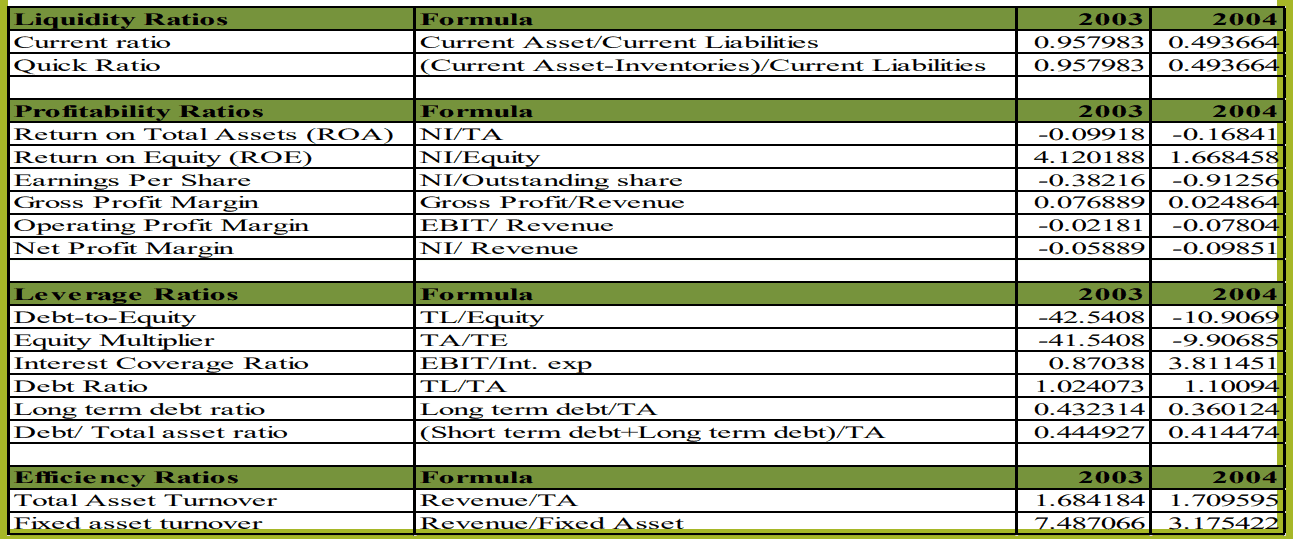

Company analysis (Ratio analysis)

Company analysis (DU Pont analysis)

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!