This case study has the objective of determining whether an angel investor should invest in ZipFit.

Steven N. Kaplan; Liz Kammel

University of Chicago Booth School of Business

September 2013

Case questions answered:

-

As an angel investor, would you invest in ZipFit? At what terms?

-

In getting to this point, what did Liz do well? Is there anything she did not do well?

-

What are the pros and cons of a convertible note versus a priced convertible preferred? For Liz? For the angel investors?

-

Evaluate Liz’s and ZipFit’s search for capital. Should she take money from the angel group? Should she broaden her search to Silicon Valley or elsewhere? Assume: Treasury Bond rate is 3%. Asset Beta equals 1. Expected inflation is 2%.

Not the questions you were looking for? Submit your own questions & get answers.

Zipfit: Finding Perfect Clothing Using Technology Case Answers

This case solution includes an Excel file with calculations.

Please scroll down to the bottom of this post to download the additional Excel spreadsheet.

As an angel investor, would you invest in ZipFit? In what terms?

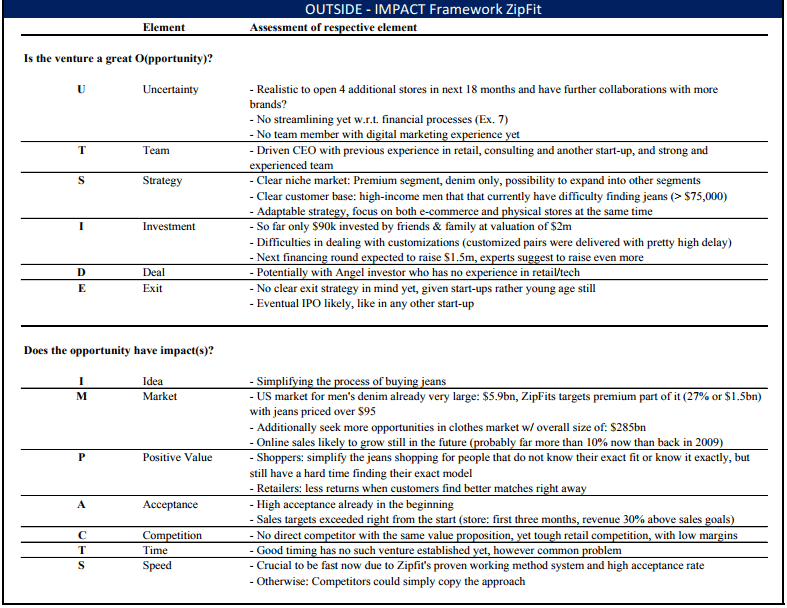

Qualitatively, to assess whether an angel investor should invest in ZipFit, we used the ”OUTSIDE – IMPACTS” framework by Kaplan (key points summarized below, for a detailed analysis, see Appendix I).

First, we analyzed whether ZipFit demonstrates a good investment opportunity. A key benefit is obviously its technology that focuses on the large and well-defined premium denim market with a high-income customer base.

Additionally, ZipFit’s adaptable strategy offers the possibility to further expand into other parts of the US apparel market while using physical stores and the website as sales channels.

Additional strengths include but are not limited to the driven and experienced CEO and her team and the strong bonds to friends and family, which made it possible to gather $90k that helped to fund her business for more than 1.5 years.

From the above, we concluded that Zipfit represented a good investment opportunity and assessed its impact.

ZipFit offers a unique selling point to customers and retailers, emphasizing its positive value: On the one hand, it simplifies jeans shopping for people who do not know their exact fit and have difficulty finding their exact model.

On the other hand, ZipFit reduces costs for retailers due to fewer product returns. Hence, both the supply and the customer sides show great acceptance of the product.

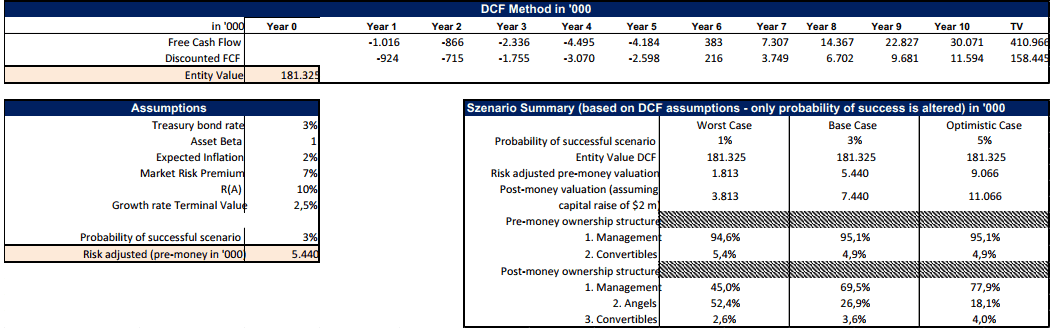

We valued ZipFit using the DCF method. Using DCF with the stated assumptions of a market risk premium of 7% and the cost of capital (RA) of 10%, a 3% TV growth rate, ZipFit’s entity value amounts to $181m (see Appendix II).

Since the stated financial forecasts are management forecasts and, thus, very likely to be very optimistic, we assessed the probability of this scenario to occur at around 3%, leading to an expected (risk-adjusted) pre-money valuation of $5.4m.

As investors, we would try to persuade the CEO to raise $2m in total to have a cash cushion for unforeseen events (given the rather tight cash plan in Exhibit 5).

We would be the lead investor with $1.5m, while a co-investor would contribute the other $0.5m. We would only invest if we received preferred shares in return, with veto rights regarding certain actions, more votes per share than common shares, representing at least 1/5 of the board, and higher preference in case of a liquidation.

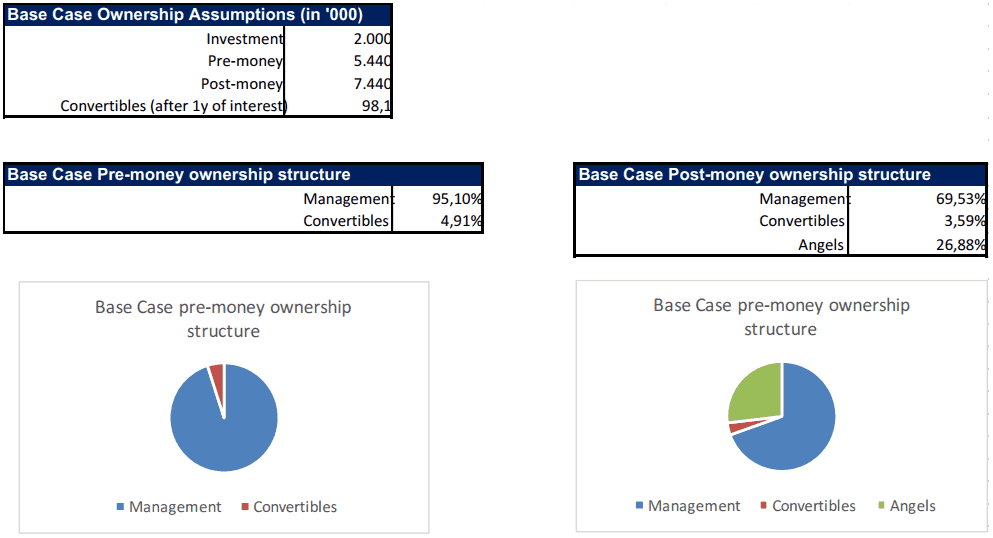

Given our $1.5m investment and a pre-money expected valuation of $5.4m, this would leave us to ask for ownership of roughly 20% of ZipFit’s equity (combined with the 2nd angel: ca. 27%, see Appendix III).

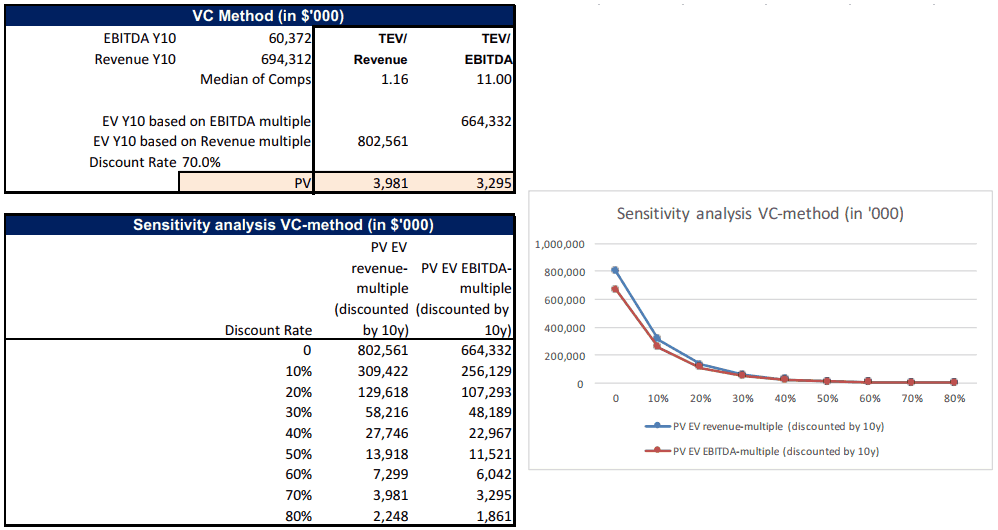

Using the VC method, based on median revenue- and EBITDA multiples of comparable companies and a discount rate of 70%, we derived a slightly more prudent pre-money valuation of $3.3-3.9m (see appendix IV).

However, ZipFit is not really comparable to the included comps, which is why we focus on the DCF valuation. All in all, with these terms and the above-mentioned qualitative assessment, we feel confident about investing in ZipFit.

In getting to this point, what did Liz do well? Is there anything she did not do well?

On the positive side, Liz’s management skill first needs to be emphasized. She identified a market niche (namely, a group of males with huge difficulties in purchasing jeans) that was previously not effectively catered to by retailers.

Besides, she selectively picked the premium segment within the denim market while still maintaining the flexibility of expanding to other segments.

Secondly, Liz’s research capabilities should be highlighted. On the one hand, she effectively gathered data that impacted the selection process for jeans shopping and developed an algorithm based on these data.

Also, her research on the location of the first Zipfit store was sophisticated and effective, as shown by the exceeded sales targets of that store.

Third, her networking activities should be praised. By participating in the ‘New Venture Challenge,’ she built a potential investor base, and by sending out monthly newsletters, she kept these investors informed about ZipFit.

The resulting broad range of investors available to Zipfit and their corresponding interest increase the likelihood of Zipfit receiving a high valuation already during seed-stage financing.

Lastly, the use of funds from her family and friends can be considered a good move since the financial terms she got there are likely to be more favorable than if she had solely relied on professional investors (e.g., angels, VCs, or banks).

However, some of Liz’s actions can be criticized. First, her initial moves did not work out as previously anticipated: the initial website did not scale due to the limited acceptance and collaboration of denim brands.

For her second move, she failed to anticipate the time it would take retailers to accommodate her new system. Instead, this created awareness on the retailers’ side for her system and its strong acceptance by customers.

In turn, these retailers may now attempt to implement a similar system themselves, thereby intensifying competition. Negative aspects regarding her management skills include her inability to establish an adequate inventory policy and to identify a marketing expert, which is why she now has to outsource this function expensively.

Furthermore, having the Zipfit website ready already at the first store opening would have helped the company increase brand awareness in this early stage.

Lastly, her decision to operate both stores and an e-commerce platform (which both require significant capital) in full intensity can be questioned rather than focusing on only one of them.

What are the pros and cons of a convertible note versus a priced convertible preferred? For Liz? For the angel investors?

From Liz’s perspective, convertible notes yield several advantages. First, issuing shares would require Liz to agree with investors on a valuation of Zipfit early on, which is especially difficult given Zipfit’s early stage and Liz’s comparatively little valuation experience.

Convertible notes, instead, would not need such a valuation directly. Still, only once equity is issued in a subsequent round in which more data is available to value ZipFit more accurately.

Moreover, while issuing equity could potentially give rise to additional taxable income for Liz, this would not be the case with convertible notes.

Additionally, despite the existence of standardized forms, convertible notes are still faster and, due to the only limited legal fees, also cheaper than equity issues, which is also an upside for investors.

Further, with convertible notes, Liz would not give up control over her company (using either board seats or veto rights) and would also have greater flexibility concerning pricing, as, under convertible notes, investors can be charged different prices by applying different valuation caps.

Lastly, by using convertible notes, the pricing problem regarding stock option grants can be avoided. Nevertheless, there are certain downsides to convertible notes for Liz, too.

If covenants are part of the term sheet, investors could still take indirect control by restricting Zipfit from conducting certain operative actions.

Furthermore, if no valuation caps are placed on the convertible notes, investors will be incentivized to stimulate a lower valuation of Zipfit in a subsequent financing round, which is against Liz’s interests.

From an investor’s perspective, preferred equity entails a greater ability to control (using board seats and veto rights) than the (potential) covenants under convertible notes.

Moreover, preferred equity will usually enjoy liquidation preference. In contrast to convertible notes, the investment horizon and capital gain evaluation associated with preferred equity starts immediately and not when debt is converted.

Furthermore, preferred equity allows investors to receive and negotiate a stake in the company right from the beginning. Additionally, the fact that different prices can be charged for different investors utilizing different valuation caps improves the bargaining position of sophisticated investors.

In sum, convertible notes seem favorable for co-founders, whereas preferred shares are favorable for (sophisticated) investors.

Evaluate Liz’s and ZipFit’s search for capital. Should she take money from the angel group? Should she broaden her search to Silicon Valley or elsewhere?

Assume: Treasury Bond rate is 3%. Asset Beta equals 1. Expected inflation is 2%.

On the positive side, Liz made use of her broad network of potential investors by asking them for feedback on the offer she received and keeping them both close and informed with her newsletter on the company’s development.

However, the current potential investors do not demonstrate a perfect fit for the company. Brown Maple has, e.g., no experience in tech/retail, and their $1.5m funding is below other investors’ expectations for ZipFit.

Furthermore, it is uncertain whether Maple can participate in the subsequent financing round, which is less favorable for Zipfit.

Ultimately, we stress that Liz should not accept the Brown Maples deal but continue looking for potential investors representing a better fit.

Ideally, she should look for an investor who has a good track record for investments and experience in retail and e-commerce and who can invest in the next round, too.

Additionally, ZipFit should opt for an investor willing to accept convertible notes instead of preferred shares, although most sophisticated investors probably would not accept such a deal structure.

Appendix I: “OUTSIDE – IMPACT” Framework for ZipFit

Appendix II: DCF-Valuation

All financial figures in thousands of USD

Appendix III: Ownership structure based on DCF base case scenario

All financial figures in thousands of USD

Appendix IV: VC-method valuation

All financial figures in thousands of USD

Additional File:

Excel Spreadsheet. Download here.