Tse Sui Luen Jewellery or TSL Jewellery is a family-owned business that was renowned for its entrepreneurial and innovative spirit. After a leadership crisis, TSL is back on its feet pushed by its latest campaign which highlighted its newest design. Knowing that the following year would be a busy one, its chairman is facing the challenge of what direction it should go into next. TSL's chairman and the company's management staff must come up with strategic moves to maximize the opportunities coming its way without acting beyond the company's core values and capitalizing on its revitalized brand.

Kevin Au; Andrew Chan; Howard Lam; Cinty Li

Harvard Business Review (W15035-PDF-ENG)

February 24, 2015

Case questions answered:

Not the questions you were looking for? Submit your own questions & get answers.

TSL Jewellery: An Innovator Across Generations Case Answers

This case solution includes an Excel file with calculations.

Part 1 – Accounting has been called the language of business. Financial statements tell the story of an organization using the accounting language. This case study provides only one of the three financial statements, the Income Statement. What story do the Income Statements from 2006-2012 tell about the change and evolution of TSL Jewellery? How does TSL’s current performance compare with its competitors? Limit your analysis and comparison with competitors to what you feel are three key items.

a) The data set for TSL Jewellery provides us with price, advertising, the price of a related product, and the quantity sold for the new product project. Therefore, the demand curve can be estimated using the three key variables: price, advertising, and the price of a related product.

Price has a negative relationship with demand. As the price increases, the demand for the product falls. On the other hand, advertising directly impacts the demand for the product in normal circumstances. As firms increase their advertising expenditure, the demand for the company’s product also increases.

Finally, the impact of the price of the related product will be determined by further analysis because, at this point, we do not know whether the related product is a substitute or a complementary product. Overall, by using these three factors, we can estimate the demand curve for the new product.

b) The five concepts that should be considered in evaluating the given dataset are as follows:

- The correlation between each variable needs to be determined to show the relationship for each variable with other variables.

- Dependency is another important concept that needs to be analyzed to show the impact of each variable on the dependent variable.

- Descriptive statistics could also be performed to understand the trend and pattern of the dataset provided by calculations of mean, variance, and standard deviation.

- Histograms and other plots could be created to evaluate the distribution of the dependent variable on the basis of other variables.

- Regression analysis can be performed to determine the overall demand model for this new product. The significance of the model could be determined through regression analysis.

c) If we are provided with a cost function and the given data set, then for determining the optimal price, we will have first to determine the demand function. The demand function shows the relationship between quantity and price. Hence, this function could be rearranged for the price of the product.

Moreover, we will determine the equation for marginal revenue. At the point where marginal revenue is equal to the marginal cost of variable cost for each unit sold, we can determine the optimal quantity and the optimum price for the new product.

d) Other issues that should be considered by the management of TSL Jewellery in evaluating the profitability of this project are the estimation of the total costs required to launch this project, including marketing and advertising costs. The estimation of the projected cash flows, net present value, and the internal rate of return for this new product would also determine the potential of this product.

The management also needs to assess the features of this new product. If the product is similar to one of the current products of the company, then this might lead to product cannibalization and loss of sales for TSL Jewellery.

Finally, the management should also evaluate and compare the estimated profit margin for this product, market penetration, and gross margin over the costs of producing this product with the other related products in the market. TSL’s management should also evaluate the impact on the overall business strategy and competition in the market if it decides to launch this product.

Part 2

Regression Analysis

The regression analysis for the given dataset has been performed in the Excel spreadsheet by taking the Quantity (demand) of the new product as the dependent variable and the price, advertising expense, and the price of the related product as the independent variable.

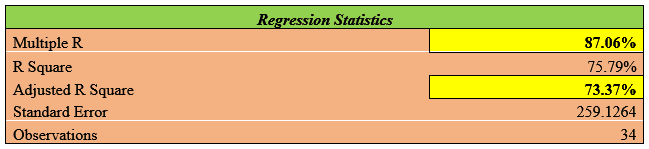

First of all, if we analyze the regression statistics table, then we can see that the correlation between the dependent and the three independent variables is 87.06%, which is quite high and positive. Apart from this, the dependency or the percentage variation in the quantity demanded of the new product as a result of the three key variables is 73.37%.

Therefore, by looking at these statistics, we can say that this data is effective for estimating the demand curve for the new product. The table is shown below:

Moreover, if we want to determine the significance…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster!

Michael

MBA student, Boston

Best decision to get my homework done faster!

Best decision to get my homework done faster!